- South Korea

- /

- Electrical

- /

- KOSDAQ:A018000

The Unison (KOSDAQ:018000) Share Price Has Soared 365%, Delighting Many Shareholders

Unison Co., Ltd. (KOSDAQ:018000) shareholders might be concerned after seeing the share price drop 25% in the last quarter. But that isn't a problem when you consider how the share price has soared over the last year. Indeed, the share price is up a whopping 365% in that time. So we wouldn't blame sellers for taking some profits. The real question is whether the fundamental business performance can justify the strong increase over the long term.

See our latest analysis for Unison

Unison wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Unison saw its revenue grow by 19%. We respect that sort of growth, no doubt. Arguably it's more than reflected in the truly wondrous share price gain of 365% in the last year. While we are always careful about jumping on a hot stock too late, there's certainly good reason to keep an eye on Unison.

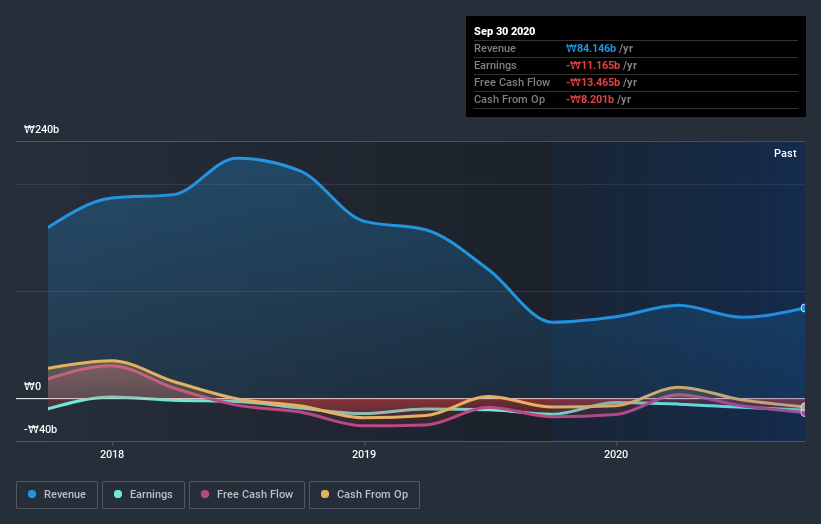

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Unison shareholders have received a total shareholder return of 365% over the last year. That's better than the annualised return of 24% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Unison better, we need to consider many other factors. Even so, be aware that Unison is showing 3 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Unison, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A018000

Unison

Engages in the manufacture, sale, and installation of wind power generation systems and towers in South Korea and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives