- South Korea

- /

- Machinery

- /

- KOSDAQ:A044490

Asian Growth Companies With High Insider Ownership In July 2025

Reviewed by Simply Wall St

As of July 2025, Asian markets are navigating a complex landscape marked by China's steady yet cautious economic growth and Japan's political uncertainties ahead of its Upper House election. In this environment, companies with high insider ownership can offer a unique advantage, as such ownership often aligns management interests with those of shareholders, potentially fostering resilience and strategic growth amid fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 61% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 42.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 25.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

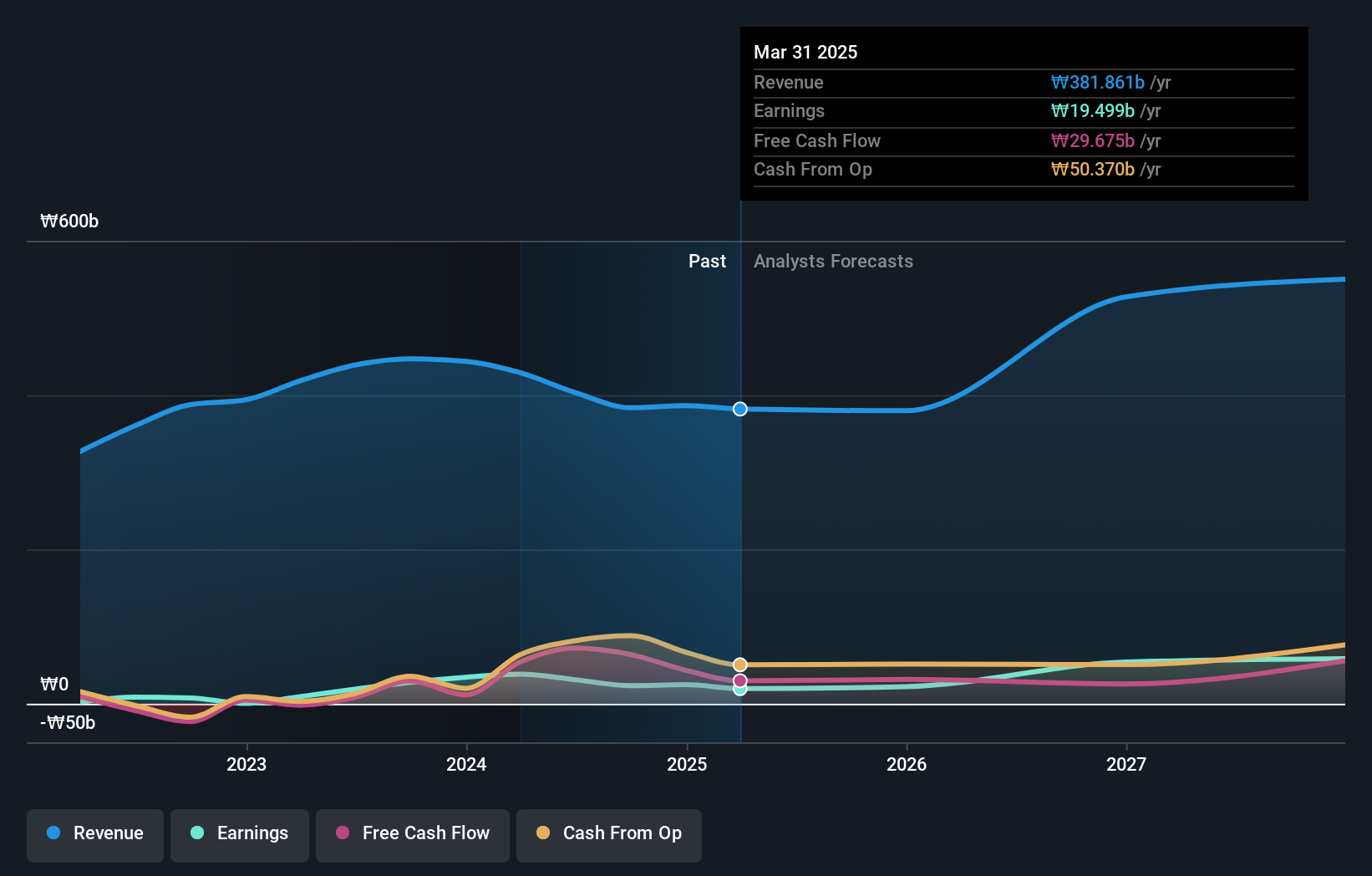

TaewoongLtd (KOSDAQ:A044490)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taewoong Co., Ltd is a company that manufactures and sells open-die forgings and ring rolled products both in South Korea and internationally, with a market cap of approximately ₩863.32 billion.

Operations: Revenue Segments (in millions of ₩):

Insider Ownership: 21.7%

Taewoong Ltd. is forecast to achieve significant earnings growth of 42.1% annually, outpacing the Korean market's 20.9%. Revenue growth is projected at 15.5% per year, surpassing the market average of 6.7%. Despite a low future Return on Equity of 8.3%, the stock trades at a substantial discount to its estimated fair value and has no recent insider trading activity, though its share price has been highly volatile recently.

- Take a closer look at TaewoongLtd's potential here in our earnings growth report.

- The valuation report we've compiled suggests that TaewoongLtd's current price could be inflated.

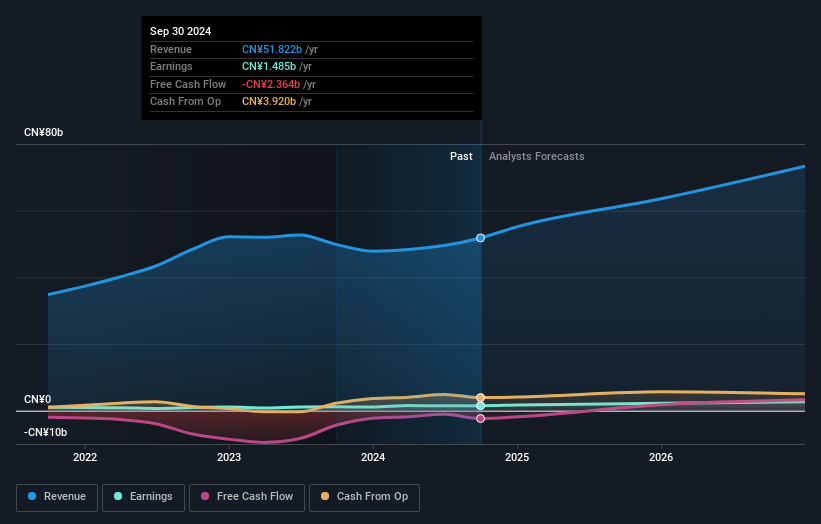

Sunwoda ElectronicLtd (SZSE:300207)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunwoda Electronic Co., Ltd focuses on the research, development, design, production, and sale of lithium-ion battery modules and has a market cap of CN¥38.55 billion.

Operations: Sunwoda Electronic Co., Ltd's revenue is primarily derived from its activities in the research, development, design, production, and sale of lithium-ion battery modules.

Insider Ownership: 28.4%

Sunwoda Electronic Ltd. is projected to achieve significant earnings growth of 25.6% annually, exceeding the Chinese market's 23.4%. Trading at a substantial discount to its estimated fair value, it offers good relative value compared to peers and industry standards. Despite low future Return on Equity forecasts and limited recent insider trading activity, Sunwoda's revenue growth of 16.5% per year outpaces the market average, supported by strategic moves like potential H-share issuance in Hong Kong.

- Get an in-depth perspective on Sunwoda ElectronicLtd's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Sunwoda ElectronicLtd's shares may be trading at a discount.

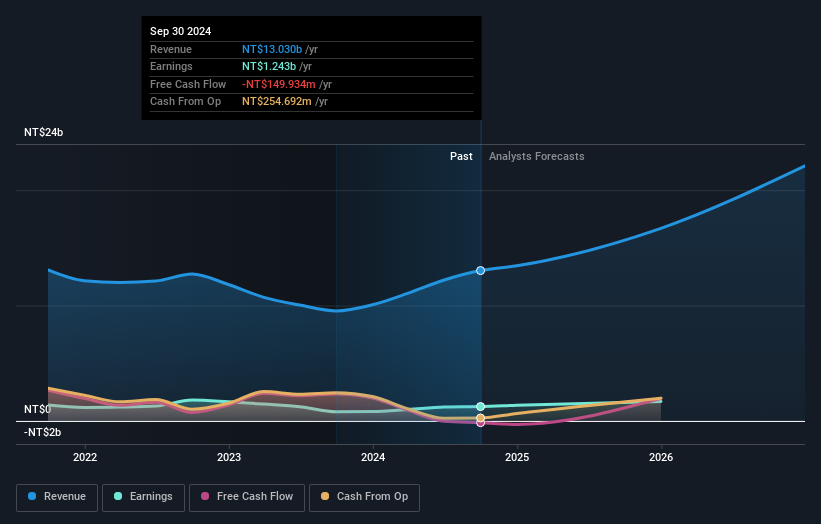

Shin Zu Shing (TWSE:3376)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shin Zu Shing Co., Ltd. operates in Taiwan, Singapore, and China, focusing on the research, design, development, production, assembly, testing, manufacturing, and trading of precision springs and various metal components with a market capitalization of approximately NT$46.40 billion.

Operations: The company's revenue segments include Pivot products generating NT$12.82 billion, MIM Products with NT$120.91 million, and Turning and Milling Products at NT$119.20 million.

Insider Ownership: 21.2%

Shin Zu Shing is set for substantial growth, with earnings forecasted to rise by 34.8% annually, outpacing Taiwan's market average. Revenue is also expected to grow significantly at 31.4% per year. Despite recent volatility in its share price and a low projected Return on Equity of 12.3%, insider ownership remains strong with no significant insider trading activity noted recently, reflecting confidence in the company's strategic direction amidst board changes and corporate amendments.

- Dive into the specifics of Shin Zu Shing here with our thorough growth forecast report.

- According our valuation report, there's an indication that Shin Zu Shing's share price might be on the expensive side.

Where To Now?

- Discover the full array of 589 Fast Growing Asian Companies With High Insider Ownership right here.

- Seeking Other Investments? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if TaewoongLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A044490

TaewoongLtd

Manufactures and sells open-die forgings and ring rolled products in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives