- South Korea

- /

- Auto Components

- /

- KOSDAQ:A310870

DycLtd's (KOSDAQ:310870) Solid Earnings Have Been Accounted For Conservatively

Dyc Co.,Ltd.'s (KOSDAQ:310870) recent earnings report didn't offer any surprises, with the shares unchanged over the last week. We did some analysis to find out why and believe that investors might be missing some encouraging factors contained in the earnings.

See our latest analysis for DycLtd

Zooming In On DycLtd's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

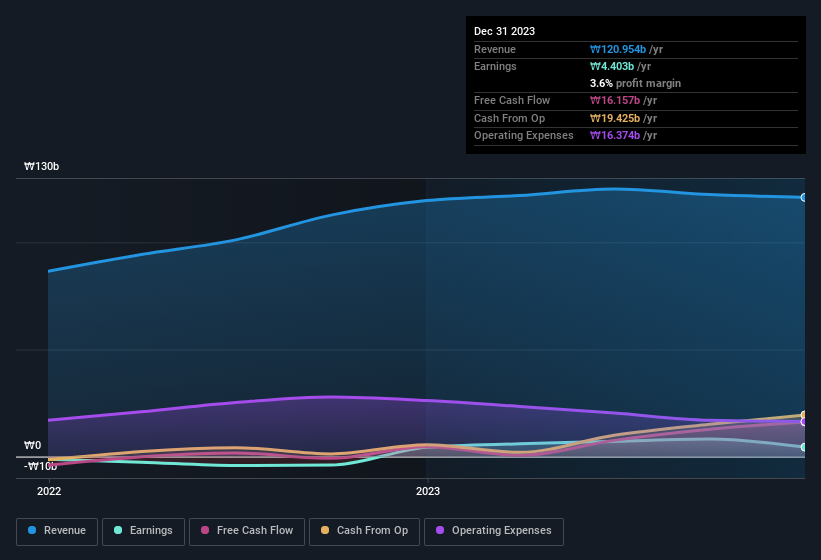

DycLtd has an accrual ratio of -0.16 for the year to December 2023. Therefore, its statutory earnings were very significantly less than its free cashflow. Indeed, in the last twelve months it reported free cash flow of ₩16b, well over the ₩4.40b it reported in profit. DycLtd's free cash flow improved over the last year, which is generally good to see. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of DycLtd.

How Do Unusual Items Influence Profit?

DycLtd's profit was reduced by unusual items worth ₩717m in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. This is what you'd expect to see where a company has a non-cash charge reducing paper profits. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. In the twelve months to December 2023, DycLtd had a big unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Our Take On DycLtd's Profit Performance

In conclusion, both DycLtd's accrual ratio and its unusual items suggest that its statutory earnings are probably reasonably conservative. Based on these factors, we think DycLtd's underlying earnings potential is as good as, or probably even better, than the statutory profit makes it seem! Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. At Simply Wall St, we found 2 warning signs for DycLtd and we think they deserve your attention.

After our examination into the nature of DycLtd's profit, we've come away optimistic for the company. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A310870

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives