- South Korea

- /

- Capital Markets

- /

- KOSE:A005940

Top Three Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding policy changes under the new U.S. administration, investors are witnessing fluctuations across various sectors, with financials and energy seeing gains while healthcare faces challenges. In this dynamic environment, dividend stocks can offer a measure of stability and income potential for portfolios by providing regular payouts that may help cushion against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

Click here to see the full list of 1966 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

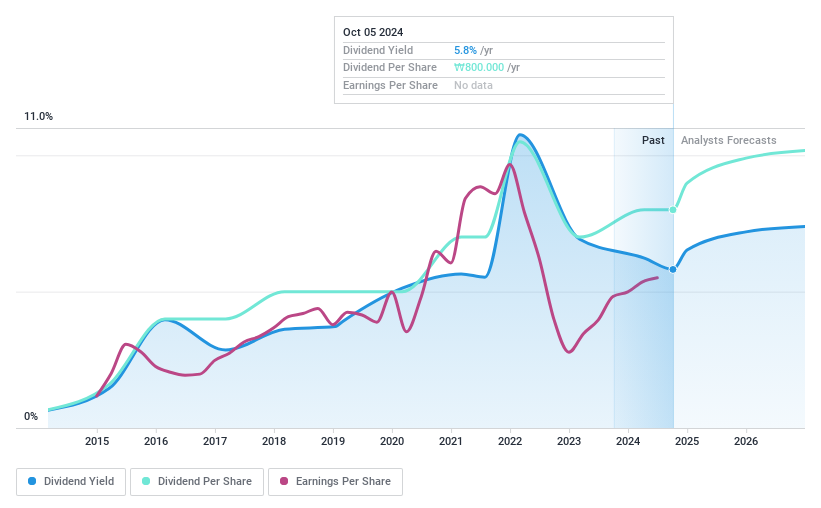

NH Investment & Securities (KOSE:A005940)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NH Investment & Securities Co., Ltd. operates in wealth management, investment banking, trading, and equity sales both in South Korea and internationally, with a market cap of ₩4.64 trillion.

Operations: NH Investment & Securities Co., Ltd.'s revenue segments include Sales at ₩2.77 billion, Trading at ₩2.65 billion, and Investment Banking (IB) at ₩859.49 million.

Dividend Yield: 5.9%

NH Investment & Securities has shown inconsistent dividend payments over the past decade, with a 5.93% yield placing it in the top 25% of KR market dividend payers. Despite a low payout ratio of 45.6%, dividends aren't backed by free cash flow, raising sustainability concerns. The stock trades at good value, and analysts expect price appreciation. Earnings have grown significantly recently but include high non-cash components, complicating quality assessments.

- Unlock comprehensive insights into our analysis of NH Investment & Securities stock in this dividend report.

- Our valuation report here indicates NH Investment & Securities may be undervalued.

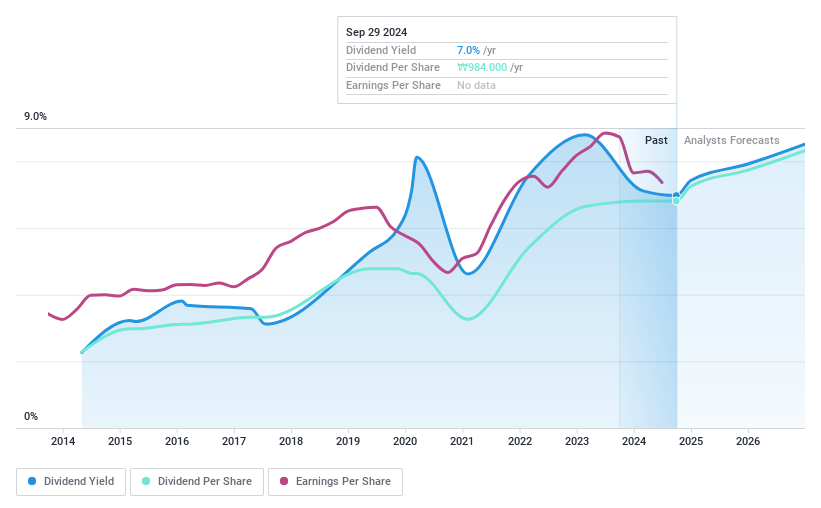

Industrial Bank of Korea (KOSE:A024110)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Industrial Bank of Korea operates as a financing bank for small and medium-sized enterprises (SMEs) both in Korea and internationally, with a market cap of ₩11.77 trillion.

Operations: Industrial Bank of Korea's revenue segments include Corporate Customer at ₩4.42 trillion, Individual Customer at ₩1.59 trillion, and Investment Banking (IB) at ₩369.17 million.

Dividend Yield: 6.7%

Industrial Bank of Korea offers a 6.67% dividend yield, ranking in the top 25% of KR market payers, with dividends well-covered by earnings at a 34.3% payout ratio. Despite this, its dividend history has been volatile over the past decade. The stock trades significantly below estimated fair value and recent fixed-income offerings suggest reliance on external borrowing for funding, which carries higher risk compared to customer deposits.

- Take a closer look at Industrial Bank of Korea's potential here in our dividend report.

- The analysis detailed in our Industrial Bank of Korea valuation report hints at an deflated share price compared to its estimated value.

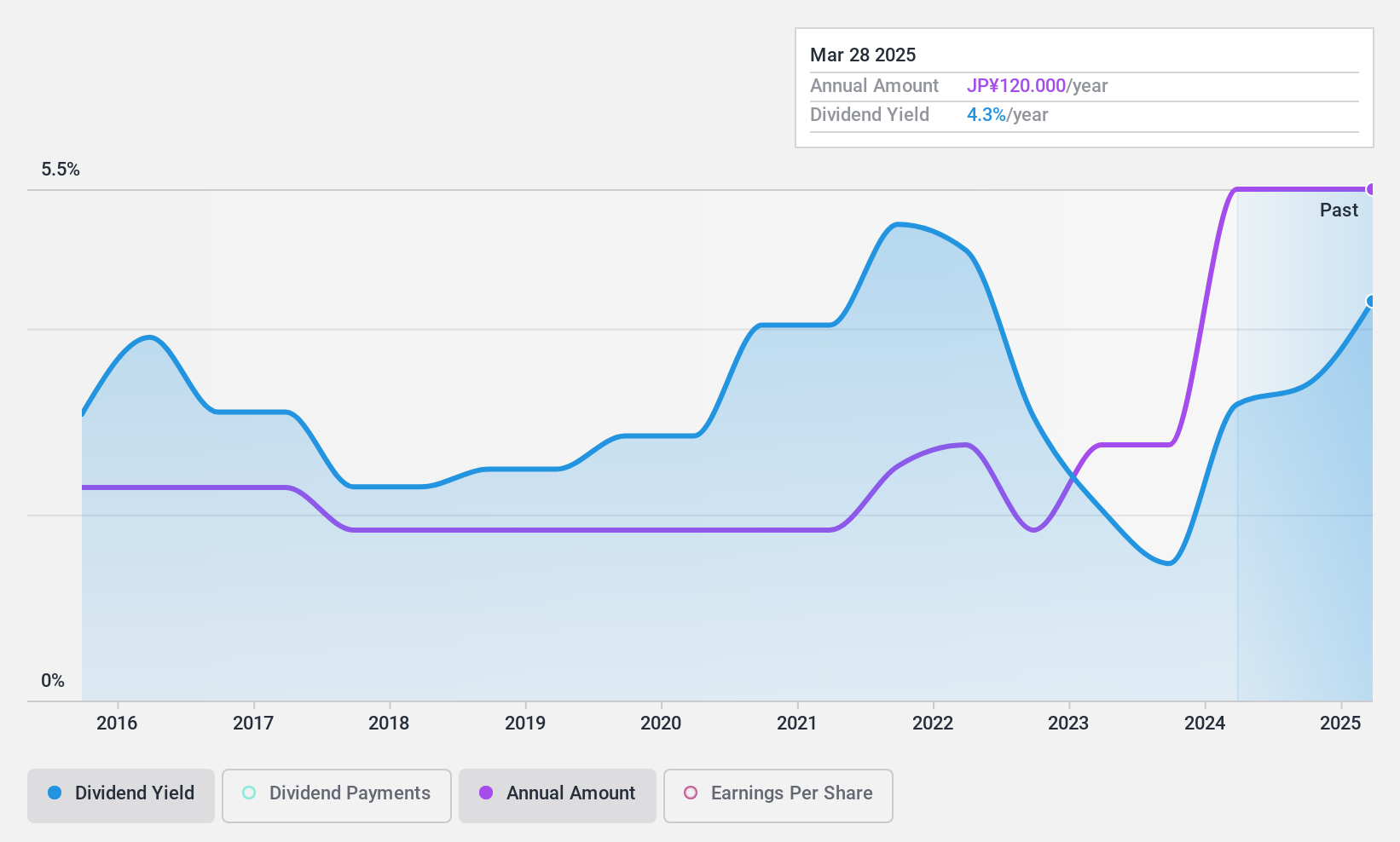

Daikoku Denki (TSE:6430)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daikoku Denki Co., Ltd. engages in the development, production, and sale of computer and information system equipment for pachinko halls in Japan, with a market cap of ¥50.60 billion.

Operations: Daikoku Denki Co., Ltd. generates revenue through its operations in developing, producing, and selling computer and information system equipment specifically designed for pachinko halls in Japan.

Dividend Yield: 3.5%

Daikoku Denki's dividend payments are well-covered by earnings and cash flows, with a low payout ratio of 4.8% and a cash payout ratio of 27.6%. However, its dividend yield is below the top tier in Japan at 3.51%, and the company's dividend history has been volatile, with significant annual drops over the past decade. Despite recent earnings growth of 16.7%, the sustainability of its dividends remains questionable due to this instability.

- Dive into the specifics of Daikoku Denki here with our thorough dividend report.

- Our expertly prepared valuation report Daikoku Denki implies its share price may be lower than expected.

Taking Advantage

- Click through to start exploring the rest of the 1963 Top Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NH Investment & Securities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005940

NH Investment & Securities

Engages in the wealth management, investment banking, trading, and equity sales businesses in South Korea and internationally.

Undervalued with adequate balance sheet and pays a dividend.