- South Korea

- /

- Machinery

- /

- KOSDAQ:A051490

Does The Market Have A Low Tolerance For Nara Mold & Die Co., Ltd.'s (KOSDAQ:051490) Mixed Fundamentals?

It is hard to get excited after looking at Nara Mold & Die's (KOSDAQ:051490) recent performance, when its stock has declined 19% over the past month. It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Fundamentals usually dictate market outcomes so it makes sense to study the company's financials. Particularly, we will be paying attention to Nara Mold & Die's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Nara Mold & Die

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Nara Mold & Die is:

2.7% = ₩2.2b ÷ ₩83b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. So, this means that for every ₩1 of its shareholder's investments, the company generates a profit of ₩0.03.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Nara Mold & Die's Earnings Growth And 2.7% ROE

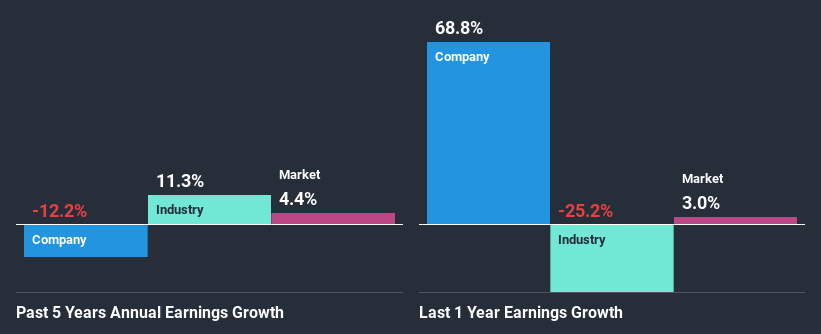

It is hard to argue that Nara Mold & Die's ROE is much good in and of itself. Even when compared to the industry average of 4.8%, the ROE figure is pretty disappointing. For this reason, Nara Mold & Die's five year net income decline of 12% is not surprising given its lower ROE. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

That being said, we compared Nara Mold & Die's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 11% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Nara Mold & Die's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Nara Mold & Die Making Efficient Use Of Its Profits?

Looking at its three-year median payout ratio of 35% (or a retention ratio of 65%) which is pretty normal, Nara Mold & Die's declining earnings is rather baffling as one would expect to see a fair bit of growth when a company is retaining a good portion of its profits. It looks like there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

In addition, Nara Mold & Die only recently started paying a dividend so the management probably decided the shareholders prefer dividends even though earnings have been shrinking.

Summary

In total, we're a bit ambivalent about Nara Mold & Die's performance. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. To know the 4 risks we have identified for Nara Mold & Die visit our risks dashboard for free.

If you’re looking to trade Nara Mold & Die, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nara Mold & Die might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A051490

Nara Mold & Die

Engages in the manufacture and sale of press dies, plastic molds, stamped parts, and assembly parts in South Korea.

Excellent balance sheet and good value.

Market Insights

Community Narratives