- South Korea

- /

- Machinery

- /

- KOSDAQ:A014940

The 32% Return On Capital At Oriental Precision & EngineeringLtd (KOSDAQ:014940) Got Our Attention

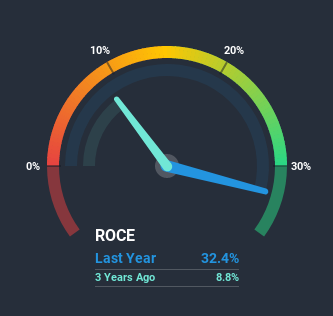

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So when we looked at the ROCE trend of Oriental Precision & EngineeringLtd (KOSDAQ:014940) we really liked what we saw.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Oriental Precision & EngineeringLtd:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.32 = ₩23b ÷ (₩165b - ₩95b) (Based on the trailing twelve months to September 2020).

Therefore, Oriental Precision & EngineeringLtd has an ROCE of 32%. That's a fantastic return and not only that, it outpaces the average of 5.4% earned by companies in a similar industry.

View our latest analysis for Oriental Precision & EngineeringLtd

Historical performance is a great place to start when researching a stock so above you can see the gauge for Oriental Precision & EngineeringLtd's ROCE against it's prior returns. If you're interested in investigating Oriental Precision & EngineeringLtd's past further, check out this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

We're delighted to see that Oriental Precision & EngineeringLtd is reaping rewards from its investments and has now broken into profitability. Historically the company was generating losses but as we can see from the latest figures referenced above, they're now earning 32% on their capital employed. At first glance, it seems the business is getting more proficient at generating returns, because over the same period, the amount of capital employed has reduced by 45%. The reduction could indicate that the company is selling some assets, and considering returns are up, they appear to be selling the right ones.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. Essentially the business now has suppliers or short-term creditors funding about 57% of its operations, which isn't ideal. And with current liabilities at those levels, that's pretty high.

In Conclusion...

In summary, it's great to see that Oriental Precision & EngineeringLtd has been able to turn things around and earn higher returns on lower amounts of capital. And given the stock has remained rather flat over the last five years, there might be an opportunity here if other metrics are strong. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

On a separate note, we've found 1 warning sign for Oriental Precision & EngineeringLtd you'll probably want to know about.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

If you’re looking to trade Oriental Precision & EngineeringLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A014940

Oriental Precision & EngineeringLtd

Oriental Precision & Engineering Co.,Ltd.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives