- Mexico

- /

- Capital Markets

- /

- BMV:ACTINVR B

Exploring Three Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In the current landscape, global markets have been experiencing volatility amid political uncertainties and shifting economic policies, with indices like the S&P 600 reflecting these changes in small-cap stocks. As investors navigate this environment, identifying promising opportunities requires a focus on companies that demonstrate resilience and adaptability to evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Corporación Actinver S. A. B. de C. V (BMV:ACTINVR B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Corporación Actinver, S. A. B. de C. V., operates through its subsidiaries to offer financial and investment banking services to both businesses and individuals in Mexico and internationally, with a market cap of MX$8.97 billion.

Operations: Actinver generates revenue primarily from financial and investment banking services. The company's net profit margin has shown notable variation, reflecting changes in its cost structure and operational efficiency over time.

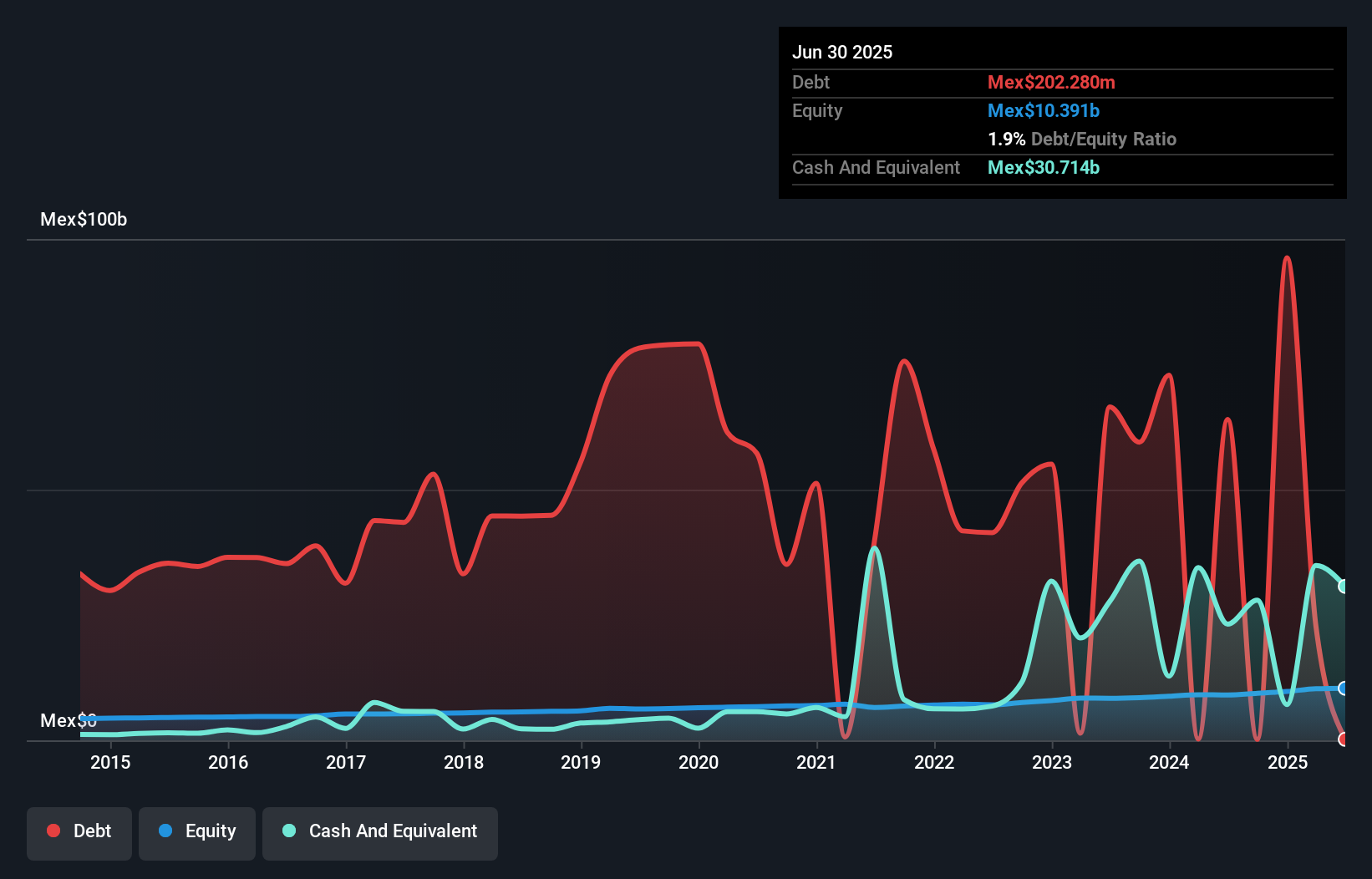

Corporación Actinver, with total assets of MX$153 billion and equity of MX$9.4 billion, showcases a solid financial foundation. The company has a sufficient allowance for bad loans at 108%, though it faces a high level of non-performing loans at 3.7%. Trading at a price-to-earnings ratio of 7.1x, it is valued attractively against the broader MX market's 11.6x average. Despite primarily relying on higher-risk funding sources (82%), Actinver reported net income growth to MX$916 million for the first nine months of 2024 from MX$769 million last year, indicating robust performance in earnings growth above industry averages.

RFHIC (KOSDAQ:A218410)

Simply Wall St Value Rating: ★★★★★☆

Overview: RFHIC Corporation designs and manufactures radio frequency (RF) and microwave components for various applications, including wireless infrastructure and military radar, serving both domestic and international markets, with a market cap of ₩383.31 billion.

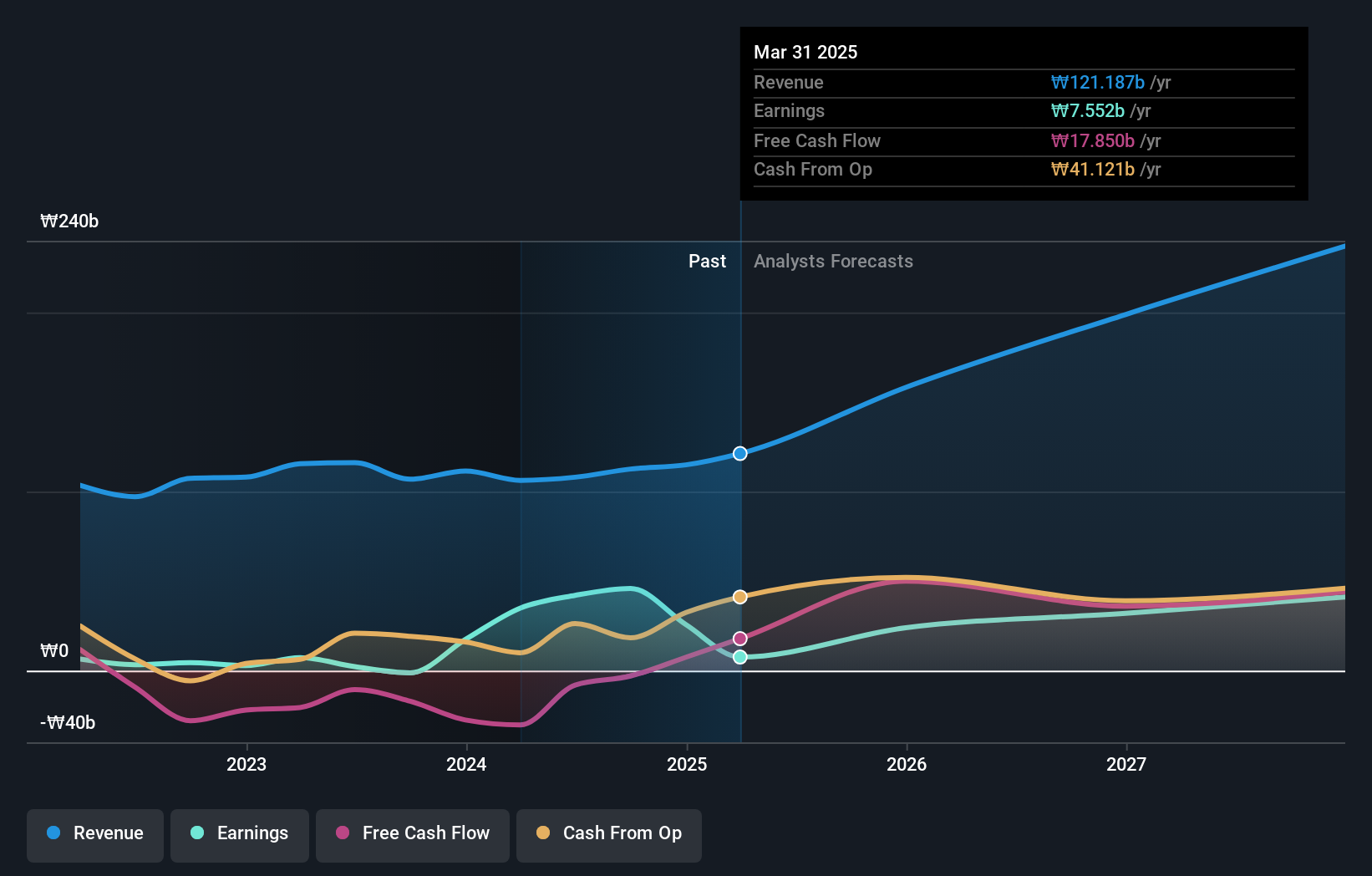

Operations: RFHIC generates revenue primarily from its wireless communications equipment segment, which contributed ₩107.99 billion. The company's financial performance can be further analyzed through its gross profit margin or net profit margin trends for a comprehensive understanding of profitability dynamics.

RFHIC, a player in the semiconductor sector, has shown impressive earnings growth of 1802.9% over the past year, outpacing the industry average of -6.1%. Despite its volatile share price recently, it maintains a favorable price-to-earnings ratio of 9.1x compared to the KR market's 10.7x, suggesting potential undervaluation. The company has more cash than total debt and high-quality non-cash earnings, indicating financial robustness. Recent buybacks totaling KRW 5 billion for 406,256 shares aim to enhance shareholder value and stabilize stock prices amidst forecasted earnings declines averaging 17.9% annually over three years.

- Navigate through the intricacies of RFHIC with our comprehensive health report here.

Examine RFHIC's past performance report to understand how it has performed in the past.

KG Mobility (KOSE:A003620)

Simply Wall St Value Rating: ★★★★☆☆

Overview: KG Mobility Corp. is engaged in the manufacturing and sale of automobiles and parts both within South Korea and internationally, with a market capitalization of ₩815.08 billion.

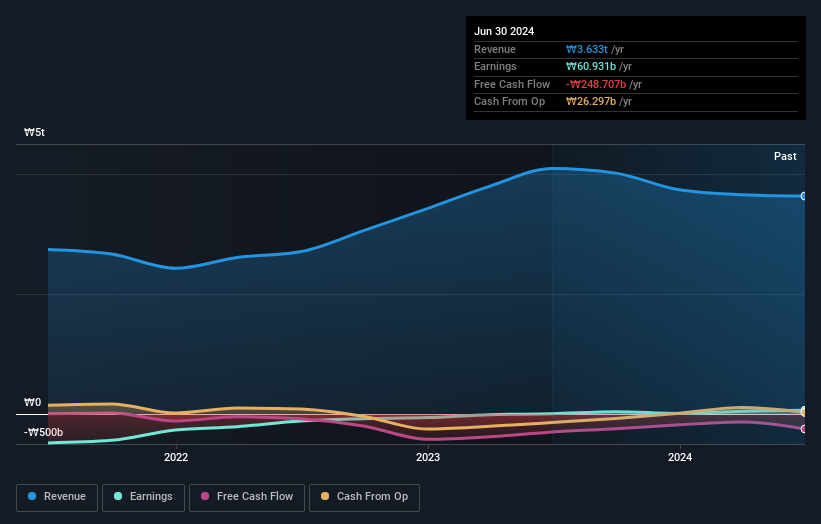

Operations: KG Mobility generates revenue primarily from automobile manufacturing, amounting to ₩3.63 trillion. The company focuses on the sale of automobiles and parts in both domestic and international markets.

KG Mobility, a compact player in the auto sector, offers an intriguing mix of strengths and challenges. Its earnings skyrocketed by 1196% over the past year, outpacing the industry growth of 9.9%, which is quite impressive. The company boasts a favorable price-to-earnings ratio of 13x compared to the industry's average of 17x, suggesting it might be undervalued. However, despite reducing its debt to equity ratio from 47% to 22% over five years and maintaining a satisfactory net debt level at about 5%, its interest coverage remains tight at just one time EBIT. With high non-cash earnings quality but no free cash flow positivity yet, KG Mobility's financial journey seems both promising and precarious as it gears up for its Q3 results announcement on November 21st.

- Take a closer look at KG Mobility's potential here in our health report.

Gain insights into KG Mobility's historical performance by reviewing our past performance report.

Next Steps

- Discover the full array of 4651 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:ACTINVR B

Corporación Actinver S. A. B. de C. V

Through its subsidiaries, provides financial and investment banking services for individuals and businesses in Mexico and internationally.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion