- Japan

- /

- Electric Utilities

- /

- TSE:9506

Tohoku Electric Power Company, Incorporated's (TSE:9506) 32% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Tohoku Electric Power Company, Incorporated (TSE:9506) shares have been powering on, with a gain of 32% in the last thirty days. The last 30 days bring the annual gain to a very sharp 87%.

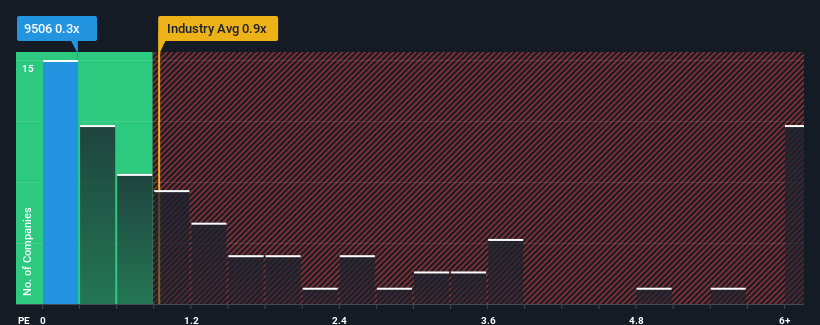

Although its price has surged higher, it's still not a stretch to say that Tohoku Electric Power Company's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Electric Utilities industry in Japan, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Tohoku Electric Power Company

How Has Tohoku Electric Power Company Performed Recently?

Tohoku Electric Power Company has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tohoku Electric Power Company.Is There Some Revenue Growth Forecasted For Tohoku Electric Power Company?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Tohoku Electric Power Company's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 6.3% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 23% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to plummet, contracting by 5.7% each year during the coming three years according to the four analysts following the company. Meanwhile, the broader industry is forecast to moderate by 0.2% per year, which indicates the company should perform poorly indeed.

With this in mind, we find it intriguing that Tohoku Electric Power Company's P/S is similar to its industry peers. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

What We Can Learn From Tohoku Electric Power Company's P/S?

Tohoku Electric Power Company's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Tohoku Electric Power Company currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. We also have our reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. This presents a risk to investors if the P/S were to decline to a level that more accurately reflects the company's revenue prospects.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Tohoku Electric Power Company (2 are concerning!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tohoku Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9506

Tohoku Electric Power Company

Operates as an energy service in Japan and internationally.

Good value average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success