- South Korea

- /

- Auto Components

- /

- KOSDAQ:A452400

Inics Corp.'s (KOSDAQ:452400) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/ERatio

Unfortunately for some shareholders, the Inics Corp. (KOSDAQ:452400) share price has dived 26% in the last thirty days, prolonging recent pain. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

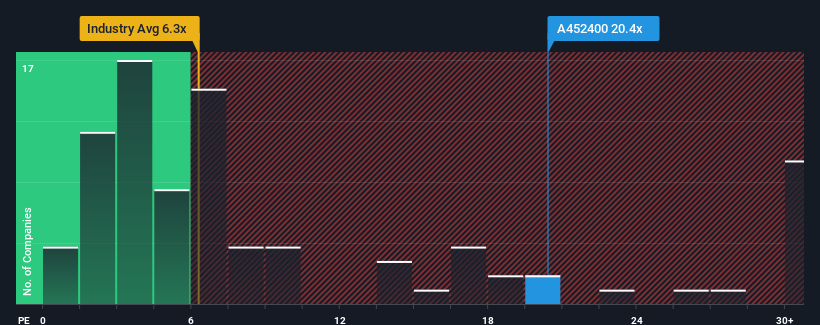

In spite of the heavy fall in price, Inics' price-to-earnings (or "P/E") ratio of 20.4x might still make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 10x and even P/E's below 6x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For example, consider that Inics' financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Inics

Is There Enough Growth For Inics?

In order to justify its P/E ratio, Inics would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 66% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 95% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 36% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Inics' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Even after such a strong price drop, Inics' P/E still exceeds the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Inics revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 5 warning signs for Inics you should be aware of, and 2 of them are a bit unpleasant.

You might be able to find a better investment than Inics. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A452400

Inics

Engages in the manufacture and sale of industrial products and automobile parts in South Korea, China, the United States, Indonesia, and Czechia.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives