- South Korea

- /

- Banks

- /

- KOSE:A105560

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate cuts from central banks and mixed performances across major indices, investors are increasingly seeking stability amidst economic uncertainties. With the Nasdaq Composite reaching new heights while other indexes face declines, dividend stocks offer a potential avenue for steady income and resilience in fluctuating conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.24% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.32% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.00% | ★★★★★★ |

| Shaanxi International TrustLtd (SZSE:000563) | 3.16% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

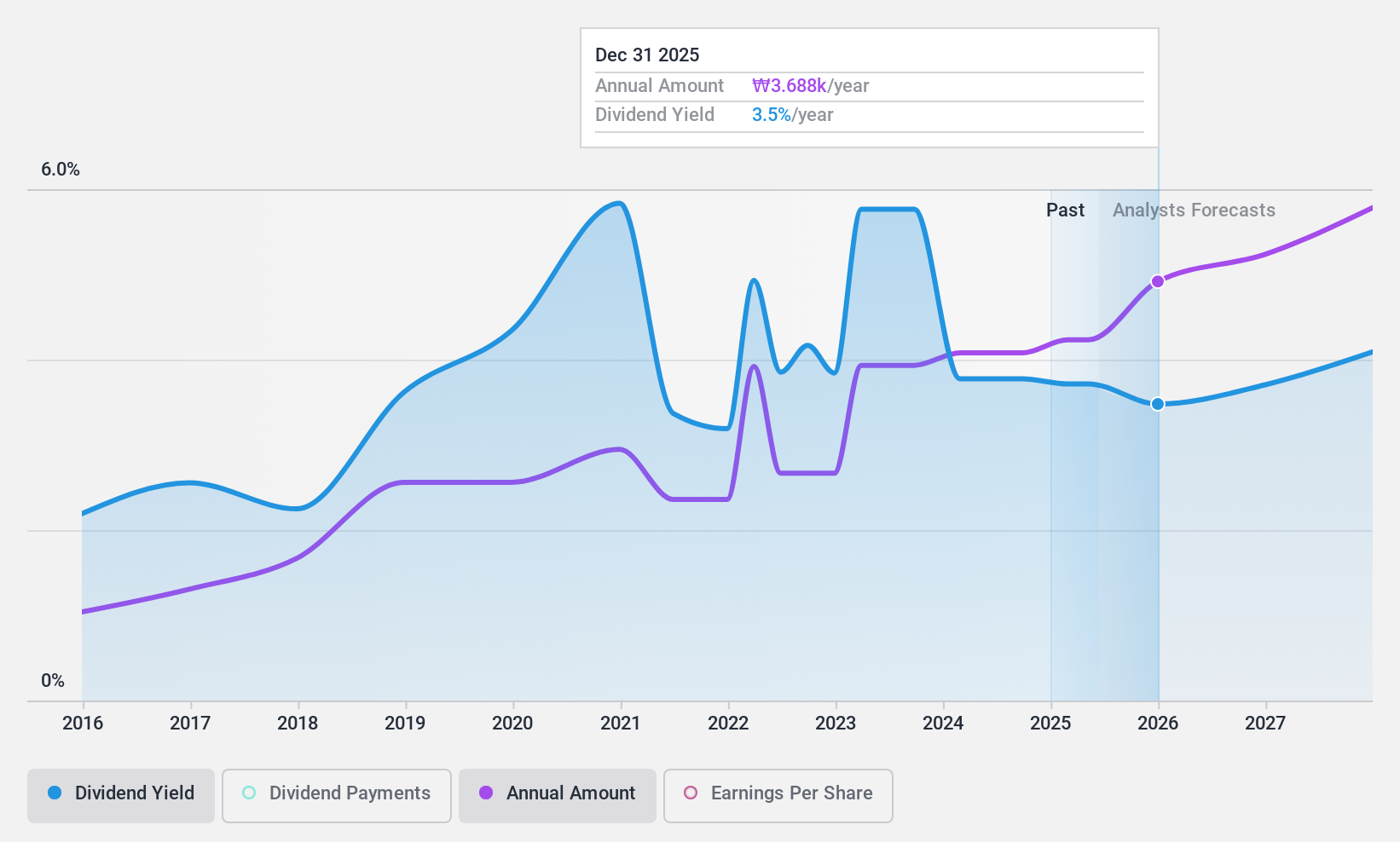

KB Financial Group (KOSE:A105560)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KB Financial Group Inc. offers a variety of banking and financial services to individuals and businesses across South Korea, the United States, New Zealand, China, Cambodia, the United Kingdom, Indonesia, and other international markets with a market cap of ₩32.13 trillion.

Operations: KB Financial Group Inc.'s revenue segments include Securities (₩1.76 billion), Life Insurance (₩0.31 billion), Credit Card Sector (₩1.15 billion), Banking Sector - Other (₩1.06 billion), Non-Life Insurance Sector (₩1.23 billion), Banking Sector - Corporate Finance (₩4.47 billion), and Banking Sector - Household Finance (₩3.97 billion).

Dividend Yield: 3.6%

KB Financial Group's dividend payments are currently well covered by earnings with a payout ratio of 33.3%, and this is expected to improve to 27.3% in three years, indicating sustainability. However, the dividends have been volatile over the past decade despite recent increases. The stock trades significantly below its estimated fair value, suggesting potential undervaluation. Recent share buybacks totaling KRW 400 billion aim to enhance shareholder returns alongside a quarterly cash dividend declaration of KRW 795 per share.

- Take a closer look at KB Financial Group's potential here in our dividend report.

- Our valuation report here indicates KB Financial Group may be undervalued.

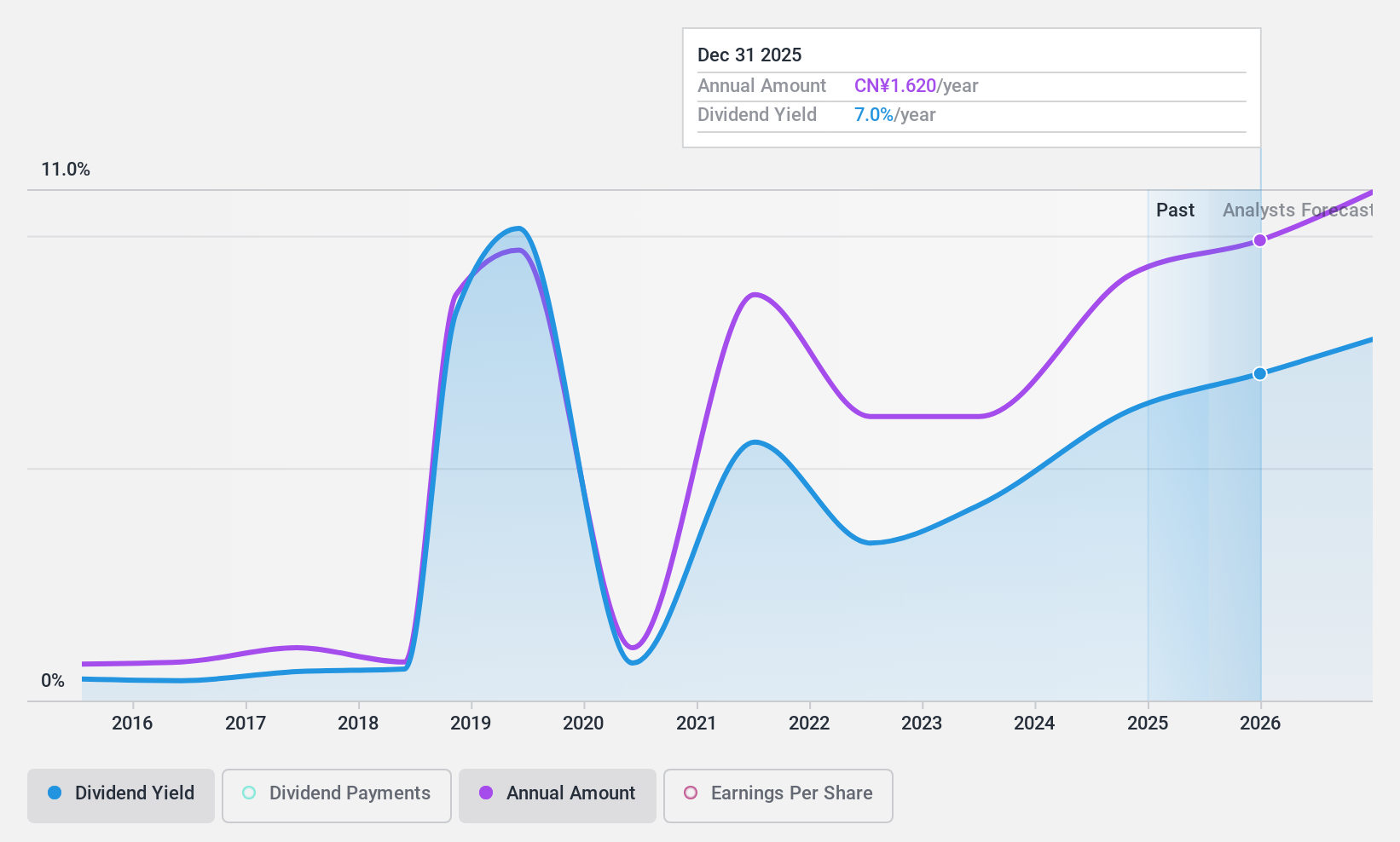

Kingclean ElectricLtd (SHSE:603355)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kingclean Electric Co., Ltd is a Chinese company that manufactures and sells home appliances, kitchen appliances, and garden tools under the KingClean brand, with a market cap of CN¥13.17 billion.

Operations: Kingclean Electric Co., Ltd generates revenue of CN¥9.57 billion from its Appliance & Tool segment.

Dividend Yield: 6.5%

Kingclean Electric Ltd's dividend yield of 6.53% ranks it among the top 25% in China's market, yet its dividends are not well covered by free cash flow due to a high cash payout ratio of 114.8%. Despite a reasonable payout ratio of 73.5%, indicating coverage by earnings, the dividends have been unreliable and volatile over the past decade. Recent earnings growth and good relative value compared to peers provide some positive aspects for investors.

- Click here to discover the nuances of Kingclean ElectricLtd with our detailed analytical dividend report.

- Our expertly prepared valuation report Kingclean ElectricLtd implies its share price may be lower than expected.

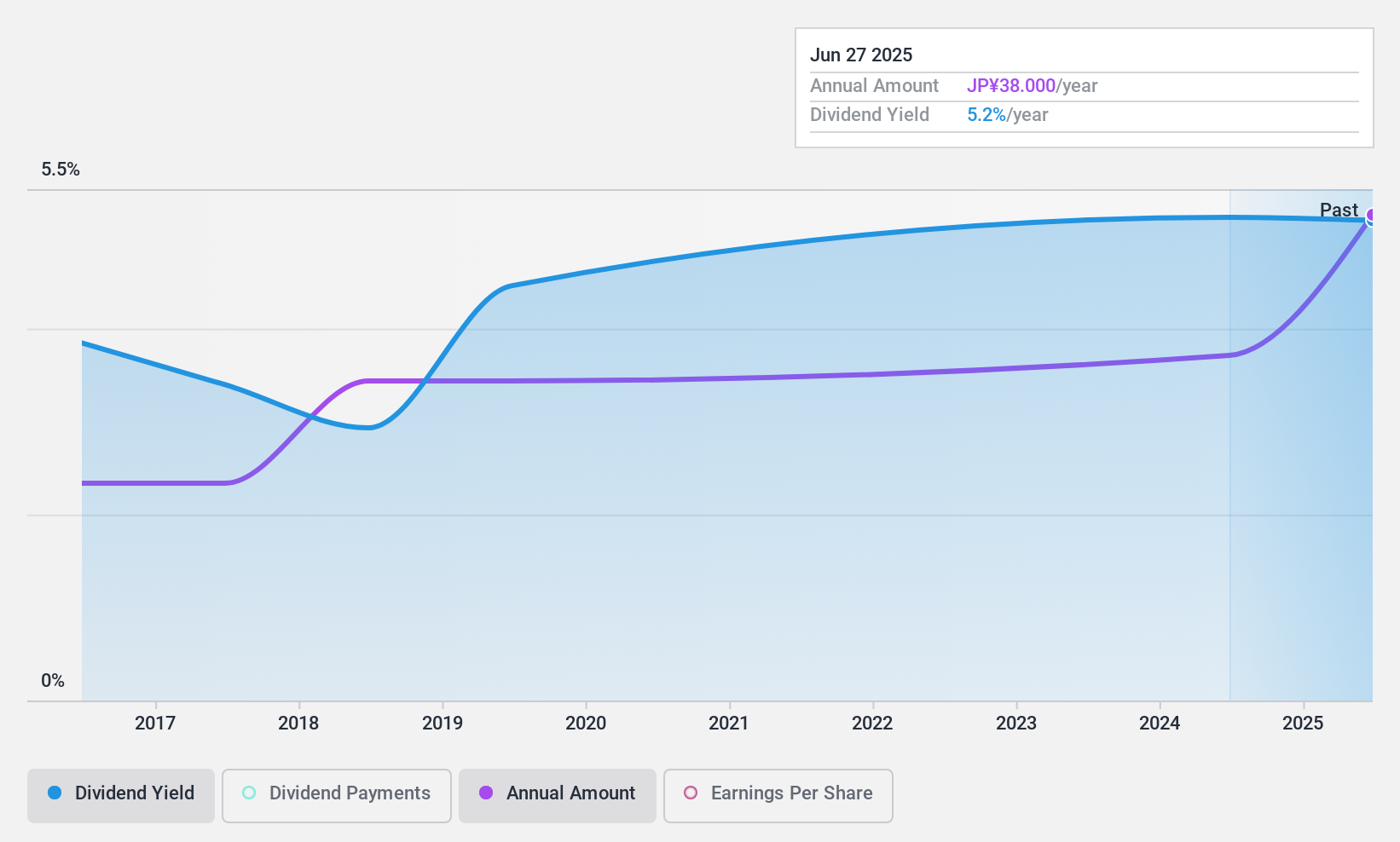

Global (TSE:3271)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Ltd., with a market cap of ¥17.86 billion, operates through its subsidiaries in Japan, focusing on the development of condominiums, apartment complexes, earning properties, commercial facilities, and hotels.

Operations: Global Ltd.'s revenue is primarily derived from its Income Property Business at ¥9.64 billion, followed by the Sales Agency Business at ¥1.34 billion, the Hotel Business generating ¥468 million, and the Building Management Business contributing ¥507 million.

Dividend Yield: 6%

Global's dividend yield of 6.02% places it in the top 25% of Japan's market, but payments have been volatile and unreliable over the past decade. Despite a low payout ratio of 27.1%, dividends are not covered by free cash flows or earnings, raising sustainability concerns. Earnings growth of 48.6% last year and a price-to-earnings ratio of 5.9x suggest good value, though debt coverage by operating cash flow remains inadequate.

- Click to explore a detailed breakdown of our findings in Global's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Global shares in the market.

Key Takeaways

- Gain an insight into the universe of 1976 Top Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KB Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A105560

KB Financial Group

Provides various banking and related financial services to consumers and corporations in South Korea, the United States, New Zealand, China, Cambodia, the United Kingdom, Indonesia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives