- South Korea

- /

- Auto Components

- /

- KOSE:A018880

Does It Make Sense To Buy Hanon Systems (KRX:018880) For Its Yield?

Today we'll take a closer look at Hanon Systems (KRX:018880) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

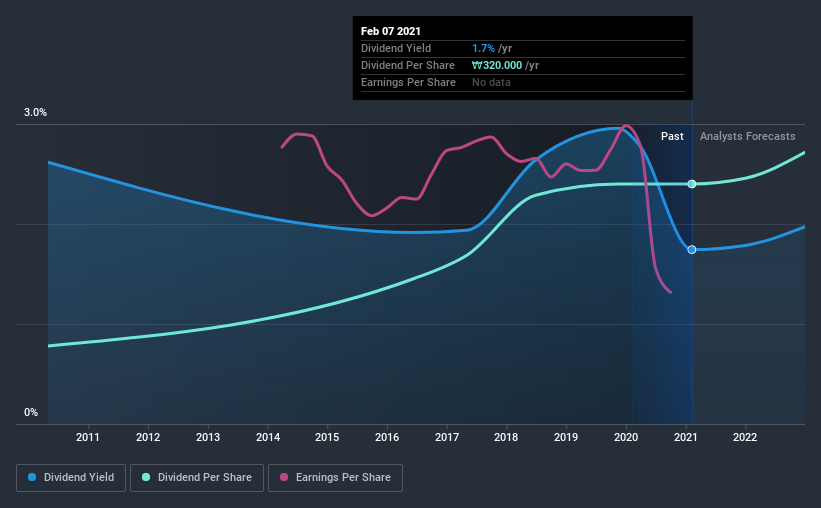

A slim 1.7% yield is hard to get excited about, but the long payment history is respectable. At the right price, or with strong growth opportunities, Hanon Systems could have potential. Remember though, due to the recent spike in its share price, Hanon Systems's yield will look lower, even though the market may now be factoring in an improvement in its long-term prospects. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on Hanon Systems!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 199% of Hanon Systems' profits were paid out as dividends in the last 12 months. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. With a cash payout ratio of 104%, Hanon Systems' dividend payments are poorly covered by cash flow. As Hanon Systems' dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

We update our data on Hanon Systems every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. For the purpose of this article, we only scrutinise the last decade of Hanon Systems' dividend payments. During this period the dividend has been stable, which could imply the business could have relatively consistent earnings power. During the past 10-year period, the first annual payment was ₩104 in 2011, compared to ₩320 last year. Dividends per share have grown at approximately 12% per year over this time.

Dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. It's not great to see that Hanon Systems' have fallen at approximately 8.8% over the past five years. A modest decline in earnings per share is not great to see, but it doesn't automatically make a dividend unsustainable. Still, we'd vastly prefer to see EPS growth when researching dividend stocks.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're a bit uncomfortable with Hanon Systems paying out a high percentage of both its cashflow and earnings. It's not great to see earnings per share shrinking. The dividends have been relatively consistent, but we wonder for how much longer this will be true. There are a few too many issues for us to get comfortable with Hanon Systems from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 4 warning signs for Hanon Systems that investors need to be conscious of moving forward.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading Hanon Systems or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hanon Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A018880

Hanon Systems

Provides thermal and energy management solutions to automotive market in Korea, Europe, Asia, and the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion