- South Korea

- /

- Electrical

- /

- KOSDAQ:A018000

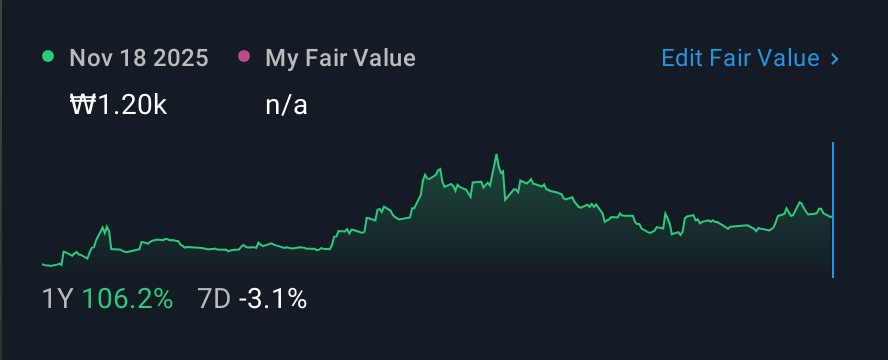

Unison (KOSDAQ:018000) pulls back 15% this week, but still delivers shareholders favorable 76% return over 1 year

The Unison Co., Ltd. (KOSDAQ:018000) share price is down a rather concerning 30% in the last month. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. After all, the share price is up a market-beating 63% in that time.

In light of the stock dropping 15% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

Unison isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Unison actually shrunk its revenue over the last year, with a reduction of 72%. The stock is up 63% in that time, a fine performance given the revenue drop. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Unison's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Unison's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Unison hasn't been paying dividends, but its TSR of 76% exceeds its share price return of 63%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Unison shareholders have received a total shareholder return of 76% over the last year. There's no doubt those recent returns are much better than the TSR loss of 6% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Unison , and understanding them should be part of your investment process.

Of course Unison may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A018000

Unison

Engages in the manufacture, sale, and installation of wind power generation systems and towers in South Korea and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives