- Japan

- /

- Renewable Energy

- /

- TSE:9519

RENOVA, Inc. Just Missed Earnings - But Analysts Have Updated Their Models

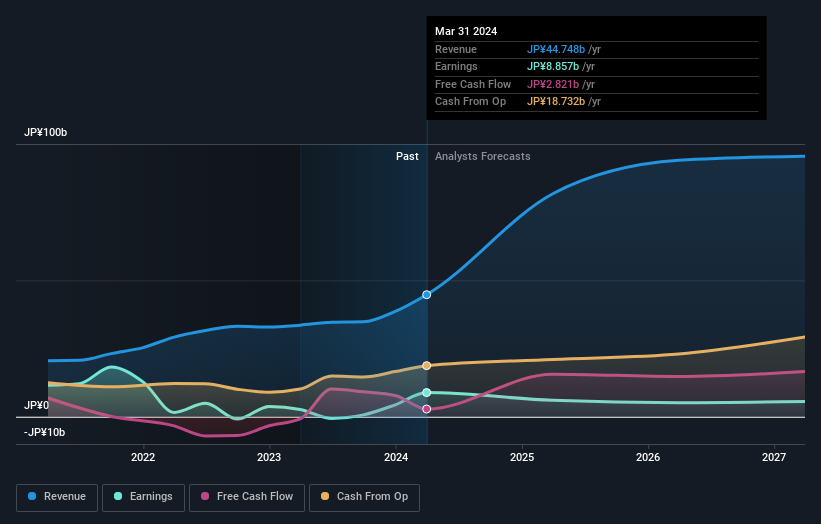

Shareholders in RENOVA, Inc. (TSE:9519) had a terrible week, as shares crashed 23% to JP¥1,142 in the week since its latest yearly results. Revenues were in line with forecasts, at JP¥45b, although statutory earnings per share came in 15% below what the analysts expected, at JP¥112 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on RENOVA after the latest results.

Check out our latest analysis for RENOVA

Taking into account the latest results, the current consensus from RENOVA's six analysts is for revenues of JP¥81.7b in 2025. This would reflect a huge 83% increase on its revenue over the past 12 months. Statutory earnings per share are expected to dive 25% to JP¥73.07 in the same period. Before this earnings report, the analysts had been forecasting revenues of JP¥83.1b and earnings per share (EPS) of JP¥58.05 in 2025. Although the revenue estimates have not really changed, we can see there's been a great increase in earnings per share expectations, suggesting that the analysts have become more bullish after the latest result.

The consensus price target was unchanged at JP¥1,525, implying that the improved earnings outlook is not expected to have a long term impact on value creation for shareholders. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic RENOVA analyst has a price target of JP¥2,850 per share, while the most pessimistic values it at JP¥1,100. We would probably assign less value to the analyst forecasts in this situation, because such a wide range of estimates could imply that the future of this business is difficult to value accurately. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that RENOVA's rate of growth is expected to accelerate meaningfully, with the forecast 83% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 19% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 2.3% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect RENOVA to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around RENOVA's earnings potential next year. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on RENOVA. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for RENOVA going out to 2027, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with RENOVA (at least 3 which make us uncomfortable) , and understanding them should be part of your investment process.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9519

RENOVA

Engages in the development and operation of renewable energy power plant in Japan.

Good value with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026