- South Korea

- /

- Machinery

- /

- KOSDAQ:A039610

The Price Is Right For HS Valve Co., Ltd (KOSDAQ:039610) Even After Diving 34%

The HS Valve Co., Ltd (KOSDAQ:039610) share price has fared very poorly over the last month, falling by a substantial 34%. Still, a bad month hasn't completely ruined the past year with the stock gaining 28%, which is great even in a bull market.

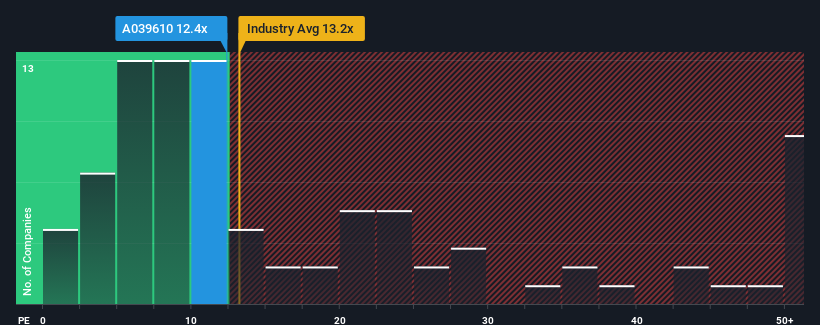

In spite of the heavy fall in price, it's still not a stretch to say that HS Valve's price-to-earnings (or "P/E") ratio of 12.4x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 11x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

As an illustration, earnings have deteriorated at HS Valve over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for HS Valve

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like HS Valve's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 149% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 33% shows it's about the same on an annualised basis.

With this information, we can see why HS Valve is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

HS Valve's plummeting stock price has brought its P/E right back to the rest of the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that HS Valve maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

You need to take note of risks, for example - HS Valve has 3 warning signs (and 2 which don't sit too well with us) we think you should know about.

If these risks are making you reconsider your opinion on HS Valve, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if HS Valve might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A039610

Excellent balance sheet and good value.

Market Insights

Community Narratives