- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2327

3 Global Dividend Stocks Yielding Up To 4%

Reviewed by Simply Wall St

In the current global market landscape, investors are closely watching economic indicators and central bank policies as they navigate a mixed bag of rising stock indices and softening labor markets. Amidst this backdrop, dividend stocks offering yields up to 4% can provide a steady income stream, making them an attractive option for those seeking stability in uncertain times.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.98% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.67% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.37% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.71% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.43% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.83% | ★★★★★★ |

| NCD (TSE:4783) | 4.25% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Daicel (TSE:4202) | 4.32% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.54% | ★★★★★★ |

Click here to see the full list of 1305 stocks from our Top Global Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

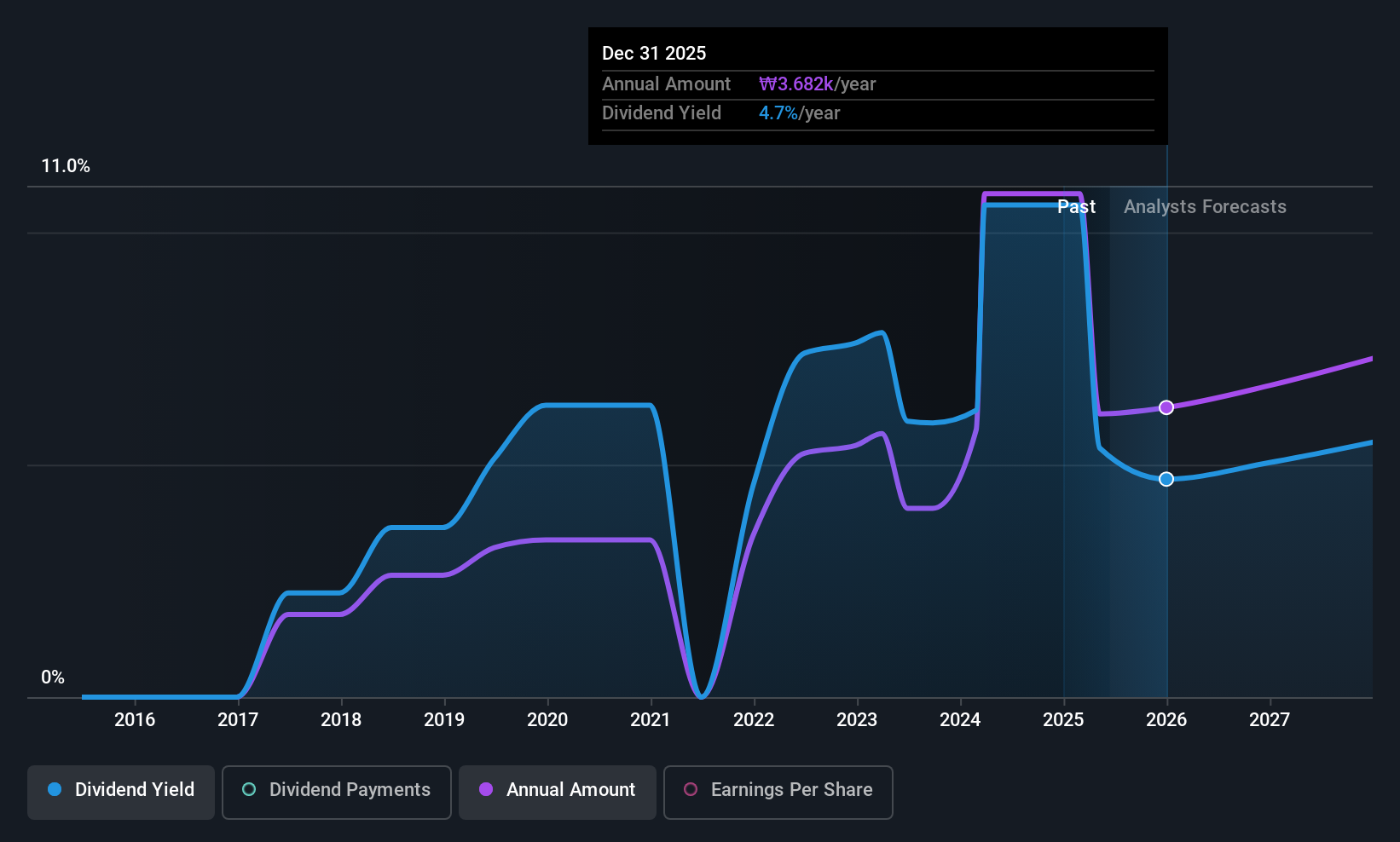

Hana Financial Group (KOSE:A086790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hana Financial Group Inc., with a market cap of ₩24.03 trillion, operates in South Korea offering financial services through its subsidiaries.

Operations: Hana Financial Group Inc. generates revenue from several segments, including Banking (₩9.32 billion), Securities (₩840.73 million), Credit Card (₩539.91 million), and Capital Financing (₩982.74 million).

Dividend Yield: 4.1%

Hana Financial Group's dividend profile shows a mixed picture. While its dividend yield of 4.06% places it in the top 25% of KR market payers, the company's track record is unstable with payments being volatile over its eight-year history. However, dividends are currently well-covered by earnings with a payout ratio of 39.9%, and this coverage is expected to improve further in three years to 26.2%. Recent buyback programs indicate a focus on shareholder returns, potentially enhancing value for investors seeking income stability despite past volatility concerns.

- Navigate through the intricacies of Hana Financial Group with our comprehensive dividend report here.

- Our valuation report unveils the possibility Hana Financial Group's shares may be trading at a discount.

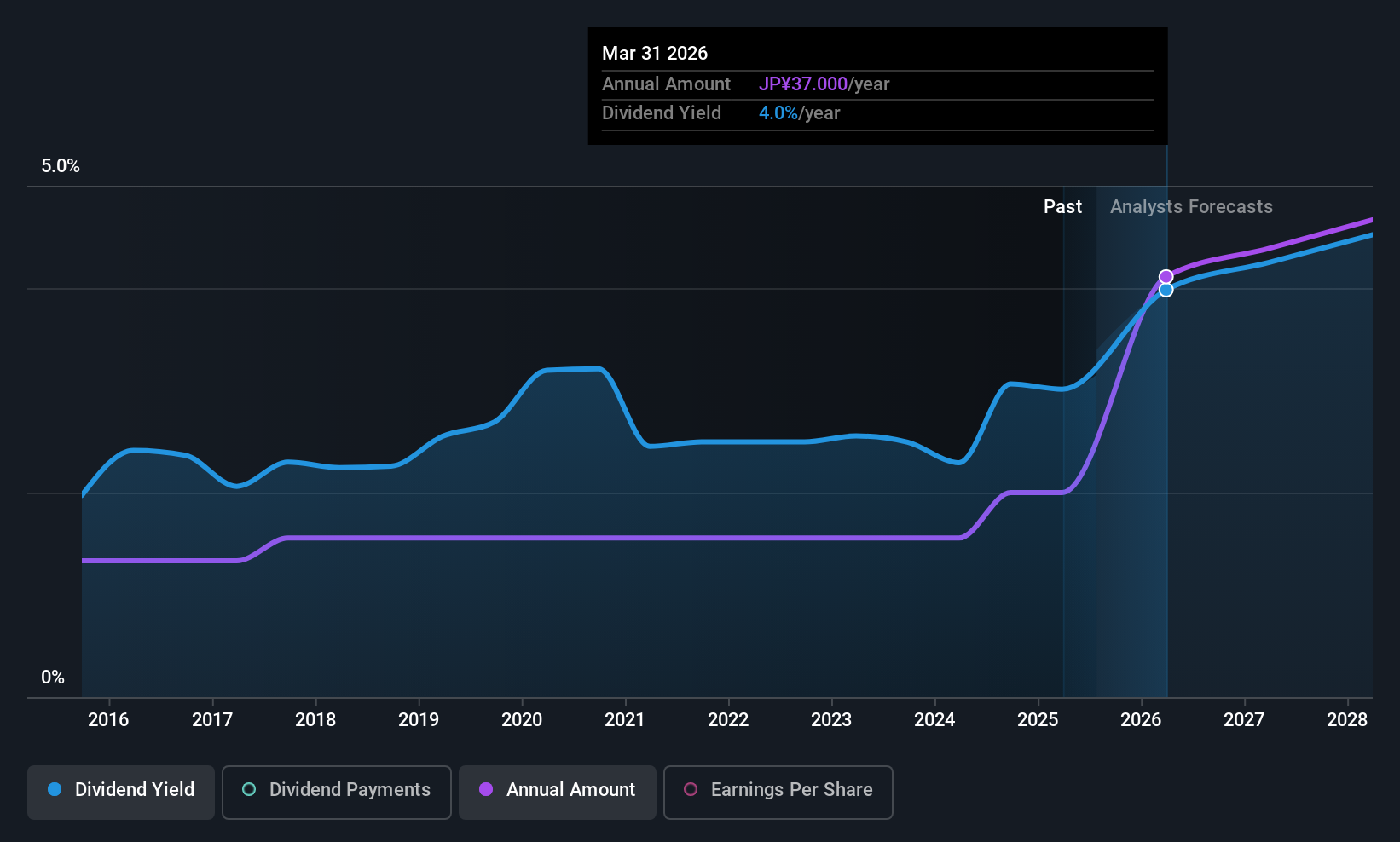

Airport Facilities (TSE:8864)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Airport Facilities Co., Ltd. operates in Japan, focusing on real estate, area heating and cooling, as well as water supply and drainage services, with a market cap of ¥56.22 billion.

Operations: Airport Facilities Co., Ltd.'s revenue is derived from its operations in real estate, area heating and cooling, and water supply and drainage services within Japan.

Dividend Yield: 3.2%

Airport Facilities offers a stable dividend history over the past decade, with consistent growth. However, its current 3.21% yield is below the top 25% of JP market payers and not well-covered by cash flows due to a high cash payout ratio of 137.8%. Despite earnings growing by 51.3% last year and dividends being covered by earnings with a low payout ratio of 32.2%, the sustainability remains questionable without improved cash flow coverage.

- Click to explore a detailed breakdown of our findings in Airport Facilities' dividend report.

- The analysis detailed in our Airport Facilities valuation report hints at an inflated share price compared to its estimated value.

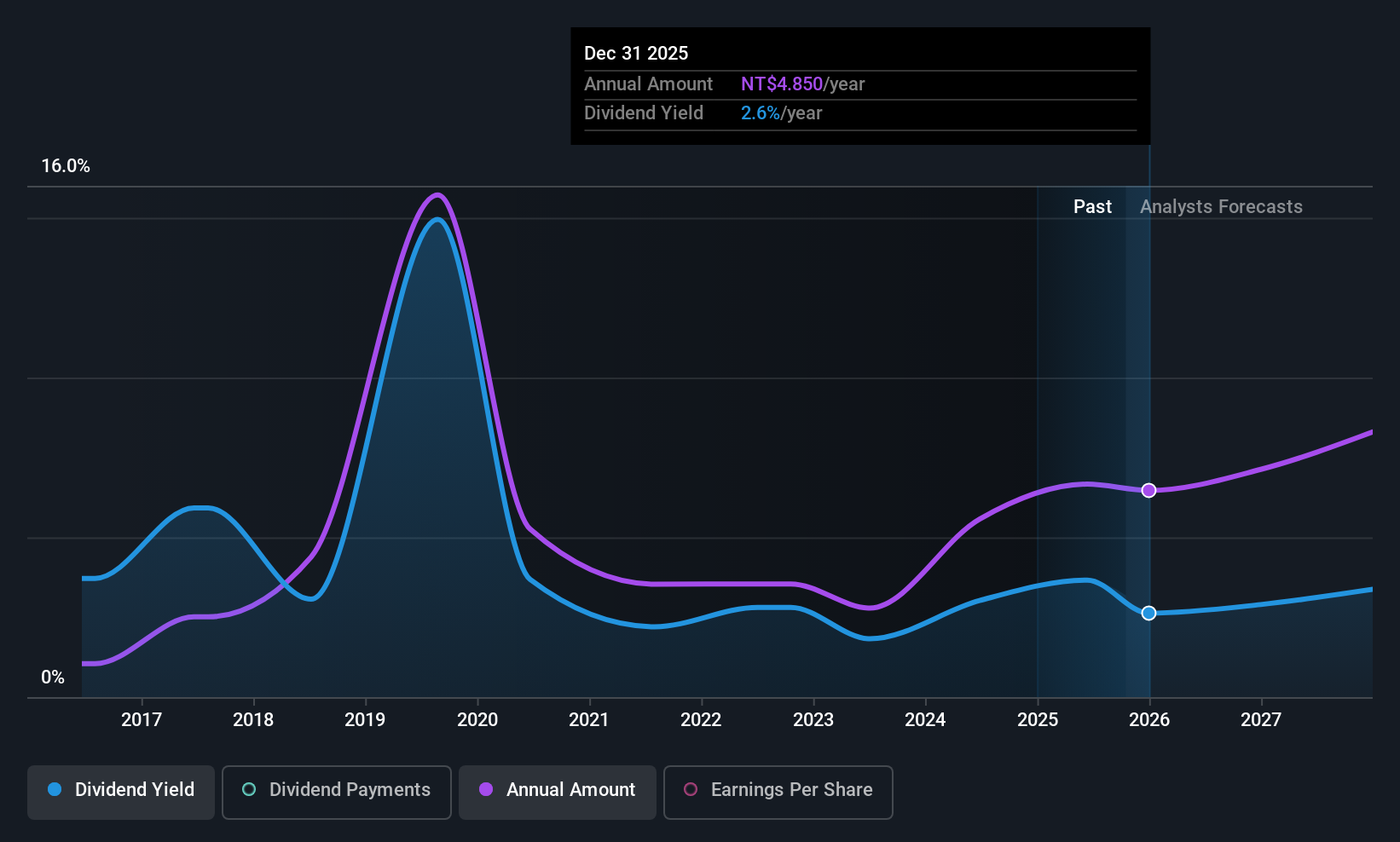

Yageo (TWSE:2327)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yageo Corporation, along with its subsidiaries, manufactures and sells electronic components across China, Europe, the United States, and other parts of Asia with a market cap of NT$283.78 billion.

Operations: Yageo Corporation generates revenue from its electronic components and parts segment, amounting to NT$125.62 billion.

Dividend Yield: 3.3%

Yageo's dividend payments are well-covered by earnings (51.9% payout ratio) and cash flows (42.3% cash payout ratio), indicating sustainability despite a volatile track record over the past decade. Although dividends have increased, their reliability is questionable due to past volatility and a relatively low yield of 3.3%, below Taiwan's top 25% payers. Recent earnings reports show stable revenue growth, but net income has slightly decreased compared to the previous year, impacting dividend stability perceptions.

- Unlock comprehensive insights into our analysis of Yageo stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Yageo is priced lower than what may be justified by its financials.

Seize The Opportunity

- Navigate through the entire inventory of 1305 Top Global Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2327

Yageo

Engages in the manufacture and sale of electronic components in China, Europe, the United States, and rest of Asia.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives