- South Korea

- /

- Machinery

- /

- KOSDAQ:A051490

We Wouldn't Rely On Nara Mold & Die's (KOSDAQ:051490) Statutory Earnings As A Guide

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Nara Mold & Die's (KOSDAQ:051490) statutory profits are a good guide to its underlying earnings.

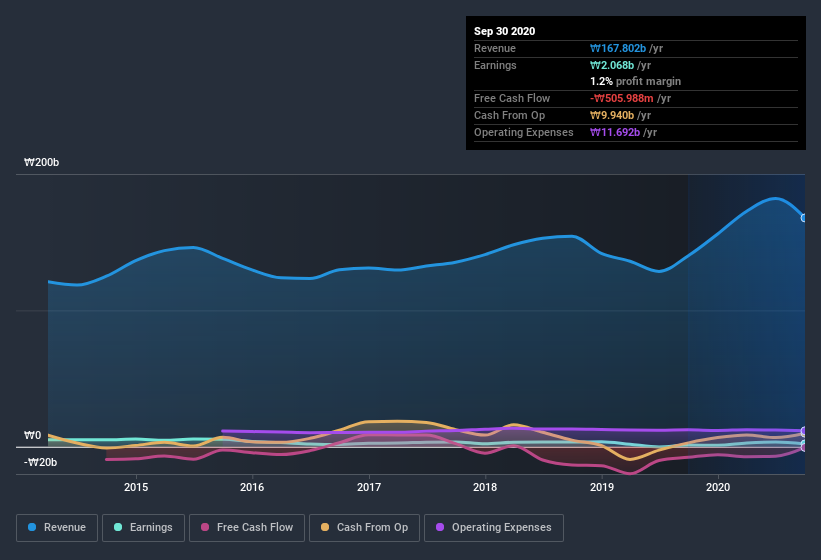

While Nara Mold & Die was able to generate revenue of ₩167.8b in the last twelve months, we think its profit result of ₩2.07b was more important. As you can see in the chart below, its profit has declined over the last three years, even though its revenue has increased.

Check out our latest analysis for Nara Mold & Die

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. This article will discuss how unusual items have impacted Nara Mold & Die's most recent profit results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Nara Mold & Die.

How Do Unusual Items Influence Profit?

To properly understand Nara Mold & Die's profit results, we need to consider the ₩1.2b gain attributed to unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. Nara Mold & Die had a rather significant contribution from unusual items relative to its profit to September 2020. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Nara Mold & Die's Profit Performance

As we discussed above, we think the significant positive unusual item makes Nara Mold & Die'searnings a poor guide to its underlying profitability. As a result, we think it may well be the case that Nara Mold & Die's underlying earnings power is lower than its statutory profit. The good news is that, its earnings per share increased by 69% in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Every company has risks, and we've spotted 3 warning signs for Nara Mold & Die (of which 2 shouldn't be ignored!) you should know about.

Today we've zoomed in on a single data point to better understand the nature of Nara Mold & Die's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Nara Mold & Die or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Nara Mold & Die, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nara Mold & Die might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A051490

Nara Mold & Die

Engages in the manufacture and sale of press dies, plastic molds, stamped parts, and assembly parts in South Korea.

Excellent balance sheet and good value.

Market Insights

Community Narratives