- South Korea

- /

- Machinery

- /

- KOSDAQ:A014200

KANGLIM's (KOSDAQ:014200) Stock Price Has Reduced 53% In The Past Three Years

While it may not be enough for some shareholders, we think it is good to see the KANGLIM Co., Ltd (KOSDAQ:014200) share price up 10% in a single quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. Regrettably, the share price slid 53% in that period. So the improvement may be a real relief to some. Perhaps the company has turned over a new leaf.

See our latest analysis for KANGLIM

KANGLIM isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, KANGLIM grew revenue at 8.1% per year. That's a fairly respectable growth rate. That contrasts with the weak share price, which has fallen 15% compounded, over three years. The market must have had really high expectations to be disappointed with this progress. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

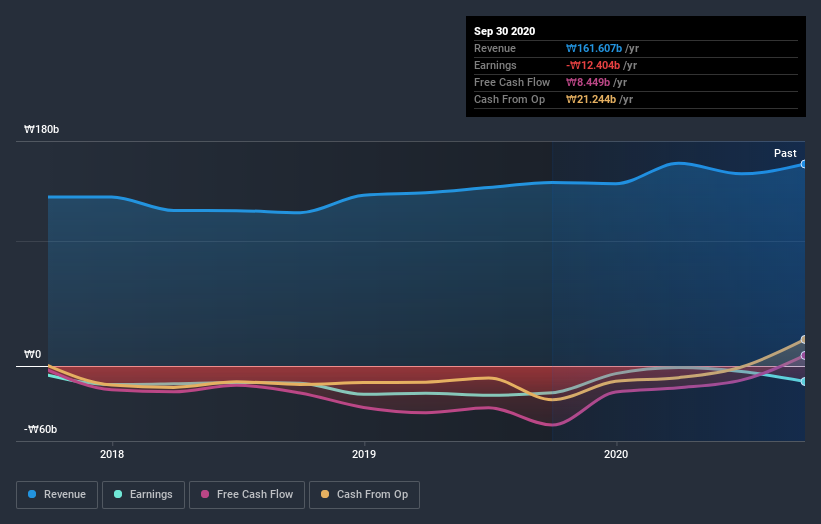

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in KANGLIM had a tough year, with a total loss of 3.7%, against a market gain of about 43%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 4% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand KANGLIM better, we need to consider many other factors. For example, we've discovered 2 warning signs for KANGLIM (1 is a bit concerning!) that you should be aware of before investing here.

We will like KANGLIM better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading KANGLIM or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade KANGLIM, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KANGLIM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A014200

KANGLIM

KANGLIM Co., Ltd produces and sells crane trucks and heavy equipment in South Korea.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives