- South Korea

- /

- Auto Components

- /

- KOSE:A090080

Pyung Hwa Industrial Co., Ltd.'s (KRX:090080) Price In Tune With Earnings

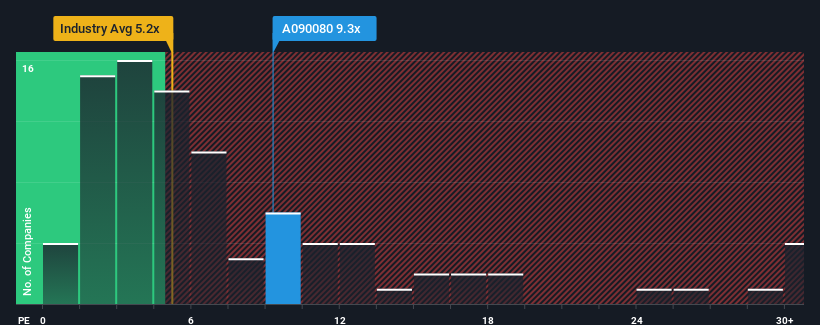

It's not a stretch to say that Pyung Hwa Industrial Co., Ltd.'s (KRX:090080) price-to-earnings (or "P/E") ratio of 9.3x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 10x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

For instance, Pyung Hwa Industrial's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Pyung Hwa Industrial

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Pyung Hwa Industrial's is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 5.2%. Still, the latest three year period has seen an excellent 96% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

It's interesting to note that the rest of the market is similarly expected to grow by 27% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we can see why Pyung Hwa Industrial is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Pyung Hwa Industrial revealed its three-year earnings trends are contributing to its P/E, given they look similar to current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Pyung Hwa Industrial (1 can't be ignored!) that you should be aware of.

Of course, you might also be able to find a better stock than Pyung Hwa Industrial. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A090080

Pyung Hwa Industrial

Produces and sells anti-vibration, air suspension, and hose auto parts for automobiles and equipment facilities in South Korea and internationally.

Solid track record and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.