- South Korea

- /

- Auto Components

- /

- KOSDAQ:A015750

Sungwoo Hitech (KOSDAQ:015750) Shareholders Have Enjoyed A 91% Share Price Gain

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. For example, the Sungwoo Hitech Co., Ltd. (KOSDAQ:015750) share price is up 91% in the last year, clearly besting the market return of around 43% (not including dividends). So that should have shareholders smiling. Having said that, the longer term returns aren't so impressive, with stock gaining just 11% in three years.

Check out our latest analysis for Sungwoo Hitech

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months Sungwoo Hitech went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. We might get a clue to explain the share price move by looking to other metrics.

We doubt the modest 1.1% dividend yield is doing much to support the share price. Sungwoo Hitech's revenue actually dropped 13% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

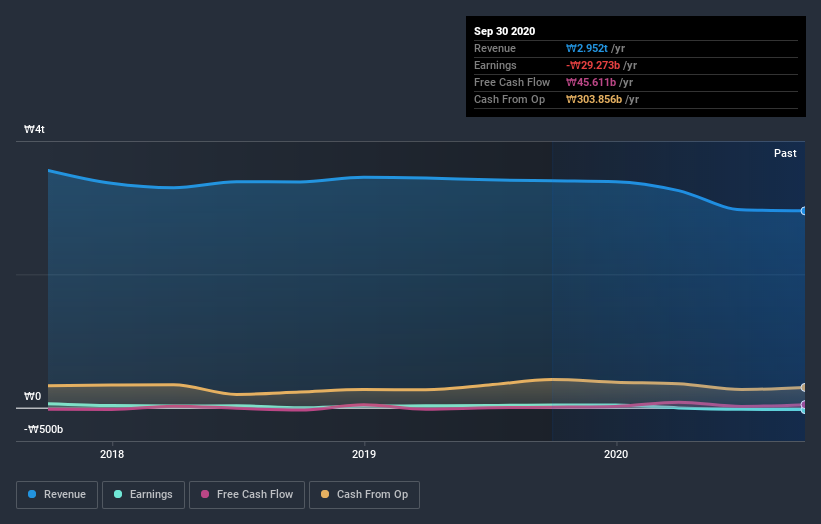

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Sungwoo Hitech stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Sungwoo Hitech's TSR for the last year was 93%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Sungwoo Hitech shareholders have received a total shareholder return of 93% over one year. And that does include the dividend. That's better than the annualised return of 1.2% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Sungwoo Hitech better, we need to consider many other factors. Take risks, for example - Sungwoo Hitech has 4 warning signs (and 2 which are a bit concerning) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Sungwoo Hitech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A015750

Sungwoo Hitech

Manufactures and sells automobile components in South Korea and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.