- South Korea

- /

- Machinery

- /

- KOSDAQ:A023160

Should You Be Adding Tae Kwang (KOSDAQ:023160) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Tae Kwang (KOSDAQ:023160). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Tae Kwang

How Fast Is Tae Kwang Growing Its Earnings Per Share?

Tae Kwang has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Tae Kwang has grown its trailing twelve month EPS from ₩1,835 to ₩2,006, in the last year. That's a fair increase of 9.3%.

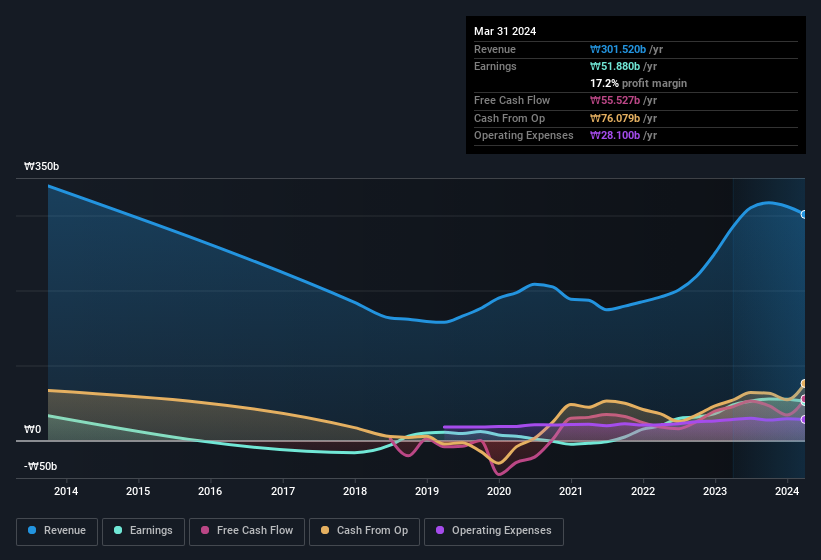

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While Tae Kwang did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Tae Kwang's forecast profits?

Are Tae Kwang Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Tae Kwang insiders have a significant amount of capital invested in the stock. To be specific, they have ₩35b worth of shares. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 9.4% of the shares on issue for the business, an appreciable amount considering the market cap.

Should You Add Tae Kwang To Your Watchlist?

As previously touched on, Tae Kwang is a growing business, which is encouraging. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. Even so, be aware that Tae Kwang is showing 2 warning signs in our investment analysis , you should know about...

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in KR with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Tae Kwang might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A023160

Tae Kwang

Manufactures, supplies, and sells butt weld pipe fittings for oil and gas, chemical and petrochemical, power plant, and shipbuilding businesses in Korea and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026