- South Korea

- /

- Construction

- /

- KOSDAQ:A020710

Sigong Tech Co., Ltd. (KOSDAQ:020710) Screens Well But There Might Be A Catch

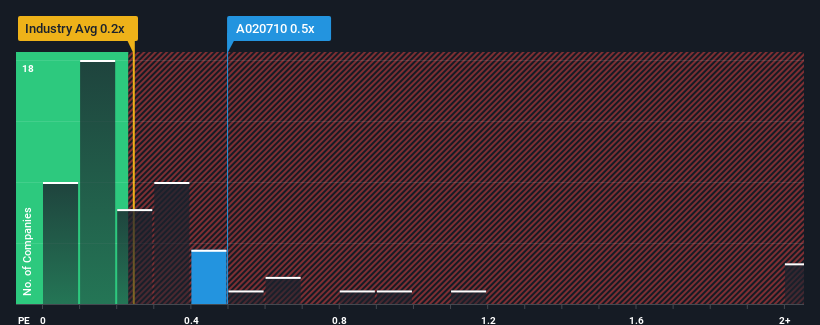

With a median price-to-sales (or "P/S") ratio of close to 0.2x in the Construction industry in Korea, you could be forgiven for feeling indifferent about Sigong Tech Co., Ltd.'s (KOSDAQ:020710) P/S ratio of 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Sigong Tech

What Does Sigong Tech's P/S Mean For Shareholders?

The revenue growth achieved at Sigong Tech over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Sigong Tech, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Sigong Tech's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 25% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

In contrast to the company, the rest of the industry is expected to decline by 0.05% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it odd that Sigong Tech is trading at a fairly similar P/S to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Sigong Tech's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Sigong Tech revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Sigong Tech (1 doesn't sit too well with us!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A020710

Sigong Tech

Operates in the exhibition and cultural industry in South Korea.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives