- Japan

- /

- Electric Utilities

- /

- TSE:9505

Is Hokuriku Electric Power’s Share Price Justified After Japan’s New Energy Policy Shift?

Reviewed by Simply Wall St

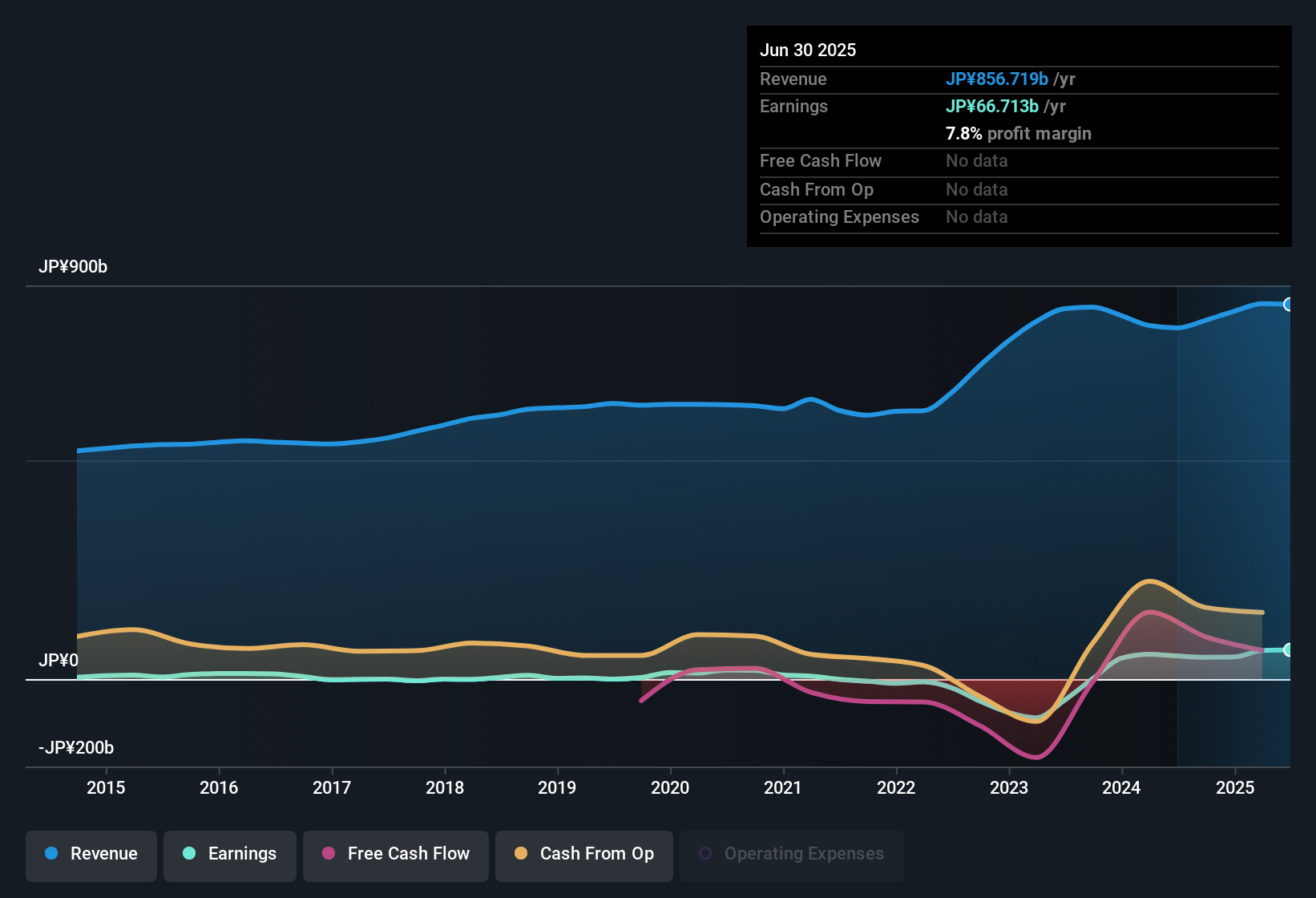

Thinking about what to do with Hokuriku Electric Power stock? You are not alone. Investors are weighing up the recent moves, trying to decode whether there is more growth on the horizon or if caution is the wiser path. Over the past month, Hokuriku Electric’s share price nudged up 6.8%, topping a more modest but steady 0.4% gain in just the last week. Zooming out, the numbers tell an intriguing story: the stock is up 8.5% year-to-date and has surged an impressive 93.6% over the past three years. Comparatively, over one year, it posted a small 0.5% gain. This hints at a market in wait-and-see mode after major long-term growth.

A recent wave of market developments in Japan, including shifts in energy policy and renewed investor interest in domestic utilities, has helped drive these changes. There is renewed optimism about power sector reforms that could benefit regional companies like Hokuriku Electric. This adds to a perception that risk is easing for the sector. Of course, long-term shareholders will recall more volatile chapters in the stock's history, but the overall trajectory is looking up as perceptions of risk and reward shift.

But is Hokuriku Electric still undervalued even after this run-up? The company scores a 3 out of 6 on our value checklist, meaning it meets half of the major value checks analysts use to spot a bargain. Let us dive deeper into what drives that score, which valuation metrics matter most, and why even these traditional methods do not always capture the full story. There is an even smarter way to approach valuation lurking ahead, so stick around as we explore the numbers in context.

Why Hokuriku Electric Power is lagging behind its peersApproach 1: Hokuriku Electric Power Dividend Discount Model (DDM) Analysis

The Dividend Discount Model, or DDM, estimates a stock's value by projecting future dividends and discounting them back to today's value. This approach is particularly useful for companies with stable and predictable dividend payouts such as Hokuriku Electric Power.

For Hokuriku Electric Power, the most recent dividend per share (DPS) stands at ¥26.79, with a return on equity (ROE) of 15.01% and a relatively conservative payout ratio of 11.06%. Analysts expect dividends to grow at a modest 0.52% annually, with growth projections intentionally capped to prevent overestimation. This conservative growth rate reflects a cautious outlook despite strong underlying profitability.

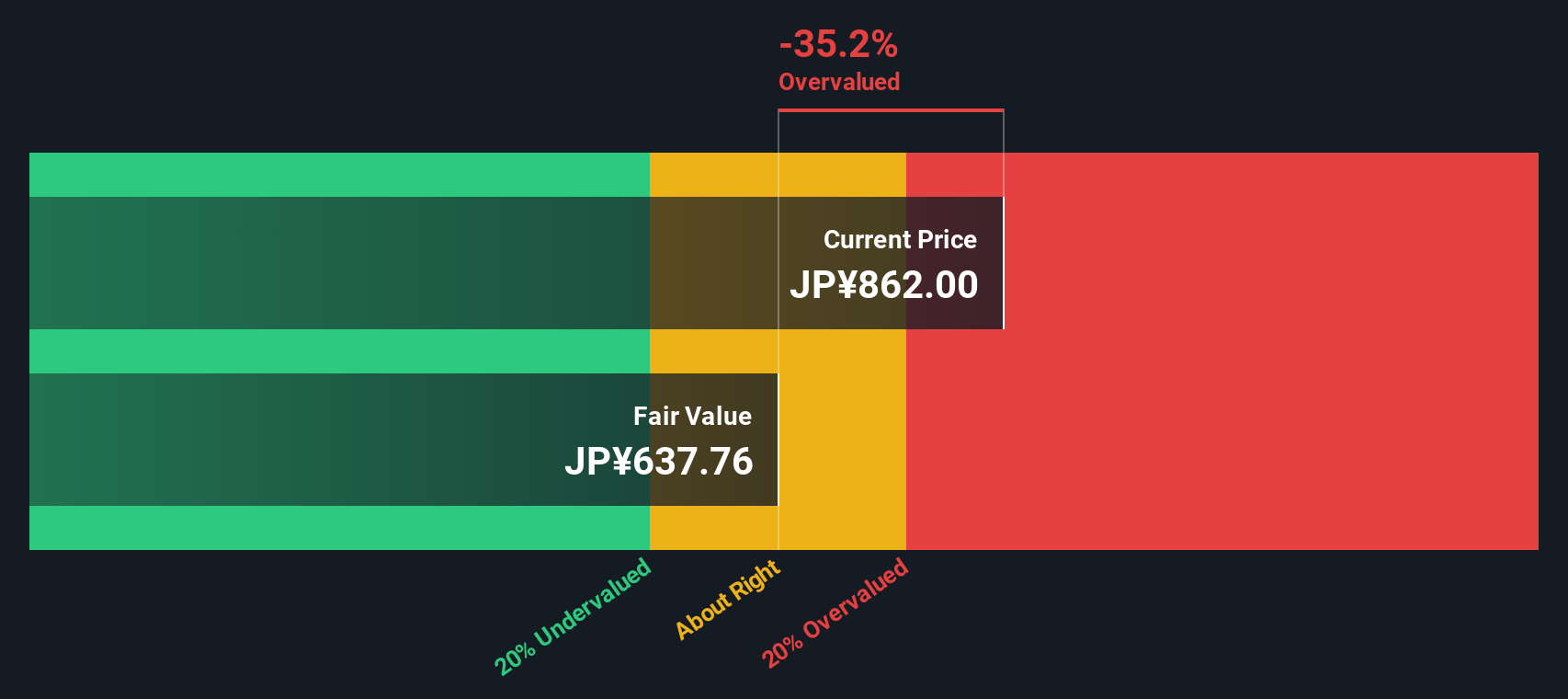

According to the DDM output, the fair intrinsic value of Hokuriku Electric Power's stock is estimated at ¥638 per share. However, the current market price exceeds this valuation. This suggests the stock is approximately 45.1% overvalued based on the model's calculations. While the company's fundamentals remain solid and the dividend is sustainable, investors should recognize that the stock currently trades above what its future payouts suggest is reasonable value.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Hokuriku Electric Power.

Approach 2: Hokuriku Electric Power Price vs Earnings (PE Ratio)

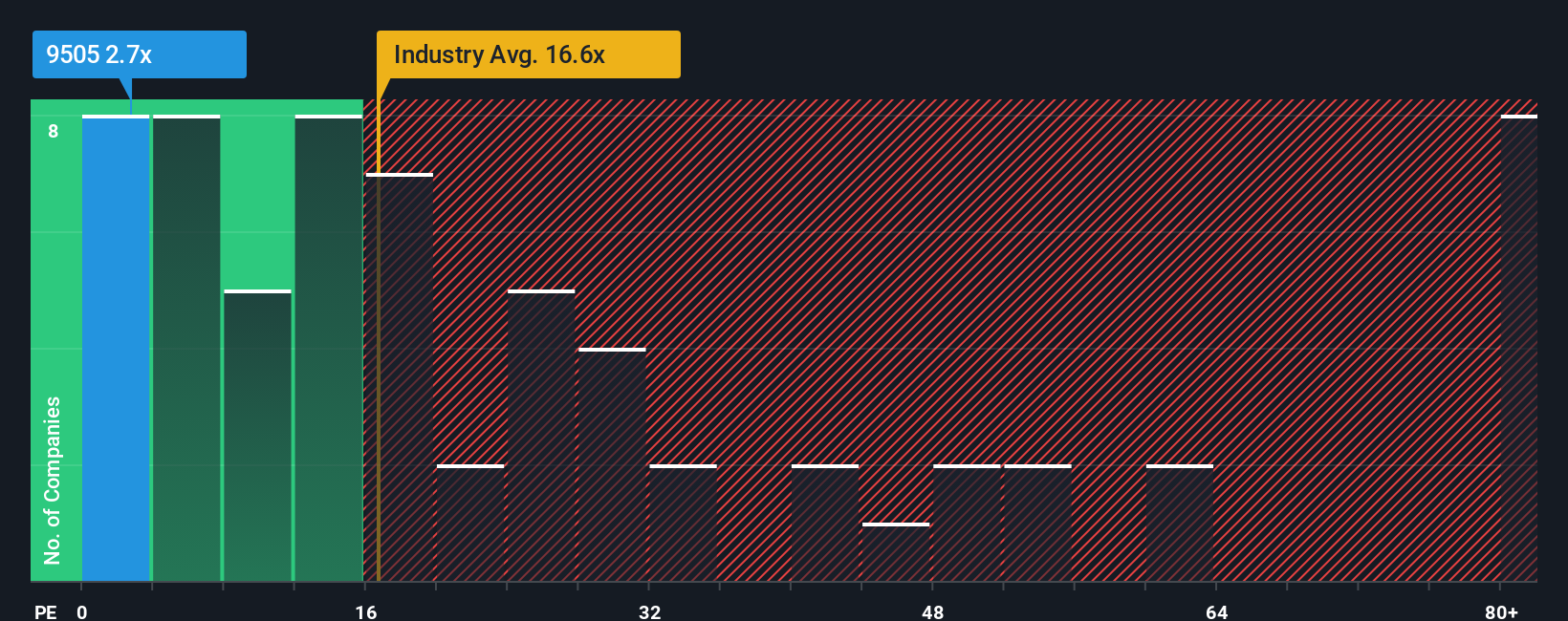

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies because it directly links share price to actual earnings performance. In simple terms, a lower PE suggests a stock may be undervalued relative to its profits, while a higher PE can indicate lofty growth expectations or greater perceived risks.

Hokuriku Electric Power currently trades at a PE of 2.90x. This is notably below the industry average PE of 14.56x and the peer group’s average of 3.89x, signaling a steep discount. Such a low ratio can reflect market caution, but it may also point to an opportunity if the company's risks are overestimated or growth prospects are underrated.

Simply Wall St's proprietary “Fair Ratio” for Hokuriku Electric Power is 5.49x. Unlike a simple peer or sector comparison, this Fair Ratio incorporates company-specific factors such as growth outlook, industry trends, profit margins, market capitalization, and unique risks. It provides a more holistic view of what the company's PE "should" be in today's market.

Looking at the numbers, Hokuriku Electric Power’s actual PE of 2.90x is well below the Fair Ratio of 5.49x. This strongly suggests the market might be undervaluing the company based on its fundamentals and risk profile.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Hokuriku Electric Power Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is more than just a statistic; it is your personal story and outlook for a company, connecting what you believe about its future (such as growth estimates or margins) with the numbers and, ultimately, a tailored fair value. Narratives let you easily bring your perspective into the investment process, helping translate your confidence in Hokuriku Electric Power’s future into actionable insight. All of this is made accessible on Simply Wall St's Community page, where millions of users share and refine their views.

By linking a company’s story to a forecast and then to a fair value, Narratives help clarify when a stock is trading at an attractive price or may have moved beyond its fundamentals. They also update automatically as new information becomes available, allowing your Narrative to evolve with updated news, results, or trends. For Hokuriku Electric Power, you might see bullish Narratives with a high fair value focused on aggressive clean energy growth, or more cautious views with a lower fair value in light of market risks and sector headwinds. Narratives offer a smart, dynamic way to guide your investment decisions in real time.

Do you think there's more to the story for Hokuriku Electric Power? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hokuriku Electric Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9505

Hokuriku Electric Power

Supplies electricity through integrated power generation, transmission, and distribution systems in Japan.

Proven track record and fair value.

Market Insights

Community Narratives