- South Korea

- /

- Machinery

- /

- KOSDAQ:A105740

Some Shareholders Feeling Restless Over DK-Lok Corporation's (KOSDAQ:105740) P/S Ratio

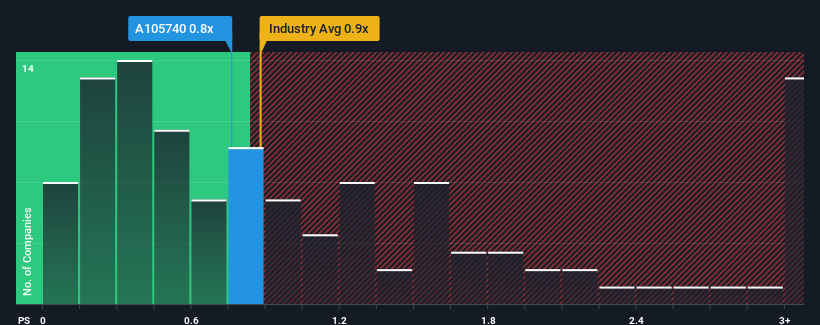

There wouldn't be many who think DK-Lok Corporation's (KOSDAQ:105740) price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S for the Machinery industry in Korea is similar at about 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for DK-Lok

How DK-Lok Has Been Performing

As an illustration, revenue has deteriorated at DK-Lok over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for DK-Lok, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For DK-Lok?

In order to justify its P/S ratio, DK-Lok would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 23% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 36% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that DK-Lok's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On DK-Lok's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that DK-Lok's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

There are also other vital risk factors to consider and we've discovered 2 warning signs for DK-Lok (1 is significant!) that you should be aware of before investing here.

If you're unsure about the strength of DK-Lok's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A105740

DK-Lok

Manufactures and sells fittings and valves in South Korea, the United States, Italy, the United Arab Emirates, Middle East, Asia, and Oceania.

Good value with adequate balance sheet.

Market Insights

Community Narratives