- South Korea

- /

- Auto Components

- /

- KOSDAQ:A241690

We Think That There Are Some Issues For UNITEKNOLtd (KOSDAQ:241690) Beyond Its Promising Earnings

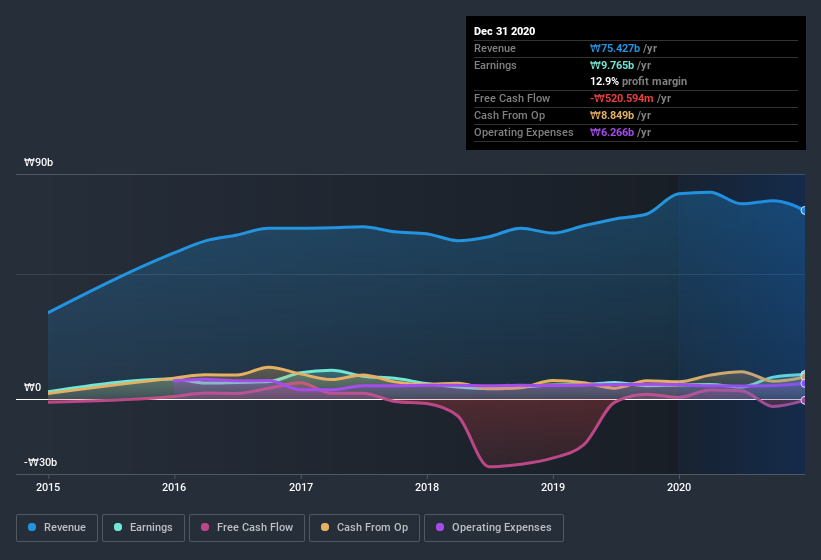

UNITEKNO Co.,Ltd's (KOSDAQ:241690) healthy profit numbers didn't contain any surprises for investors. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

See our latest analysis for UNITEKNOLtd

How Do Unusual Items Influence Profit?

Importantly, our data indicates that UNITEKNOLtd's profit received a boost of ₩6.2b in unusual items, over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. UNITEKNOLtd had a rather significant contribution from unusual items relative to its profit to December 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of UNITEKNOLtd.

Our Take On UNITEKNOLtd's Profit Performance

As we discussed above, we think the significant positive unusual item makes UNITEKNOLtd's earnings a poor guide to its underlying profitability. For this reason, we think that UNITEKNOLtd's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But at least holders can take some solace from the 73% EPS growth in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To help with this, we've discovered 4 warning signs (1 shouldn't be ignored!) that you ought to be aware of before buying any shares in UNITEKNOLtd.

Today we've zoomed in on a single data point to better understand the nature of UNITEKNOLtd's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade UNITEKNOLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A241690

UNITEKNOLtd

Engages in the manufacture and sale of automobile motor assembly parts in South Korea and internationally.

Moderate risk with imperfect balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion