- Japan

- /

- Electric Utilities

- /

- TSE:9501

Tokyo Electric Power Company Holdings, Incorporated's (TSE:9501) 28% Jump Shows Its Popularity With Investors

Tokyo Electric Power Company Holdings, Incorporated (TSE:9501) shareholders have had their patience rewarded with a 28% share price jump in the last month. The last month tops off a massive increase of 111% in the last year.

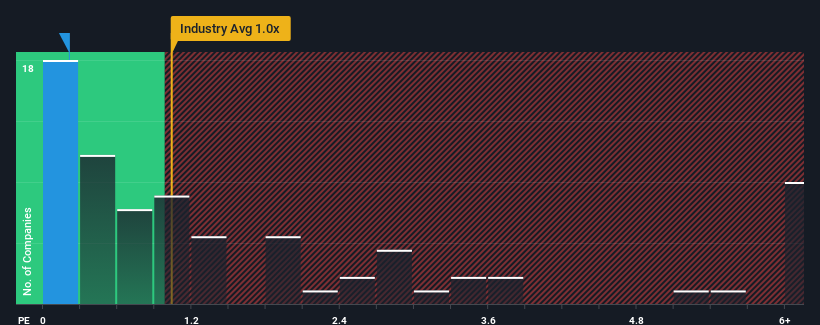

Although its price has surged higher, it's still not a stretch to say that Tokyo Electric Power Company Holdings' price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Electric Utilities industry in Japan, where the median P/S ratio is around 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Tokyo Electric Power Company Holdings

How Tokyo Electric Power Company Holdings Has Been Performing

With revenue growth that's inferior to most other companies of late, Tokyo Electric Power Company Holdings has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Tokyo Electric Power Company Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Tokyo Electric Power Company Holdings would need to produce growth that's similar to the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 30% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the four analysts covering the company are not great, suggesting revenue should decline by 1.2% per annum over the next three years. Meanwhile, the industry is forecast to moderate by 2.7% per year, which suggests the company won't escape the wider industry forces.

In light of this, it's understandable that Tokyo Electric Power Company Holdings' P/S sits in line with the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There is still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Final Word

Tokyo Electric Power Company Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our findings align with our suspicions - a closer look at Tokyo Electric Power Company Holdings' analyst forecasts shows that the company's similarly unstable outlook compared to the industry is keeping its price-to-sales ratio in line with the industry's average. Right now shareholders are comfortable with the P/S as they are confident future revenue won't throw up any further unpleasant surprises. However, we're slightly cautious about the company's ability to resist further pain to its business from the broader industry turmoil. In the meantime, unless the company's prospects change they will continue to support the share price at these levels.

Plus, you should also learn about these 4 warning signs we've spotted with Tokyo Electric Power Company Holdings (including 2 which make us uncomfortable).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Tokyo Electric Power Company Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tokyo Electric Power Company Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9501

Tokyo Electric Power Company Holdings

Engages in the generation, transmission, distribution, and retail of electric power in Japan and internationally.

Fair value low.

Market Insights

Community Narratives