- South Korea

- /

- Machinery

- /

- KOSDAQ:A023160

Do These 3 Checks Before Buying Tae Kwang Corporation (KOSDAQ:023160) For Its Upcoming Dividend

Readers hoping to buy Tae Kwang Corporation (KOSDAQ:023160) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Ex-dividend means that investors that purchase the stock on or after the 29th of December will not receive this dividend, which will be paid on the 24th of April.

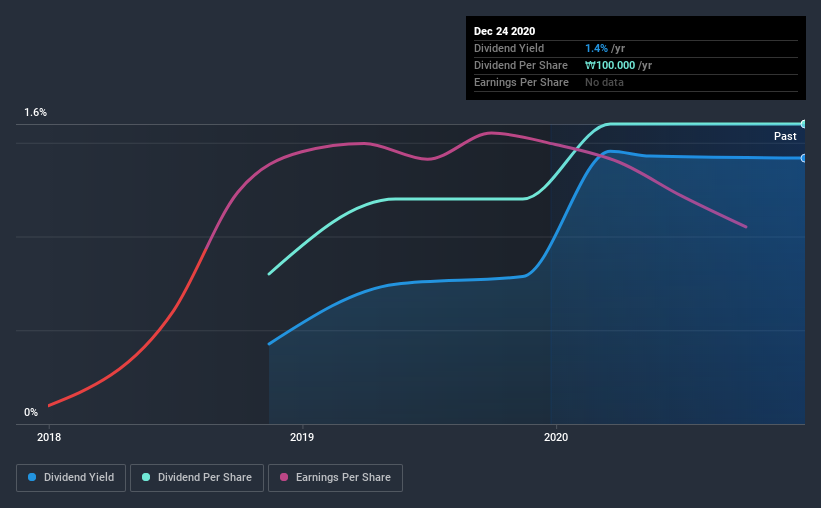

Tae Kwang's next dividend payment will be ₩100.00 per share. Last year, in total, the company distributed ₩100.00 to shareholders. Looking at the last 12 months of distributions, Tae Kwang has a trailing yield of approximately 1.4% on its current stock price of ₩7050. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether Tae Kwang has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for Tae Kwang

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Tae Kwang distributed an unsustainably high 113% of its profit as dividends to shareholders last year. Without more sustainable payment behaviour, the dividend looks precarious. A useful secondary check can be to evaluate whether Tae Kwang generated enough free cash flow to afford its dividend. Tae Kwang paid out more free cash flow than it generated - 169%, to be precise - last year, which we think is concerningly high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

Tae Kwang does have a large net cash position on the balance sheet, which could fund large dividends for a time, if the company so chose. Still, smart investors know that it is better to assess dividends relative to the cash and profit generated by the business. Paying dividends out of cash on the balance sheet is not long-term sustainable.

Cash is slightly more important than profit from a dividend perspective, but given Tae Kwang's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's comforting to see Tae Kwang's earnings have been skyrocketing, up 64% per annum for the past three years. Earnings per share are increasing at a rapid rate, but the company is paying out more than we are comfortable with, based on current earnings. Fast-growing businesses normally need to reinvest most of their earnings in order to maintain growth, so we'd suspect that either earnings growth will slow or the dividend may not be increased for a while.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past two years, Tae Kwang has increased its dividend at approximately 41% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

To Sum It Up

Has Tae Kwang got what it takes to maintain its dividend payments? While it's nice to see earnings per share growing, we're curious about how Tae Kwang intends to continue growing, or maintain the dividend in a downturn given that it's paying out such a high percentage of its earnings and cashflow. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Tae Kwang. In terms of investment risks, we've identified 2 warning signs with Tae Kwang and understanding them should be part of your investment process.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Tae Kwang or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tae Kwang might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A023160

Tae Kwang

Manufactures, supplies, and sells butt weld pipe fittings for oil and gas, chemical and petrochemical, power plant, and shipbuilding businesses in Korea and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026