- South Korea

- /

- Auto Components

- /

- KOSDAQ:A113810

Dgenx Co., Ltd. (KOSDAQ:113810) Stock's 29% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, Dgenx Co., Ltd. (KOSDAQ:113810) shares are down a considerable 29% in the last month, which continues a horrid run for the company. Looking at the bigger picture, even after this poor month the stock is up 30% in the last year.

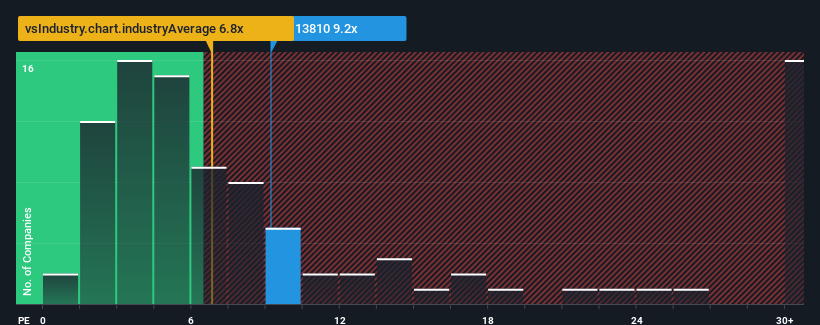

Even after such a large drop in price, Dgenx may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9.2x, since almost half of all companies in Korea have P/E ratios greater than 13x and even P/E's higher than 26x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

The earnings growth achieved at Dgenx over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Dgenx

Is There Any Growth For Dgenx?

In order to justify its P/E ratio, Dgenx would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a decent 9.9% gain to the company's bottom line. Pleasingly, EPS has also lifted 78% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 20% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

With this information, we find it odd that Dgenx is trading at a P/E lower than the market. It may be that most investors are not convinced the company can maintain recent growth rates.

The Key Takeaway

The softening of Dgenx's shares means its P/E is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Dgenx currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

It is also worth noting that we have found 2 warning signs for Dgenx (1 doesn't sit too well with us!) that you need to take into consideration.

If you're unsure about the strength of Dgenx's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A113810

Dgenx

Engages in the manufacture and sale of automobile parts in South Korea and China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success