- South Korea

- /

- Machinery

- /

- KOSDAQ:A090710

Market Participants Recognise Hyulim ROBOT Co.,Ltd.'s (KOSDAQ:090710) Revenues Pushing Shares 26% Higher

Hyulim ROBOT Co.,Ltd. (KOSDAQ:090710) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 56% share price drop in the last twelve months.

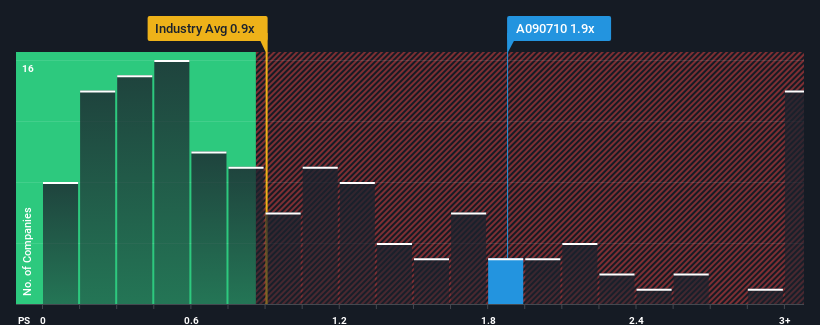

Following the firm bounce in price, when almost half of the companies in Korea's Machinery industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Hyulim ROBOTLtd as a stock probably not worth researching with its 1.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Hyulim ROBOTLtd

How Has Hyulim ROBOTLtd Performed Recently?

Revenue has risen firmly for Hyulim ROBOTLtd recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hyulim ROBOTLtd's earnings, revenue and cash flow.How Is Hyulim ROBOTLtd's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Hyulim ROBOTLtd's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 28% last year. Pleasingly, revenue has also lifted 268% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 37% shows it's noticeably more attractive.

In light of this, it's understandable that Hyulim ROBOTLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Hyulim ROBOTLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Hyulim ROBOTLtd can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Hyulim ROBOTLtd that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hyulim ROBOTLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A090710

Mediocre balance sheet low.

Market Insights

Community Narratives