- South Korea

- /

- Construction

- /

- KOSDAQ:A026150

Do Tuksu Engineering & ConstructionLtd's (KOSDAQ:026150) Earnings Warrant Your Attention?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Tuksu Engineering & ConstructionLtd (KOSDAQ:026150), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Tuksu Engineering & ConstructionLtd

Tuksu Engineering & ConstructionLtd's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. I, for one, am blown away by the fact that Tuksu Engineering & ConstructionLtd has grown EPS by 53% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

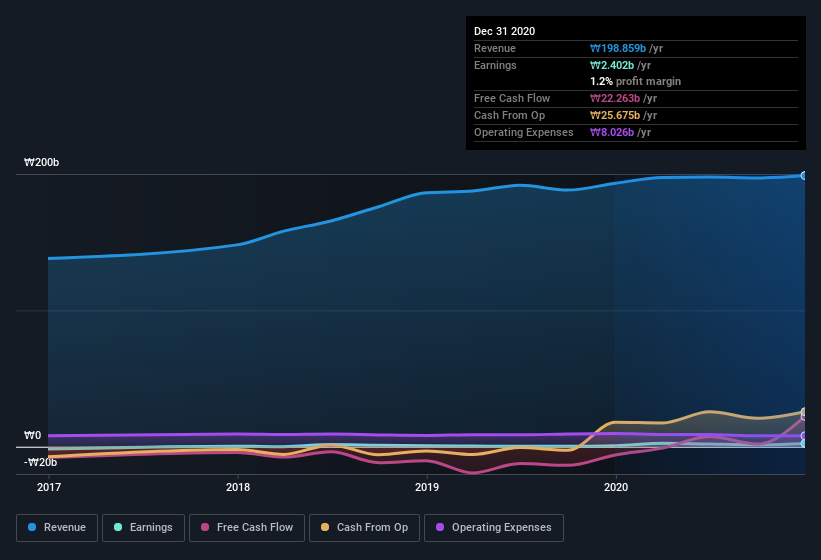

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Tuksu Engineering & ConstructionLtd's EBIT margins were flat over the last year, revenue grew by a solid 2.9% to ₩199b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Tuksu Engineering & ConstructionLtd is no giant, with a market capitalization of ₩141b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Tuksu Engineering & ConstructionLtd Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Tuksu Engineering & ConstructionLtd shares worth a considerable sum. Indeed, they hold ₩42b worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 30% of the company; visible skin in the game.

Should You Add Tuksu Engineering & ConstructionLtd To Your Watchlist?

Tuksu Engineering & ConstructionLtd's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So to my mind Tuksu Engineering & ConstructionLtd is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Still, you should learn about the 2 warning signs we've spotted with Tuksu Engineering & ConstructionLtd .

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tuksu Engineering & ConstructionLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A026150

Tuksu Engineering & ConstructionLtd

Operates as an engineering and construction company in South Korea and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives