- South Korea

- /

- Electrical

- /

- KOSDAQ:A119850

Key Things To Watch Out For If You Are After GnCenergy Co., Ltd's (KOSDAQ:119850) 0.8% Dividend

Is GnCenergy Co., Ltd (KOSDAQ:119850) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

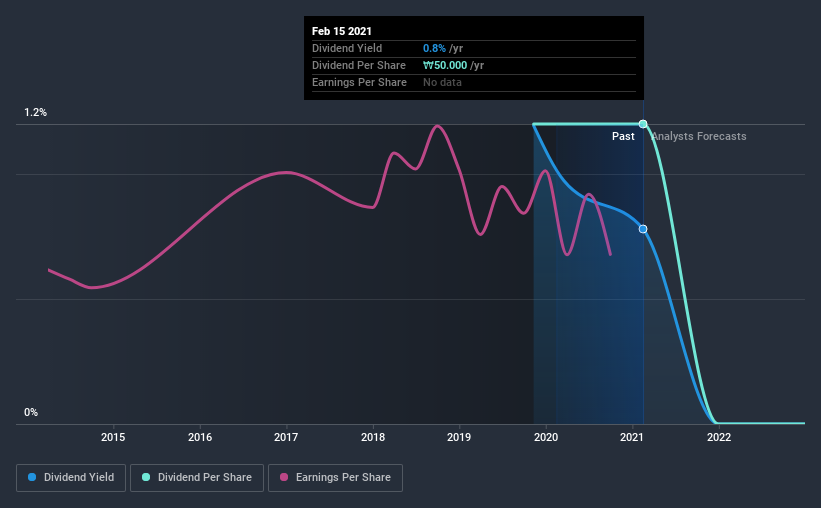

GnCenergy has only been paying a dividend for a year or so, so investors might be curious about its 0.8% yield. During the year, the company also conducted a buyback equivalent to around 0.8% of its market capitalisation. Some simple research can reduce the risk of buying GnCenergy for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. GnCenergy paid out 18% of its profit as dividends, over the trailing twelve month period. We'd say its dividends are thoroughly covered by earnings.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. GnCenergy's cash payout ratio last year was 7.1%, which is quite low and suggests that the dividend was thoroughly covered by cash flow. It's positive to see that GnCenergy's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

With a strong net cash balance, GnCenergy investors may not have much to worry about in the near term from a dividend perspective.

Remember, you can always get a snapshot of GnCenergy's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. Its most recent annual dividend was ₩50.0 per share.

It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Earnings have grown at around 4.5% a year for the past five years, which is better than seeing them shrink! So, we know earnings growth has been thin on the ground. On the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. It's great to see that GnCenergy is paying out a low percentage of its earnings and cash flow. Second, earnings growth has been ordinary, and its history of dividend payments is shorter than we'd like. GnCenergy has a number of positive attributes, but it falls slightly short of our (admittedly high) standards. Were there evidence of a strong moat or an attractive valuation, it could still be well worth a look.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 3 warning signs for GnCenergy that investors should take into consideration.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you decide to trade GnCenergy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade GnCenergy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A119850

GnCenergy

Engages in the manufacture and sale of power generators in Korea.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives