- South Korea

- /

- Chemicals

- /

- KOSDAQ:A036830

Discovering Young Poong Precision And 2 Hidden Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

The South Korean market has shown promising growth, up 2.5% over the last week and 4.6% over the past 12 months, with earnings forecasted to grow by 29% annually. In this favorable environment, identifying stocks with strong fundamentals can be particularly rewarding; here we explore Young Poong Precision and two other hidden small caps that stand out.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Young Poong Precision (KOSDAQ:A036560)

Simply Wall St Value Rating: ★★★★★★

Overview: Young Poong Precision Corporation develops, manufactures, and sells chemical process pumps in South Korea and internationally, with a market cap of ₩334.69 billion.

Operations: Young Poong Precision generates revenue primarily from the sale of chemical process pumps. The company has experienced fluctuations in its net profit margin, which has impacted overall profitability.

Young Poong Precision, a small-cap entity in South Korea, has shown promising financial health with earnings growth of 10.1% over the past year, surpassing the Machinery industry's 5.4%. The company is debt-free and trades at 79.8% below its estimated fair value. Recent news includes an acquisition offer by Korea Corporate Investment Holdings for approximately ₩140 billion (US$105 million), expected to finalize by October 4, 2024.

- Click here and access our complete health analysis report to understand the dynamics of Young Poong Precision.

Explore historical data to track Young Poong Precision's performance over time in our Past section.

Soulbrain Holdings (KOSDAQ:A036830)

Simply Wall St Value Rating: ★★★★★☆

Overview: Soulbrain Holdings Co., Ltd. develops, manufactures, and supplies core materials for the semiconductor, display, and secondary battery cell industries in South Korea and internationally with a market cap of ₩1.18 trillion.

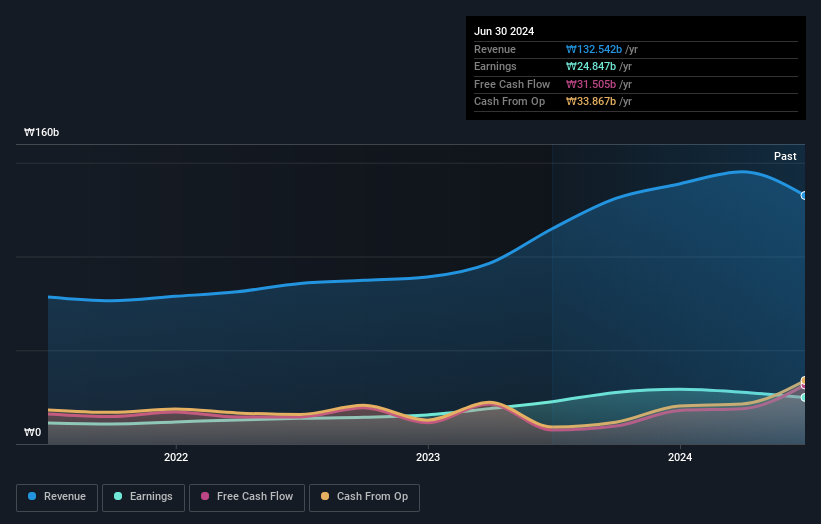

Operations: Soulbrain Holdings generates revenue primarily from product manufacturing (₩428.42 billion) and distribution and service (₩105.34 billion).

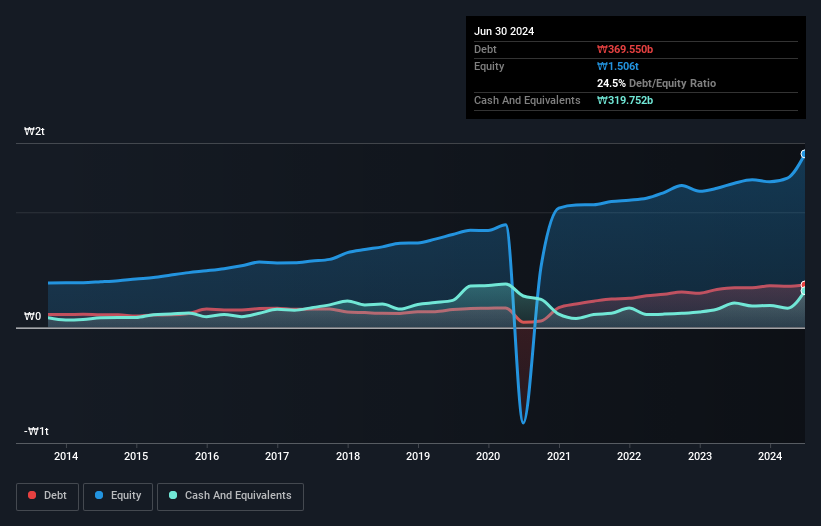

Soulbrain Holdings, a notable player in South Korea's chemical industry, has shown promising signs despite its small cap status. Over the past year, earnings grew by 2.4%, outpacing the broader chemicals sector which saw a -5.1% decline. The company’s net debt to equity ratio stands at a satisfactory 3.3%, and interest payments are well covered by EBIT at 7.6x coverage. Trading at 69% below its estimated fair value, Soulbrain seems undervalued with substantial growth potential ahead.

- Click here to discover the nuances of Soulbrain Holdings with our detailed analytical health report.

FnGuide (KOSDAQ:A064850)

Simply Wall St Value Rating: ★★★★☆☆

Overview: FnGuide Inc. provides online-based financial information services and has a market cap of ₩436.41 billion.

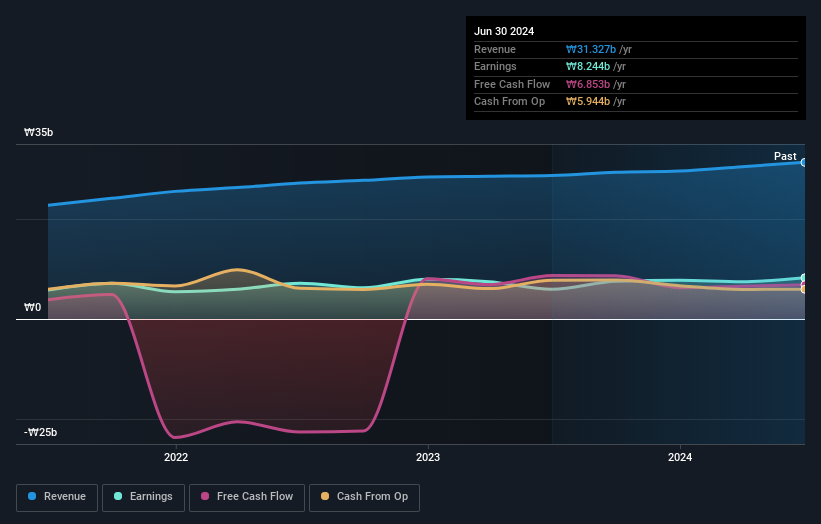

Operations: FnGuide Inc. generates revenue primarily from its online financial information services, amounting to ₩31.33 billion. The company's market cap stands at ₩436.41 billion.

FnGuide, a small cap in South Korea's financial sector, has shown impressive earnings growth of 38.8% over the past year, outpacing the industry average of 21.5%. The company's net debt to equity ratio stands at a satisfactory 10.3%, indicating prudent financial management. A significant one-off gain of ₩2.5B impacted its latest financial results as of June 2024. Despite high volatility in its share price over the last three months, FnGuide remains free cash flow positive and profitable with EBIT covering interest payments by 20.6 times.

- Click to explore a detailed breakdown of our findings in FnGuide's health report.

Assess FnGuide's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Take a closer look at our KRX Undiscovered Gems With Strong Fundamentals list of 189 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A036830

Soulbrain Holdings

Develops, manufactures, and supplies technology industry core materials for semiconductor, display, and secondary battery cell industries in South Korea and internationally.

Flawless balance sheet and good value.