As global markets respond to the Federal Reserve's recent interest rate cuts and a mixed economic outlook, small-cap stocks have shown resilience, with the Russell 2000 Index outperforming its larger counterparts. In this dynamic environment, identifying undiscovered gems requires a keen eye for companies that can leverage favorable interest rates and navigate economic uncertainties effectively.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anhui Huaren Health Pharmaceutical | 55.17% | 17.65% | 10.18% | ★★★★★☆ |

| Jinsanjiang (Zhaoqing) Silicon Material | 11.75% | 17.91% | -3.17% | ★★★★★☆ |

| Zhejiang Chinastars New Materials Group | 42.04% | 1.78% | 6.47% | ★★★★★☆ |

| YuanShengTai Dairy Farm | 15.09% | 11.64% | -31.87% | ★★★★★☆ |

| Huasi Holding | 6.89% | 4.80% | 41.72% | ★★★★★☆ |

| Tai Sin Electric | 37.42% | 10.92% | 7.66% | ★★★★☆☆ |

| Sichuan Zigong Conveying Machine Group | 54.32% | 21.85% | 16.70% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Zhejiang Bofay Electric | 39.35% | -1.41% | -47.96% | ★★★★☆☆ |

| Guangdong Brandmax MarketingLtd | 20.75% | -9.15% | -24.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

SPG (KOSDAQ:A058610)

Simply Wall St Value Rating: ★★★★★★

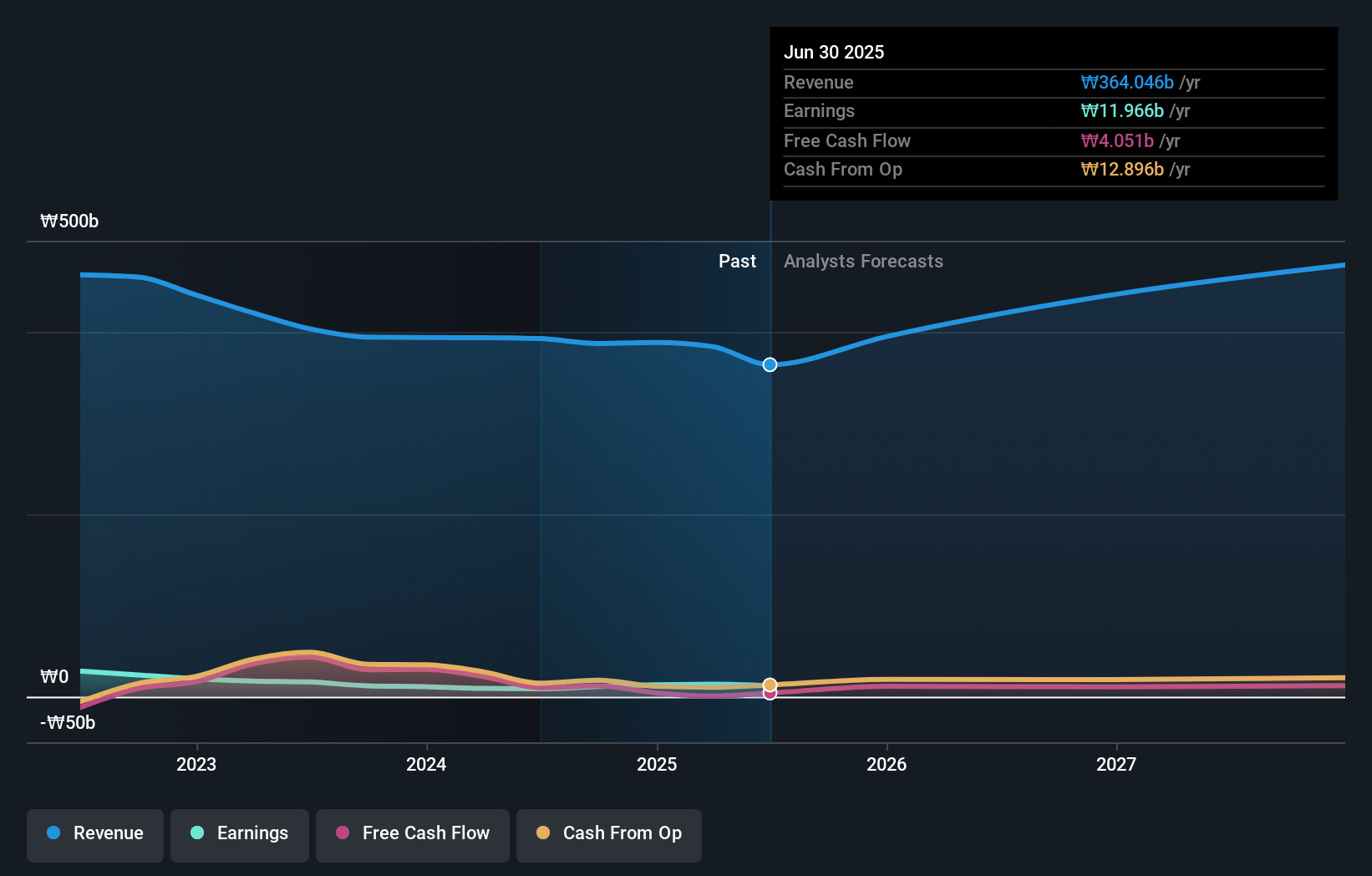

Overview: SPG Co., Ltd. is a South Korean company that manufactures and sells precision, industrial, and home-use motors, with a market cap of ₩1.55 trillion.

Operations: The primary revenue stream for SPG Co., Ltd. comes from its electric equipment segment, generating ₩355.92 billion. The company's financial performance is highlighted by a focus on this segment, which plays a significant role in its overall revenue generation strategy.

SPG, a smaller player in its sector, has shown resilience with a debt to equity ratio improving from 51.9% to 27% over five years. Despite earnings declining by 8.6% annually over the same period, the company maintains high-quality earnings and has managed to keep its interest payments well covered by EBIT at 7.5 times coverage. With revenue projected to grow at an annual rate of 11.68%, SPG seems poised for recovery despite recent share price volatility and underperformance compared to industry peers' growth rates of around 22%. The net debt to equity ratio stands satisfactorily at 10.7%, reflecting prudent financial management amidst challenges.

- Take a closer look at SPG's potential here in our health report.

Evaluate SPG's historical performance by accessing our past performance report.

China Post Technology (SHSE:688648)

Simply Wall St Value Rating: ★★★★★★

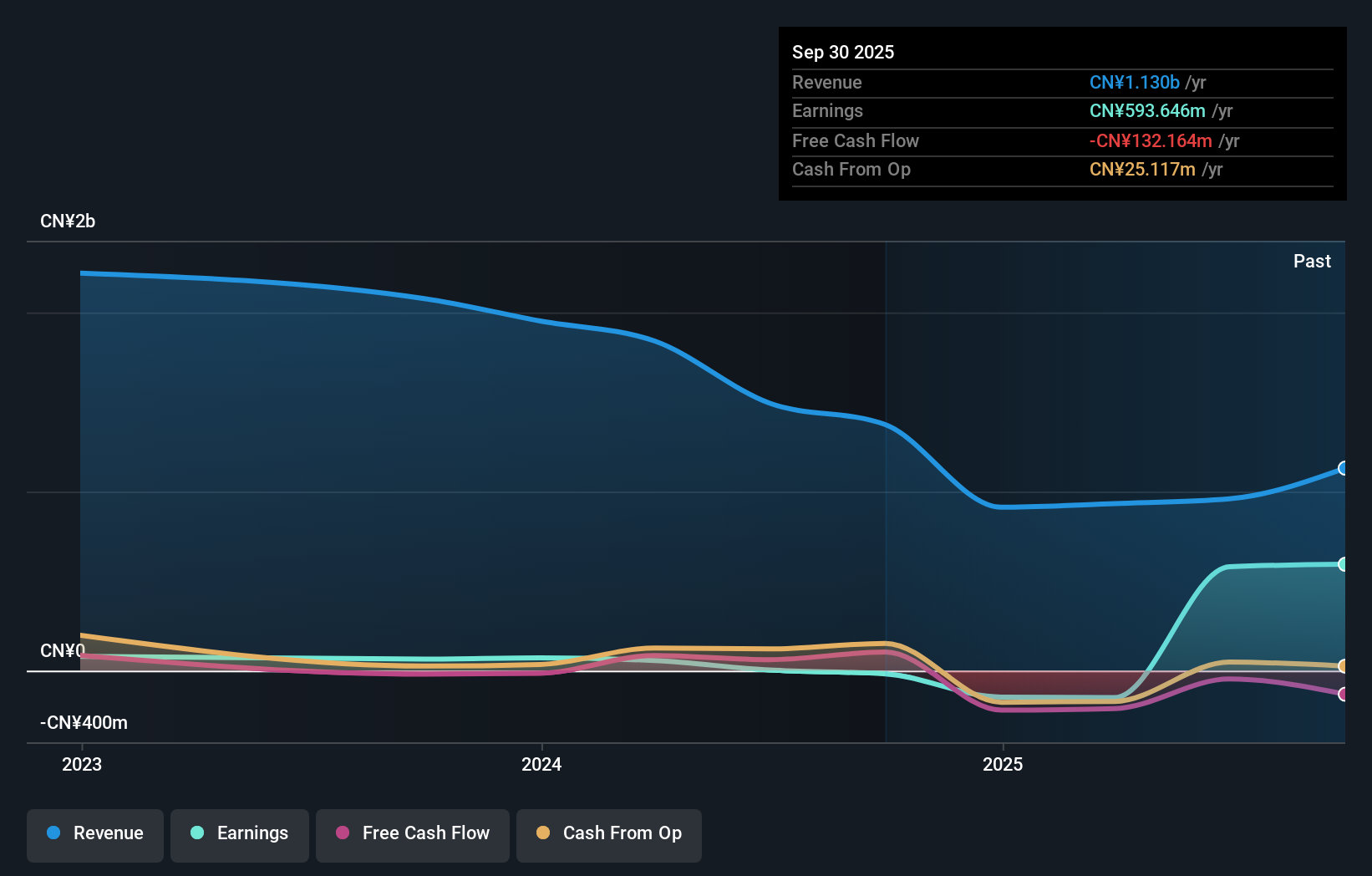

Overview: China Post Technology Co., Ltd. focuses on the research, development, design, production, sale, and servicing of intelligent logistics systems in China with a market cap of CN¥7.17 billion.

Operations: The company generates revenue primarily from the sale of intelligent logistics system products, amounting to CN¥1.13 billion.

China Post Technology, a nimble player in its field, has shown impressive financial strides recently. The company turned its fortunes around with a net income of CNY 672 million for the first nine months of 2025, compared to a net loss of CNY 69 million the previous year. This turnaround is underscored by basic earnings per share from continuing operations at CNY 4.94, up from a loss per share of CNY 0.51 last year. Its price-to-earnings ratio stands attractively at 13.4x against the broader CN market's average of 42.9x, suggesting potential value for investors seeking opportunities in emerging markets.

- Get an in-depth perspective on China Post Technology's performance by reading our health report here.

Understand China Post Technology's track record by examining our Past report.

ISE Chemicals (TSE:4107)

Simply Wall St Value Rating: ★★★★★★

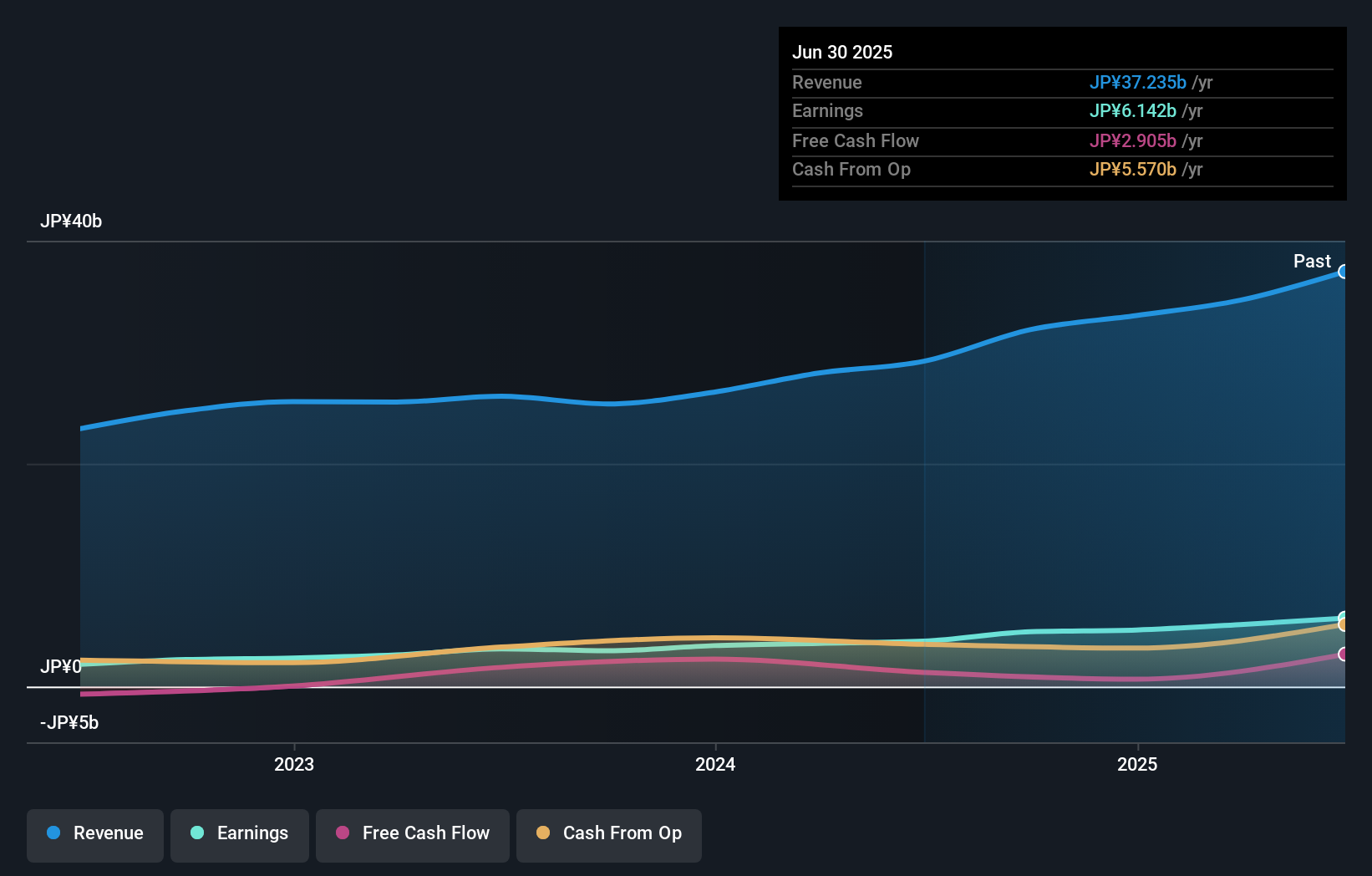

Overview: ISE Chemicals Corporation operates in Japan, focusing on the iodine and natural gas sectors as well as metallic compounds, with a market capitalization of approximately ¥192.12 billion.

Operations: ISE Chemicals generates revenue primarily from its iodine and natural gas sectors along with metallic compounds. The company has a market capitalization of approximately ¥192.12 billion.

ISE Chemicals, a nimble player in the industry, has seen its earnings surge by 30.9% over the past year, outpacing the broader chemicals sector's growth of 8.3%. This impressive performance is underpinned by high-quality earnings and a debt-to-equity ratio that has improved from 2.4 to 1.3 over five years, indicating prudent financial management. The company is free cash flow positive and boasts more cash than its total debt, suggesting robust financial health despite recent share price volatility. These factors position ISE as a compelling option for those seeking potential growth within this dynamic market segment.

- Delve into the full analysis health report here for a deeper understanding of ISE Chemicals.

Review our historical performance report to gain insights into ISE Chemicals''s past performance.

Summing It All Up

- Click this link to deep-dive into the 3010 companies within our Global Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4107

ISE Chemicals

Engages in the iodine and natural gas, and mettalic compound businesses in Japan.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion