- South Korea

- /

- Building

- /

- KOSDAQ:A014620

3 Global Companies That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

In recent weeks, global markets have been characterized by volatility and uncertainty, with U.S. consumer confidence experiencing a significant drop and growth stocks underperforming amid regulatory concerns and inflationary pressures. Despite these challenges, opportunities may exist for investors seeking undervalued stocks that could benefit from potential market corrections or shifts in economic conditions. Identifying such stocks often involves looking for companies with strong fundamentals that are trading below their estimated intrinsic value, offering the potential for upside as market dynamics stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Meorient Commerce Exhibition (SZSE:300795) | CN¥23.57 | CN¥46.82 | 49.7% |

| Zhejiang Cfmoto PowerLtd (SHSE:603129) | CN¥178.08 | CN¥352.80 | 49.5% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €53.90 | €107.22 | 49.7% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.58 | €7.05 | 49.2% |

| APAC Realty (SGX:CLN) | SGD0.415 | SGD0.83 | 49.8% |

| CD Projekt (WSE:CDR) | PLN216.00 | PLN428.55 | 49.6% |

| Bide Pharmatech (SHSE:688073) | CN¥53.95 | CN¥106.91 | 49.5% |

| Cint Group (OM:CINT) | SEK6.53 | SEK12.94 | 49.5% |

| Vinte Viviendas Integrales. de (BMV:VINTE *) | MX$32.50 | MX$64.21 | 49.4% |

| u-blox Holding (SWX:UBXN) | CHF72.80 | CHF143.72 | 49.3% |

Here's a peek at a few of the choices from the screener.

Sung Kwang BendLtd (KOSDAQ:A014620)

Overview: Sung Kwang Bend Co., Ltd. manufactures and sells pipe fittings globally, with a market cap of ₩776.42 billion.

Operations: The company generates revenue from its Machinery - Pumps segment, amounting to ₩232.82 million.

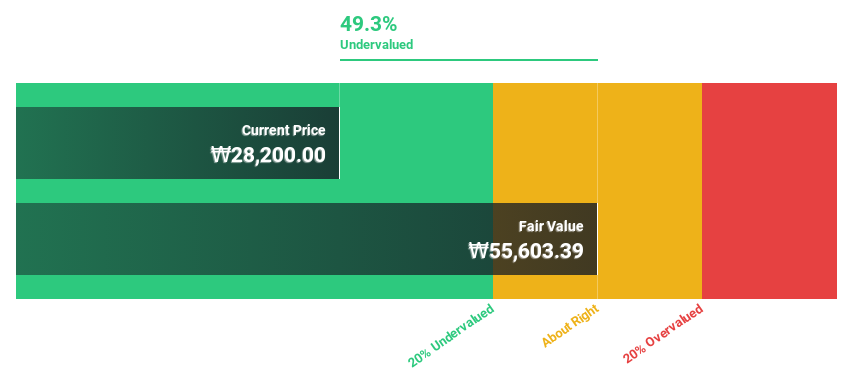

Estimated Discount To Fair Value: 46%

Sung Kwang Bend Ltd. is trading at ₩29,800, significantly below its estimated fair value of ₩55,225.67, suggesting it may be undervalued based on cash flows. The company's revenue and earnings are forecast to grow faster than the Korean market at 14.3% and 28% per year respectively. Despite a low future return on equity of 10.8%, its recent dividend increase to KRW 200 per share highlights strong cash flow management and shareholder returns.

- Our comprehensive growth report raises the possibility that Sung Kwang BendLtd is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Sung Kwang BendLtd.

Intellian Technologies (KOSDAQ:A189300)

Overview: Intellian Technologies, Inc. is a company that provides satellite antennas and terminals both in South Korea and internationally, with a market cap of approximately ₩365.09 billion.

Operations: The company's revenue primarily comes from telecommunication equipment sales, totaling approximately ₩267.04 billion.

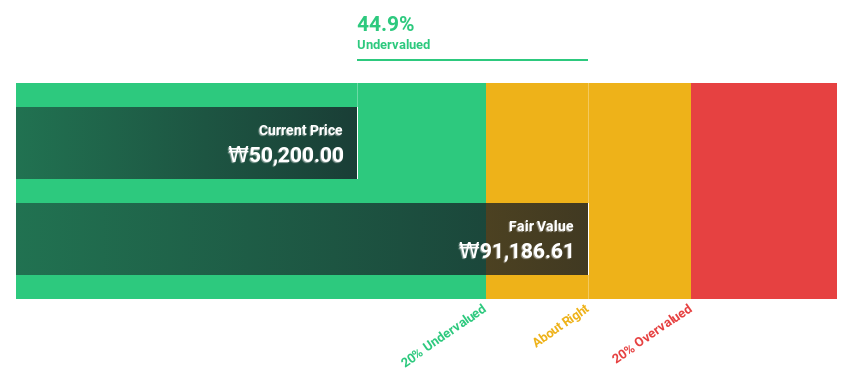

Estimated Discount To Fair Value: 48.1%

Intellian Technologies is trading at ₩38,950, well below its estimated fair value of ₩75,083.42, highlighting potential undervaluation based on cash flows. Revenue is projected to grow at 39.4% annually, outpacing the Korean market's 9.2%. Despite a forecasted low return on equity of 13.7%, Intellian's recent contract with Telesat for Ka-band LEO terminals and share buyback activity demonstrate strategic growth initiatives and effective capital allocation strategies.

- The analysis detailed in our Intellian Technologies growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Intellian Technologies stock in this financial health report.

Wiwynn (TWSE:6669)

Overview: Wiwynn Corporation manufactures and sells servers and storage products for cloud infrastructure and hyperscale data centers globally, with a market cap of NT$359.60 billion.

Operations: The company's revenue segment primarily consists of NT$360.54 billion from computer hardware sales in cloud infrastructure and hyperscale data centers across various regions, including the United States, Europe, and Asia.

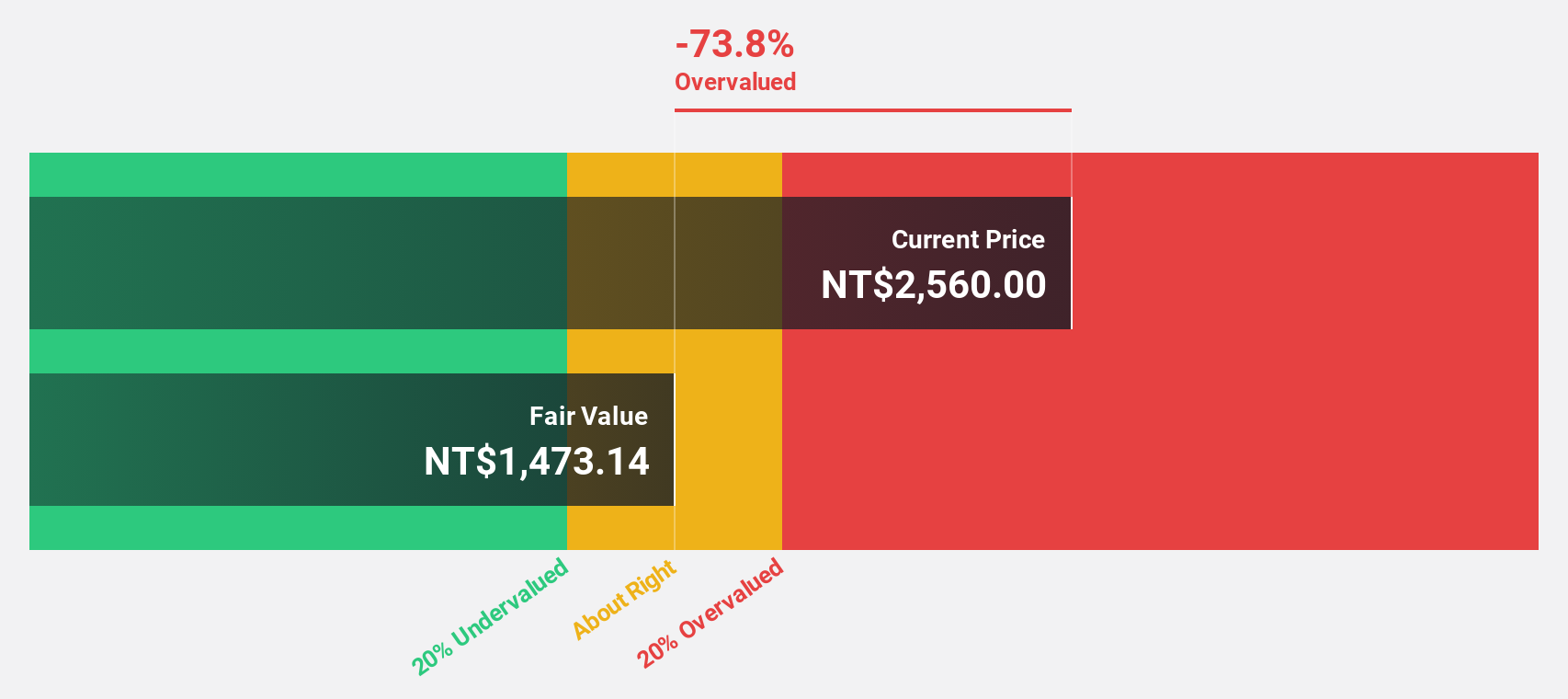

Estimated Discount To Fair Value: 46.3%

Wiwynn is trading at NT$2045, significantly below its estimated fair value of NT$3807.63, suggesting undervaluation based on cash flows. Revenue grew from TWD 241.9 billion to TWD 360.54 billion last year, with a forecasted growth rate of 25.7% annually, surpassing the Taiwan market average of 11.5%. Despite high earnings volatility and a dividend that isn't well covered by free cash flow, analysts anticipate a price rise by 47.1%.

- In light of our recent growth report, it seems possible that Wiwynn's financial performance will exceed current levels.

- Navigate through the intricacies of Wiwynn with our comprehensive financial health report here.

Seize The Opportunity

- Reveal the 503 hidden gems among our Undervalued Global Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A014620

Sung Kwang BendLtd

Engages in the manufacture and sale of pipe fittings worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives