- Japan

- /

- Gas Utilities

- /

- TSE:9531

Some Shareholders Feeling Restless Over Tokyo Gas Co.,Ltd.'s (TSE:9531) P/E Ratio

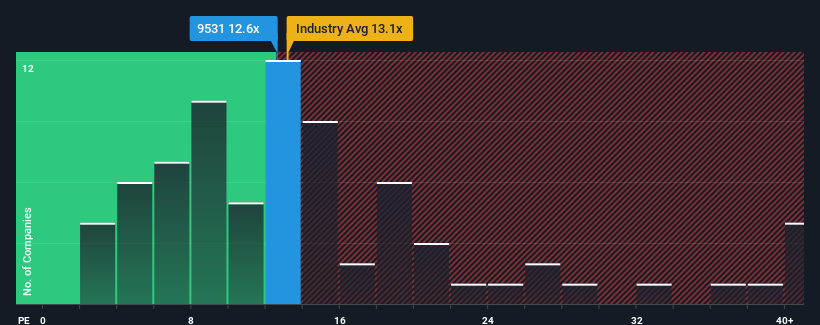

There wouldn't be many who think Tokyo Gas Co.,Ltd.'s (TSE:9531) price-to-earnings (or "P/E") ratio of 12.6x is worth a mention when the median P/E in Japan is similar at about 13x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Tokyo GasLtd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Tokyo GasLtd

Is There Some Growth For Tokyo GasLtd?

The only time you'd be comfortable seeing a P/E like Tokyo GasLtd's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 63% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 156% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 2.2% per annum as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 9.3% per year, which is noticeably more attractive.

With this information, we find it interesting that Tokyo GasLtd is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Tokyo GasLtd's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Tokyo GasLtd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Tokyo GasLtd that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo GasLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9531

Tokyo GasLtd

Engages in the production, supply, and sale of city gas, and LNG in Japan.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives