- South Korea

- /

- Auto Components

- /

- KOSE:A012330

Is Hyundai Mobis Co.,Ltd (KRX:012330) Popular Amongst Insiders?

If you want to know who really controls Hyundai Mobis Co.,Ltd (KRX:012330), then you'll have to look at the makeup of its share registry. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

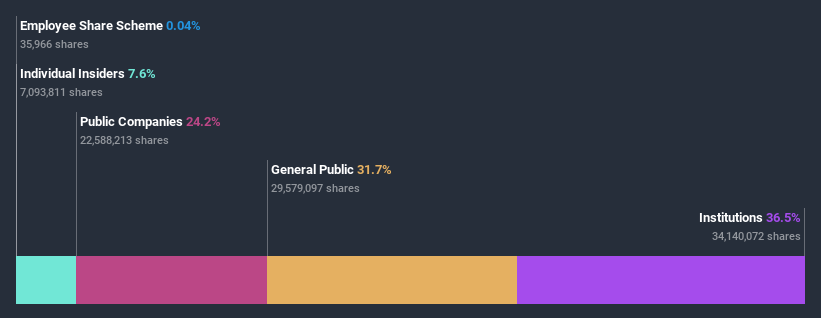

Hyundai MobisLtd is a pretty big company. It has a market capitalization of ₩23t. Normally institutions would own a significant portion of a company this size. In the chart below, we can see that institutional investors have bought into the company. Let's delve deeper into each type of owner, to discover more about Hyundai MobisLtd.

View our latest analysis for Hyundai MobisLtd

What Does The Institutional Ownership Tell Us About Hyundai MobisLtd?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

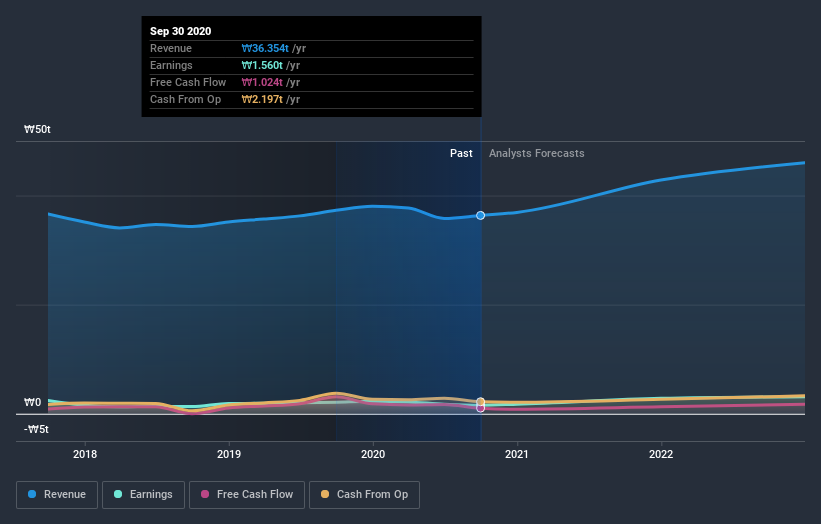

As you can see, institutional investors have a fair amount of stake in Hyundai MobisLtd. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Hyundai MobisLtd, (below). Of course, keep in mind that there are other factors to consider, too.

Hyundai MobisLtd is not owned by hedge funds. Kia Motors Corporation is currently the company's largest shareholder with 18% of shares outstanding. With 12% and 7.3% of the shares outstanding respectively, National Pension Service and Mong-Koo Chung are the second and third largest shareholders. Mong-Koo Chung, who is the third-largest shareholder, also happens to hold the title of Chairman of the Board.

We did some more digging and found that 8 of the top shareholders account for roughly 52% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Hyundai MobisLtd

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

We can see that insiders own shares in Hyundai Mobis Co.,Ltd. It is a very large company, and board members collectively own ₩1.8t worth of shares (at current prices). It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

With a 32% ownership, the general public have some degree of sway over Hyundai MobisLtd. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Public Company Ownership

It appears to us that public companies own 24% of Hyundai MobisLtd. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Hyundai MobisLtd better, we need to consider many other factors.

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow, for free.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Hyundai MobisLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hyundai MobisLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A012330

Hyundai MobisLtd

Engages in the auto parts business in Korea, China, the United States, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives