- Japan

- /

- Gas Utilities

- /

- TSE:8174

Nippon Gas (TSE:8174): Evaluating the Valuation After Its Latest Governance and Executive Reshuffle

Reviewed by Simply Wall St

Nippon Gas (TSE:8174) just shuffled its executive deck, elevating Keiichi Ozaku to lead Corporate Headquarters and broadening Madoka Yamagishi’s remit across planning, investor relations, and finance, which sharpens the company’s governance focus.

See our latest analysis for Nippon Gas.

The governance reshuffle comes after a strong run, with the share price up roughly 38 percent year to date and a 1 year total shareholder return of about 43 percent, suggesting momentum is still building rather than fading.

If this kind of management driven story has your attention, it could be a good moment to explore fast growing stocks with high insider ownership for other potential standouts.

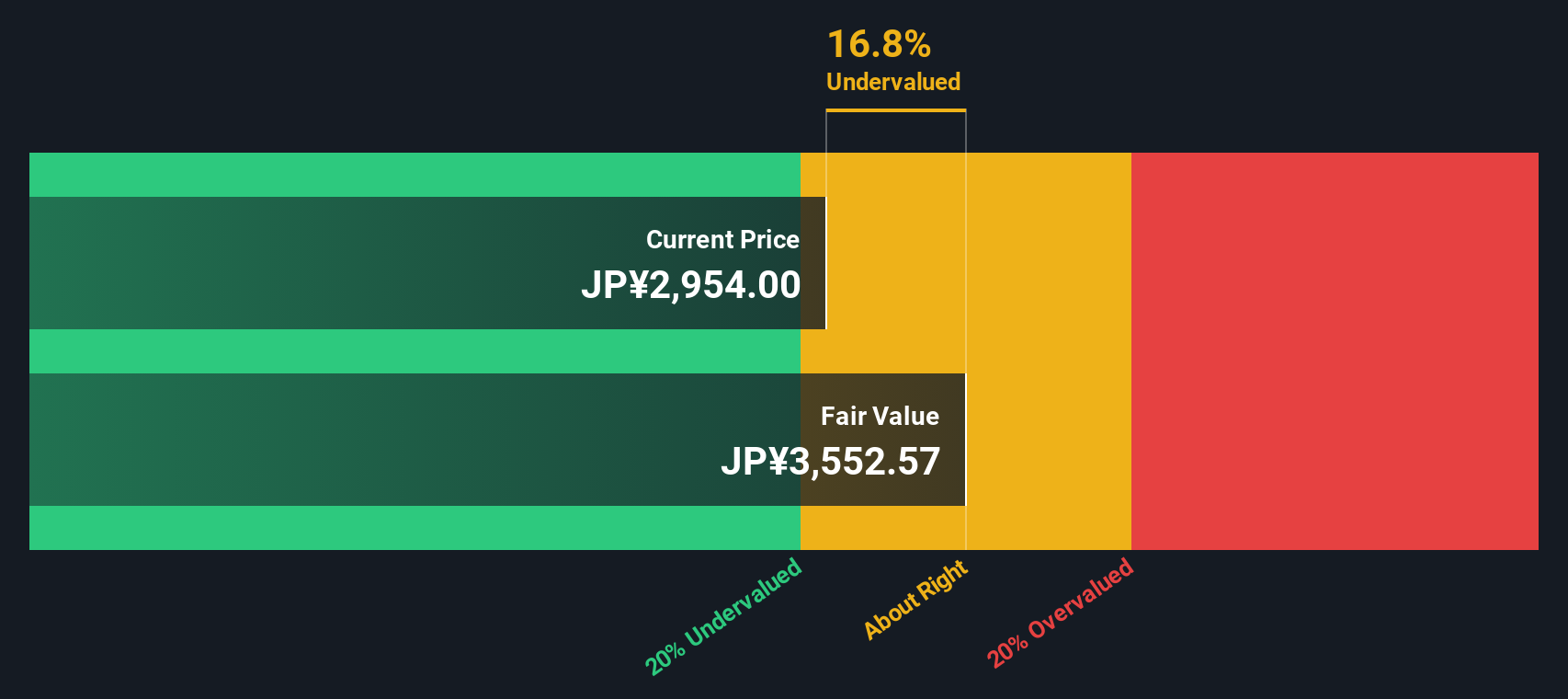

With the stock trading about 11 percent below analyst targets and roughly 20 percent under intrinsic estimates despite steady growth, the key question is whether Nippon Gas remains a buying opportunity or whether markets are already pricing in future gains.

Price to Earnings of 24.2x: Is it justified?

Nippon Gas trades on a price-to-earnings ratio of 24.2x at a last close of ¥2,980, which screens as expensive rather than a bargain versus peers.

The price-to-earnings multiple compares the share price to annual earnings per share. It provides a quick gauge of how much investors are paying for each unit of profit in a relatively mature, cash generative utility like Nippon Gas.

In this case, investors are paying a clear premium multiple despite forecasts calling for only mid single digit annual earnings growth, and revenue growth that is expected to trail the broader Japanese market, even though recent profit growth and margins have been strong.

That premium stands out when set against both the Asian Gas Utilities industry average P/E of 13.2x and the company’s estimated fair P/E of just 9.1x. This implies the current valuation could face pressure if expectations moderate.

Explore the SWS fair ratio for Nippon Gas

Result: Price-to-Earnings of 24.2x (OVERVALUED)

However, rising regulatory scrutiny and slower than expected energy demand could challenge current growth assumptions, pressuring both Nippon Gas’s earnings trajectory and elevated valuation.

Find out about the key risks to this Nippon Gas narrative.

Another View on Value

Our DCF model paints a different picture, suggesting Nippon Gas is around 20 percent undervalued at ¥2,980 versus an estimated fair value near ¥3,749. If cash flows point to upside while today’s earnings multiple screams caution, which signal should investors trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Gas for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Gas Narrative

If you would rather follow your own research path and test the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Nippon Gas research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St screener to uncover stocks that match your strategy, risk appetite, and return goals.

- Capture early stage growth by checking out these 3636 penny stocks with strong financials that may turn small market caps into meaningful upside when fundamentals align.

- Position yourself at the frontier of innovation with these 24 AI penny stocks, where artificial intelligence can support powerful, long term earnings momentum.

- Explore potential value opportunities through these 902 undervalued stocks based on cash flows, which highlights stocks trading below their cash flow based estimates while still offering solid business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nippon Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8174

Nippon Gas

Engages in the supply and sale of LP gas and natural gas in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion