- South Korea

- /

- Auto

- /

- KOSE:A003620

Exploring Undiscovered South Korean Stocks July 2024

Reviewed by Simply Wall St

The South Korean stock market has recently experienced a downturn, with the KOSPI index declining over three consecutive sessions and showing signs of continued pressure. Amidst this broader market sentiment and recent global economic uncertainties, investors might look towards less recognized stocks which could present unique opportunities in such fluctuating conditions. In times like these, identifying stocks that maintain stability or have potential growth drivers despite prevailing market challenges becomes particularly valuable.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 47.03% | 6.61% | 22.07% | ★★★★★★ |

| Korea Ratings | NA | 1.74% | 0.87% | ★★★★★★ |

| NOROO PAINT & COATINGS | 17.16% | 5.11% | 6.31% | ★★★★★★ |

| Woori Technology Investment | NA | 22.60% | -1.67% | ★★★★★★ |

| Kyung Dong Navien | 26.97% | 11.54% | 19.49% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 59.19% | 3.54% | 5.92% | ★★★★★★ |

| BIO-FD&CLtd | 2.01% | 8.27% | 22.82% | ★★★★★★ |

| THINKWARE | 36.41% | 19.78% | 21.78% | ★★★★★☆ |

| Kwang Dong Pharmaceutical | 40.57% | 5.48% | 4.75% | ★★★★☆☆ |

| EASY BIOInc | 188.46% | 15.71% | 55.75% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

Overview: VT Co., Ltd. is a global manufacturer and exporter of laminating machines and films, with a market capitalization of approximately ₩1.34 billion.

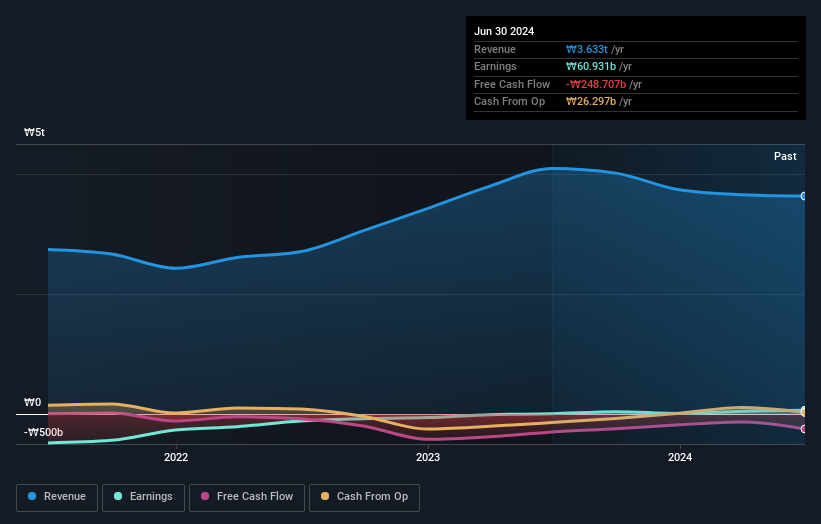

Operations: The company generates its primary revenue from the cosmetics, laminating, and entertainment sectors, with significant contributions of ₩213.71 billion, ₩33.15 billion, and ₩98.08 billion respectively. It operates with a gross profit margin that has seen an upward trend over the years, reaching 48.76% as of mid-2024, indicating increasing efficiency or pricing power in its operations despite fluctuating net income figures over the same period.

VT, a lesser-known entity in South Korea's Personal Products sector, demonstrates significant growth potential with a 727.4% earnings increase over the past year, far surpassing the industry average of 36.9%. The company has effectively managed its financial health by reducing its debt-to-equity ratio from 43.3% to 24.6% in five years while maintaining robust interest coverage at 318.5 times EBIT. VT's strategic financial maneuvers and exceptional earnings growth position it as an attractive prospect for discerning investors looking for emerging opportunities in dynamic markets.

- Get an in-depth perspective on VT's performance by reading our health report here.

Gain insights into VT's historical performance by reviewing our past performance report.

KG Mobility (KOSE:A003620)

Simply Wall St Value Rating: ★★★★★★

Overview: KG Mobility Corp. is a global manufacturer and seller of automobiles and parts, based in South Korea, with a market capitalization of approximately ₩1.18 trillion.

Operations: The company generates revenue primarily through the sale of goods, with significant costs associated with the cost of goods sold (COGS), which consistently represents a large portion of its revenue. It incurs various operating expenses, notably in sales and marketing, research and development (R&D), and general administrative activities. The firm has experienced fluctuations in net income over the years, reflecting varying degrees of profitability within its operational framework.

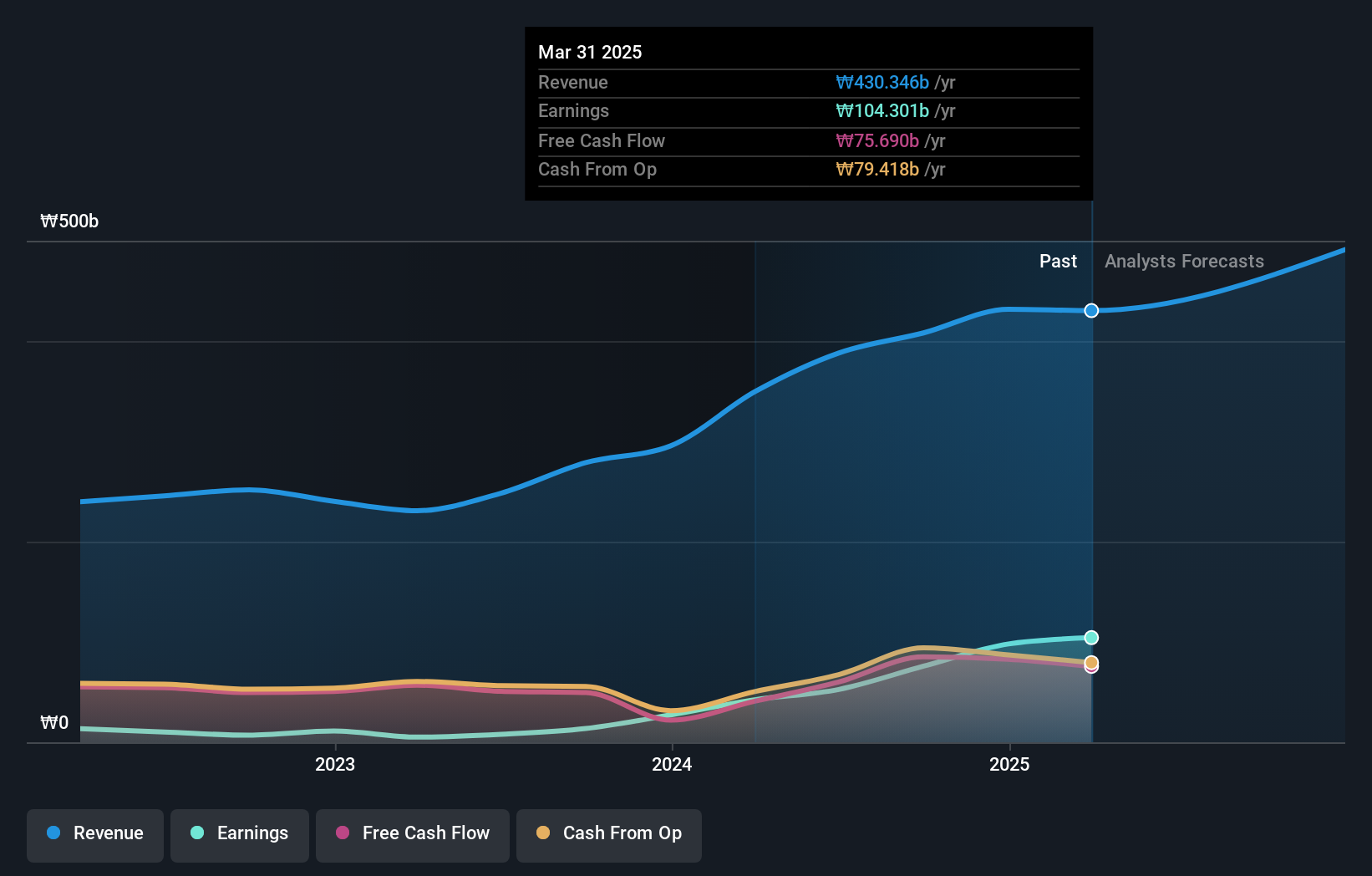

KG Mobility, a lesser-known yet promising entity in South Korea's automotive sector, has shown remarkable financial and operational improvements. Recently reporting a significant jump in net income to KRW 53.88 billion from KRW 16.52 billion year-over-year and sales growth to KRW 48.30 billion, the company underscores its robust market position. Notably, its debt-to-equity ratio improved impressively from 44.1% to 16.2% over five years, reflecting stronger financial health and strategic debt management. Additionally, KG Mobility's earnings quality is high and interest payments on debt are well-covered by EBIT at a ratio of 6.1 times, indicating efficient operational management amid industry challenges.

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. is a South Korean company specializing in the manufacture and sale of machinery and heat combustion equipment, with a market capitalization of approximately ₩829.60 billion.

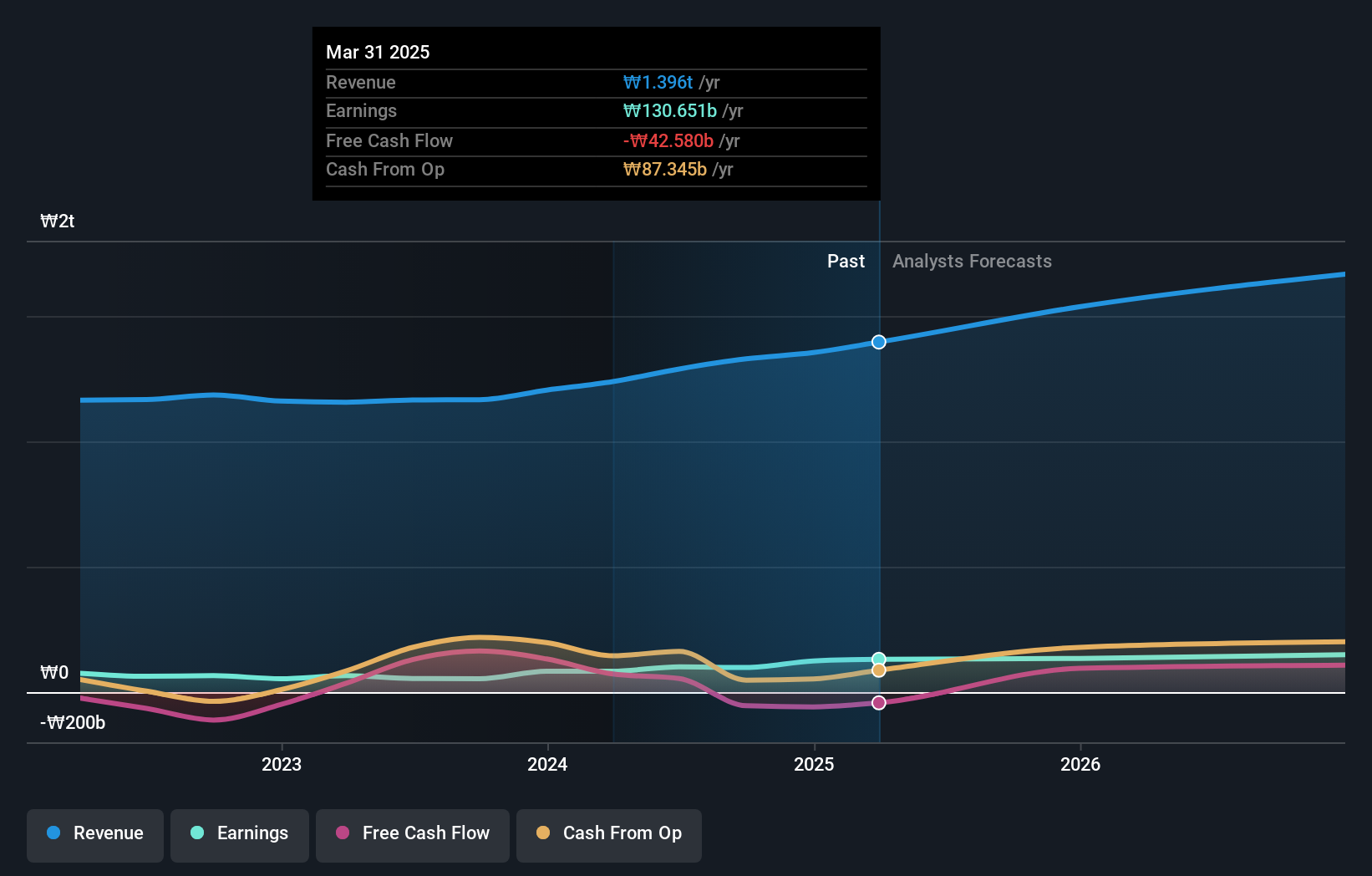

Operations: The company generates its revenue primarily through the sale of goods, reflected in a consistent increase in gross profit over the years, reaching ₩500.36 billion by the end of 2023. It manages substantial operational costs, including sales and marketing expenses which stood at ₩171.13 billion as of December 2023, alongside research and development expenses to fuel innovation.

Kyung Dong Navien, a lesser-known yet promising entity in South Korea's building industry, showcases robust financial health with a Price-To-Earnings ratio of 9.9, well below the market average of 12.5. Over the past five years, its debt-to-equity ratio impressively dropped from 41.6% to 27%. Furthermore, the company's earnings growth last year surged by 27.8%, outpacing its industry's growth of 16.2%. With an EBIT covering interest payments by over twenty times and a minimal net debt to equity at just 1.9%, Kyung Dong Navien stands as a financially sound investment with high-quality earnings and positive free cash flow.

- Click to explore a detailed breakdown of our findings in Kyung Dong Navien's health report.

Examine Kyung Dong Navien's past performance report to understand how it has performed in the past.

Key Takeaways

- Dive into all 209 of the KRX Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KG Mobility might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003620

KG Mobility

Manufactures and sells automobiles and parts in the South Korea and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives