- South Korea

- /

- Machinery

- /

- KOSDAQ:A104460

Positive Sentiment Still Eludes DYPNF Co.,Ltd (KOSDAQ:104460) Following 26% Share Price Slump

DYPNF Co.,Ltd (KOSDAQ:104460) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 51% loss during that time.

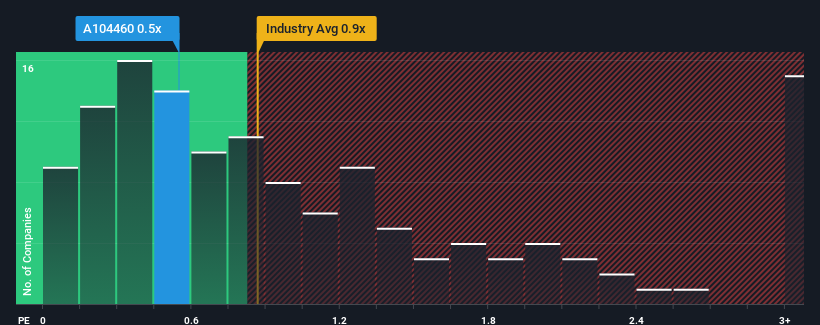

In spite of the heavy fall in price, there still wouldn't be many who think DYPNFLtd's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Korea's Machinery industry is similar at about 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for DYPNFLtd

What Does DYPNFLtd's P/S Mean For Shareholders?

Recent revenue growth for DYPNFLtd has been in line with the industry. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on DYPNFLtd will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For DYPNFLtd?

In order to justify its P/S ratio, DYPNFLtd would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 73% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 37%, the company is positioned for a stronger revenue result.

In light of this, it's curious that DYPNFLtd's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From DYPNFLtd's P/S?

Following DYPNFLtd's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, DYPNFLtd's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for DYPNFLtd that you should be aware of.

If these risks are making you reconsider your opinion on DYPNFLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A104460

DYPNFLtd

Manufactures and sells powder transport equipment in South Korea, the United States, the Middle East, Southeast Asia, Europe, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives