- South Korea

- /

- Auto Components

- /

- KOSE:A204320

We Think You Can Look Beyond Mando's (KRX:204320) Lackluster Earnings

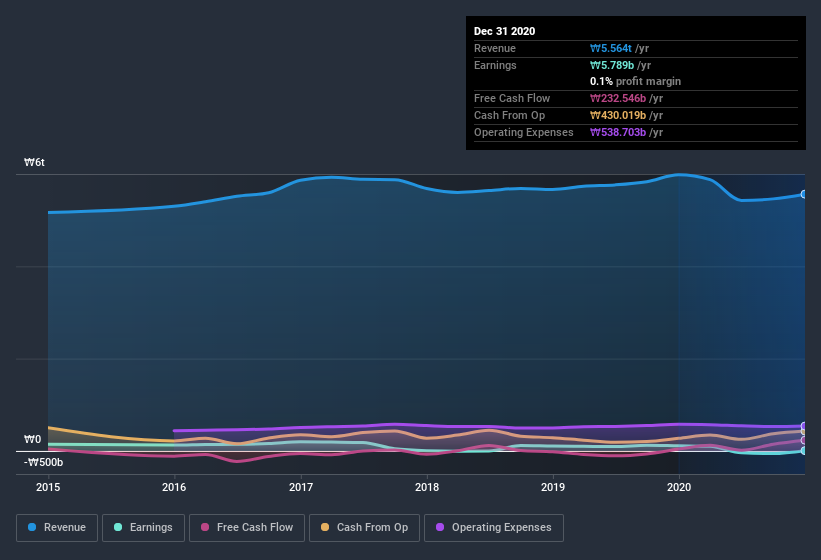

Mando Corporation's (KRX:204320) stock was strong despite it releasing a soft earnings report last week. However, we think the company is showing some signs that things are more promising than they seem.

See our latest analysis for Mando

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Mando's profit was reduced by ₩19b, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect Mando to produce a higher profit next year, all else being equal.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that Mando received a tax benefit of ₩8.7b. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Our Take On Mando's Profit Performance

In its last report Mando received a tax benefit which might make its profit look better than it really is on a underlying level. Having said that, it also had a unusual item reducing its profit. Based on these factors, it's hard to tell if Mando's profits are a reasonable reflection of its underlying profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For instance, we've identified 5 warning signs for Mando (1 is potentially serious) you should be familiar with.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Mando or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HL Mando might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A204320

HL Mando

An electric vehicle and autonomous driving solutions company, provides automotive parts and services in Korea, China, the United States, India, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives