- South Korea

- /

- Construction

- /

- KOSDAQ:A001840

Further Upside For EE-HWA Construction Co., Ltd. (KOSDAQ:001840) Shares Could Introduce Price Risks After 26% Bounce

EE-HWA Construction Co., Ltd. (KOSDAQ:001840) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.6% in the last twelve months.

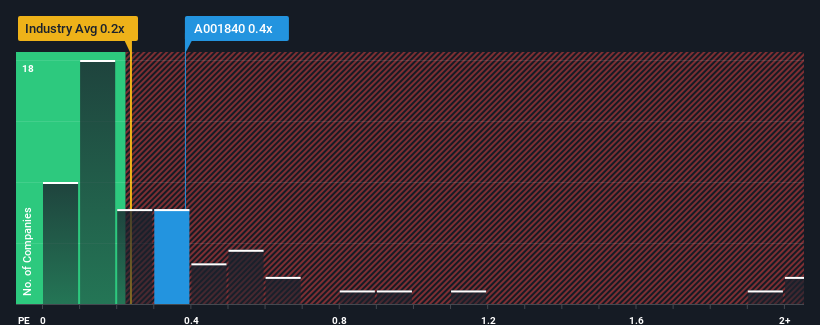

Although its price has surged higher, there still wouldn't be many who think EE-HWA Construction's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Korea's Construction industry is similar at about 0.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for EE-HWA Construction

What Does EE-HWA Construction's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for EE-HWA Construction, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on EE-HWA Construction will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

EE-HWA Construction's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.2% last year. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

In contrast to the company, the rest of the industry is expected to decline by 0.4% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, we find it intriguing that EE-HWA Construction's P/S matches its industry peers. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On EE-HWA Construction's P/S

EE-HWA Construction's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of EE-HWA Construction revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for EE-HWA Construction (2 are a bit unpleasant) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if EE-HWA Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A001840

Slight with imperfect balance sheet.

Market Insights

Community Narratives