- Japan

- /

- Electric Utilities

- /

- TSE:9502

Should Chubu Electric's Dividend Hike and Earnings Guidance Prompt Action from TSE:9502 Investors?

Reviewed by Sasha Jovanovic

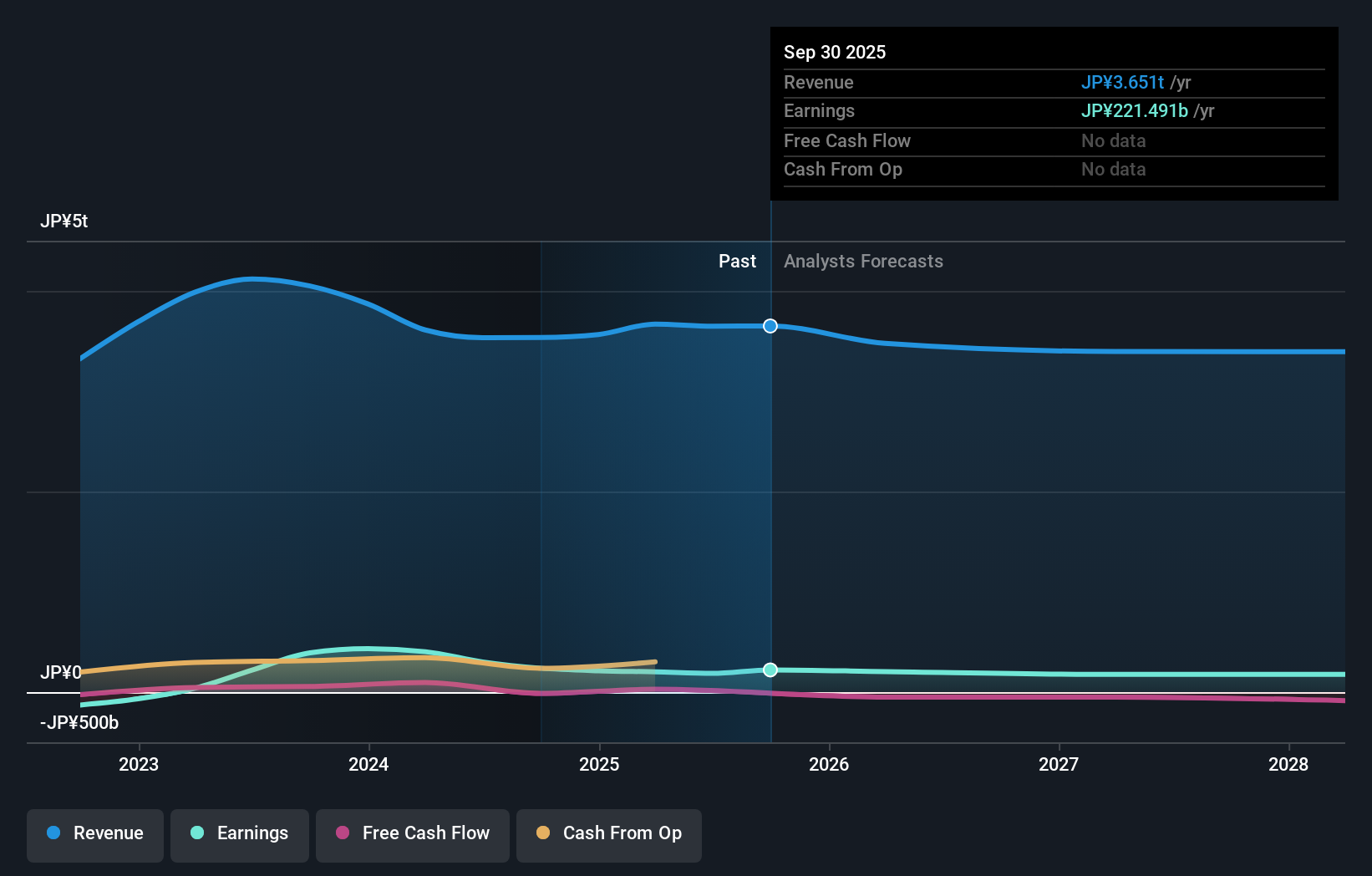

- On October 28, 2025, Chubu Electric Power Company announced a second quarter dividend increase to ¥35.00 per share and issued earnings guidance expecting ¥3.55 trillion in operating revenue and ¥185 billion in net profit for the year ending March 2026.

- The dividend hike is paired with clearer financial projections, offering shareholders enhanced visibility into future returns and signaling management's confidence.

- We’ll explore how the combination of a higher dividend and new earnings guidance shapes Chubu Electric Power’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Chubu Electric Power Company's Investment Narrative?

To be a shareholder in Chubu Electric Power Company, you need to have confidence in the company's ability to deliver stable returns amid a low-growth environment, as well as its management’s efforts to steward capital responsibly. The recently announced dividend increase and confirmed earnings guidance for fiscal 2026 help reinforce the story of consistency and management transparency, which is appealing for those prioritizing income and predictability. While the near-term catalyst from a higher dividend is material, the fundamental backdrop remains unchanged: profit growth is expected to be modest and revenue may continue to decline, mirroring previous analyst expectations. The company's price-to-earnings ratio looks reasonable against the broader Japanese and Asian electric utilities sector, but below-peer return on equity and concerns about dividend sustainability highlight ongoing risks. With these latest announcements, risks tied to weak revenue trends and lower profitability appear just as relevant, with added clarity on management's outlook. Yet, debt coverage from cash flow remains a concern investors should not overlook.

Chubu Electric Power Company's shares are on the way up, but they could be overextended by 15%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Chubu Electric Power Company - why the stock might be worth as much as ¥1851!

Build Your Own Chubu Electric Power Company Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chubu Electric Power Company research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Chubu Electric Power Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chubu Electric Power Company's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9502

Chubu Electric Power Company

Engages in the generation, transmission, distribution, and retail of electricity in Japan and internationally.

Average dividend payer with mediocre balance sheet.

Market Insights

Community Narratives