After Leaping 46% e-LogiT co.,ltd. (TSE:9327) Shares Are Not Flying Under The Radar

e-LogiT co.,ltd. (TSE:9327) shares have had a really impressive month, gaining 46% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 40%.

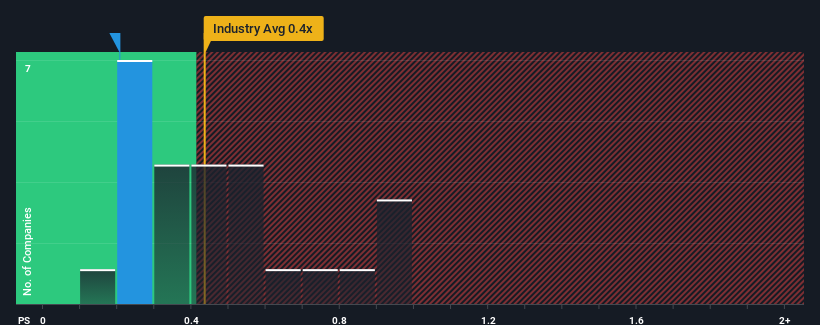

Even after such a large jump in price, there still wouldn't be many who think e-LogiTltd's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Japan's Logistics industry is similar at about 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for e-LogiTltd

What Does e-LogiTltd's Recent Performance Look Like?

It looks like revenue growth has deserted e-LogiTltd recently, which is not something to boast about. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on e-LogiTltd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

e-LogiTltd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 21% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 5.1% shows it's about the same on an annualised basis.

With this information, we can see why e-LogiTltd is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What Does e-LogiTltd's P/S Mean For Investors?

e-LogiTltd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we've seen, e-LogiTltd's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

We don't want to rain on the parade too much, but we did also find 4 warning signs for e-LogiTltd (2 are concerning!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9327

Slight risk with weak fundamentals.

Market Insights

Community Narratives