- South Korea

- /

- Machinery

- /

- KOSDAQ:A083650

There's Reason For Concern Over BHI Co., Ltd.'s (KOSDAQ:083650) Massive 30% Price Jump

BHI Co., Ltd. (KOSDAQ:083650) shares have continued their recent momentum with a 30% gain in the last month alone. The last month tops off a massive increase of 106% in the last year.

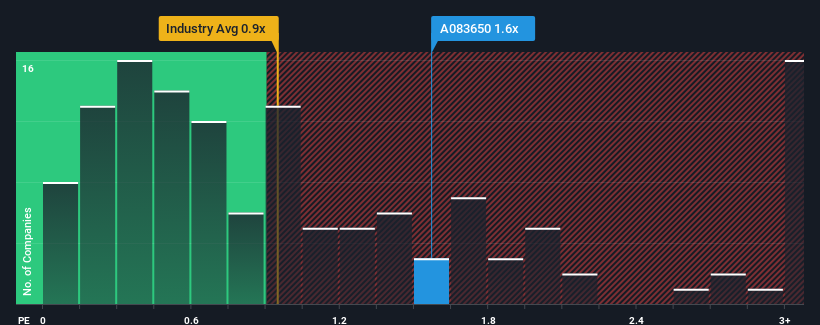

Since its price has surged higher, you could be forgiven for thinking BHI is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.6x, considering almost half the companies in Korea's Machinery industry have P/S ratios below 0.9x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for BHI

How Has BHI Performed Recently?

BHI hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BHI.How Is BHI's Revenue Growth Trending?

In order to justify its P/S ratio, BHI would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.5%. Even so, admirably revenue has lifted 42% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 34% over the next year. That's shaping up to be materially lower than the 42% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that BHI's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From BHI's P/S?

BHI shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that BHI currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with BHI, and understanding them should be part of your investment process.

If you're unsure about the strength of BHI's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if BHI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A083650

BHI

Engages in the development, manufacture, and supply of power plant equipment worldwide.

Outstanding track record with adequate balance sheet.

Market Insights

Community Narratives