- Japan

- /

- Electric Utilities

- /

- TSE:9504

A Look at Chugoku Electric Power’s (TSE:9504) Valuation Following Substantial Upgrades to Earnings and Dividend Guidance

Reviewed by Simply Wall St

Chugoku Electric Power (TSE:9504) has raised both its full-year earnings and dividend guidance for the fiscal year ending March 2026, attributing the improved projections to stronger supply and demand profit as well as fuel cost adjustments.

See our latest analysis for Chugoku Electric Power.

After boosting its guidance, Chugoku Electric Power has seen momentum gather pace, notching a 13.4% share price gain over the past month and 7.5% year-to-date. Even with market volatility, its three-year total shareholder return stands at an impressive 46%, which signals resilience and renewed confidence in the company’s earnings power.

If this run of positive news has you considering other potential movers, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with these positive revisions and a recent rally, the key question is whether Chugoku Electric Power is undervalued or if the market has already priced in its improved outlook. This could leave little room for further upside.

Price-to-Earnings of 3.1x: Is it justified?

Chugoku Electric Power has a low price-to-earnings (P/E) ratio of 3.1x, which signals the stock trades at a significant discount to its sector peers and the broader Japanese market. With the last close at ¥971.1, investors may be underestimating future earnings potential or pricing in company-specific concerns.

The P/E ratio is a key measure of how much investors are willing to pay for each yen of earnings. In the electric utilities sector, a lower P/E could indicate anticipation of slower growth or elevated risk. It can also reveal an overlooked opportunity if company performance or profitability outpaces market expectations.

Compared to the Asian Electric Utilities industry average of 16.7x, Chugoku Electric Power's 3.1x P/E is substantially lower. This highlights a disconnect between its earnings strength and market perception. Additionally, this figure is well below the estimated fair Price-to-Earnings ratio of 5.8x. The market could move towards this level if confidence and fundamentals improve.

Explore the SWS fair ratio for Chugoku Electric Power

Result: Price-to-Earnings of 3.1x (UNDERVALUED)

However, recent declines in annual revenue and net income growth could challenge ongoing confidence if these trends are not reversed in the upcoming quarters.

Find out about the key risks to this Chugoku Electric Power narrative.

Another View: Discounted Cash Flow Model Raises Questions

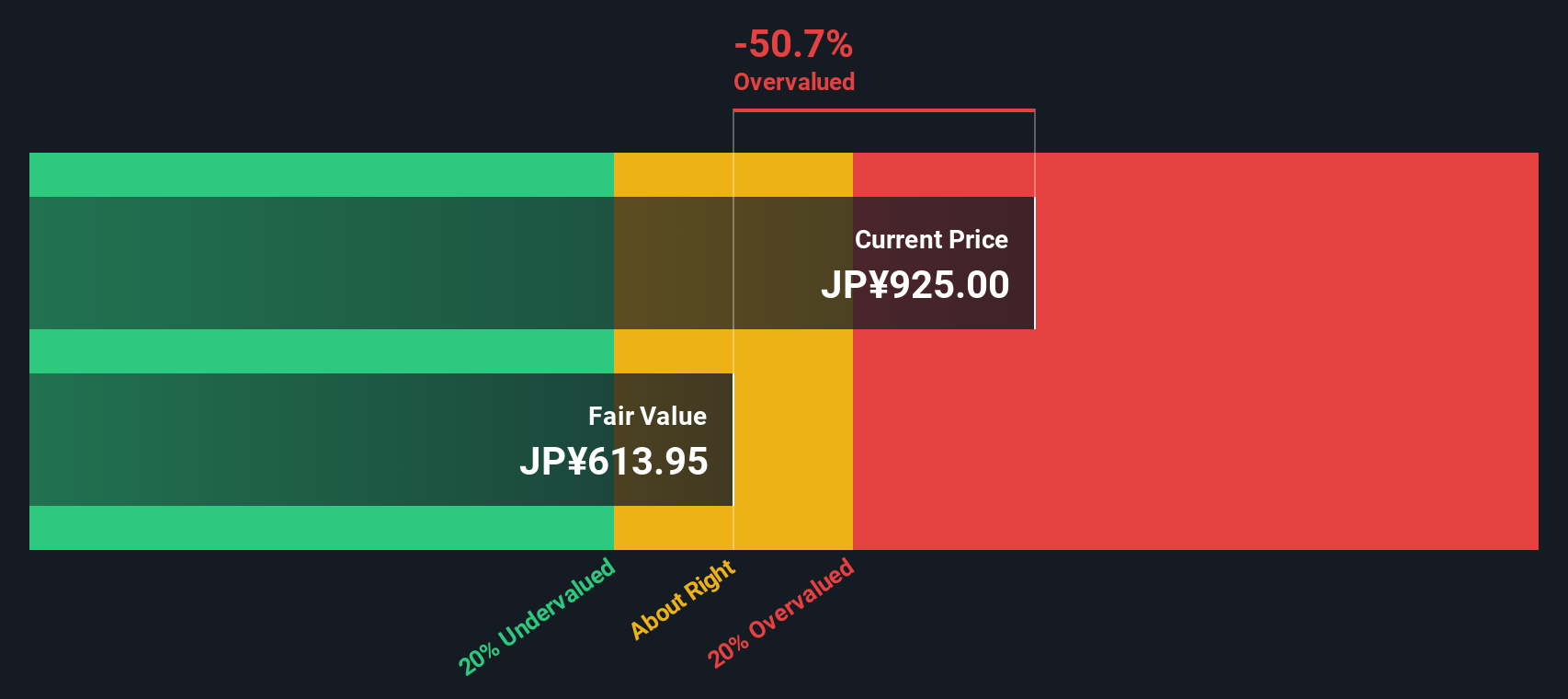

While the price-to-earnings ratio suggests Chugoku Electric Power is undervalued, our DCF model tells a different story. According to this approach, the current share price of ¥971.1 is well above the estimated fair value of ¥613.95, which implies the stock could actually be overvalued. Which method offers the clearer direction for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Chugoku Electric Power for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Chugoku Electric Power Narrative

If you want to challenge these findings or take a hands-on approach, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your Chugoku Electric Power research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock the power of smarter investing by expanding your watchlist with unique opportunities Simply Wall Street has already identified, so you never miss the next winner.

- Accelerate your search for potential value plays with these 885 undervalued stocks based on cash flows, targeting companies that stand out based on strong cash flow fundamentals.

- Gain an edge in health innovation by tapping into these 32 healthcare AI stocks, where emerging AI-driven healthcare firms are pushing boundaries in patient care and diagnostics.

- Boost your portfolio’s income potential by targeting these 14 dividend stocks with yields > 3%. This tool focuses on stocks with attractive yields above 3% and solid payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9504

Chugoku Electric Power

Engages in generation, transmission, and distribution of electric power in Japan.

Solid track record and fair value.

Market Insights

Community Narratives