- South Korea

- /

- Auto

- /

- KOSE:A003620

KG Mobility's (KRX:003620) Promising Earnings May Rest On Soft Foundations

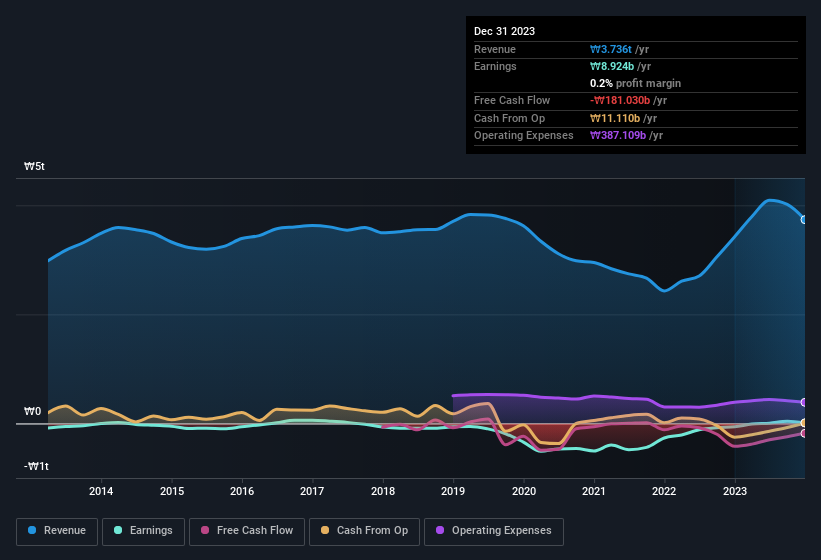

Last week's profit announcement from KG Mobility Corp. (KRX:003620) was underwhelming for investors, despite headline numbers being robust. Our analysis uncovered some concerning factors that we believe the market might be paying attention to.

Check out our latest analysis for KG Mobility

An Unusual Tax Situation

KG Mobility reported a tax benefit of ₩12b, which is well worth noting. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of KG Mobility.

Our Take On KG Mobility's Profit Performance

In its most recent report, KG Mobility disclosed a tax benefit, as we discussed above. Tax is usually an expense, not a benefit, so we don't think the reported profit number is a particularly good guide to the earning potential of the business. As a result, we think it may well be the case that KG Mobility's underlying earnings power is lower than its statutory profit. The good news is that it earned a profit in the last twelve months, despite its previous loss. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Just as investors must consider earnings, it is also important to take into account the strength of a company's balance sheet. We've done some analysis and you can see our take on KG Mobility's balance sheet by clicking here.

Today we've zoomed in on a single data point to better understand the nature of KG Mobility's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if KG Mobility might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A003620

KG Mobility

Manufactures and sells automobiles and parts in the South Korea and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives