- South Korea

- /

- Aerospace & Defense

- /

- KOSDAQ:A099320

What Satrec Initiative Co., Ltd.'s (KOSDAQ:099320) 33% Share Price Gain Is Not Telling You

Satrec Initiative Co., Ltd. (KOSDAQ:099320) shares have had a really impressive month, gaining 33% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 73%.

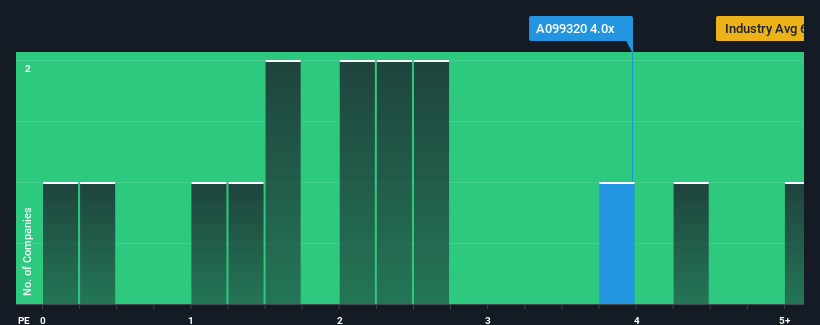

Since its price has surged higher, you could be forgiven for thinking Satrec Initiative is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4x, considering almost half the companies in Korea's Aerospace & Defense industry have P/S ratios below 2.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Satrec Initiative

How Satrec Initiative Has Been Performing

There hasn't been much to differentiate Satrec Initiative's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Satrec Initiative.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Satrec Initiative would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 37% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 84% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 38% during the coming year according to the three analysts following the company. That's shaping up to be materially lower than the 159% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Satrec Initiative's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Satrec Initiative shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Satrec Initiative currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Satrec Initiative has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A099320

Satrec Initiative

Provides solutions for earth observation missions worldwide.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives