Unveiling 3 Undiscovered Gems For Potential Portfolio Growth

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of shifting trade policies and economic indicators, major indices like the S&P 500 have reached record highs, driven by optimism surrounding AI investments and a potential easing in tariff tensions. While large-cap stocks have generally outperformed their smaller-cap counterparts, the current market environment presents unique opportunities for discerning investors to identify under-the-radar small-cap stocks with strong growth potential. In this context, discovering companies that combine solid fundamentals with innovative strategies can be particularly rewarding for those looking to enhance portfolio growth amidst evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Xili Intelligent TechnologyLtd | NA | 10.32% | 5.63% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | 7.88% | 10.55% | ★★★★★★ |

| Beijing WKW Automotive PartsLtd | 14.05% | -0.88% | 72.94% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Nacity Property Service GroupLtd | NA | 8.88% | 3.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Komori (TSE:6349)

Simply Wall St Value Rating: ★★★★★☆

Overview: Komori Corporation specializes in the manufacture, sale, and repair of printing presses across various regions including Japan, North America, Europe, and Greater China with a market capitalization of ¥65.10 billion.

Operations: Komori generates significant revenue from Japan, contributing ¥80.50 billion, followed by Europe at ¥22.47 billion and Greater China at ¥15.72 billion. The company experiences a notable reduction in revenue due to the elimination of inter-segment transactions amounting to -¥27.14 billion.

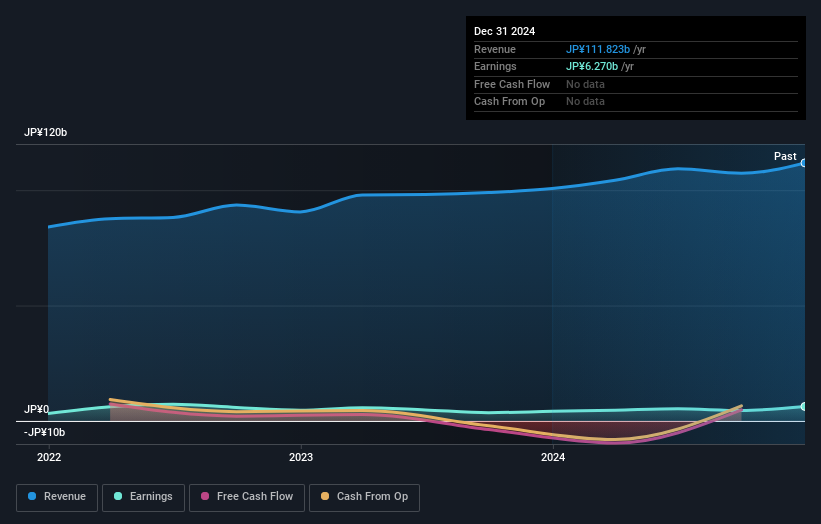

Komori, a smaller player in the machinery sector, has shown impressive earnings growth of 25.5% over the past year, outpacing the industry average of 1.6%. Despite an increase in its debt-to-equity ratio from 0.5 to 9.8 over five years, Komori's financial health remains robust with cash exceeding total debt and strong interest coverage. The company recently raised its full-year earnings guidance and doubled its dividend to JPY 30 per share from JPY 15 last year. Trading at nearly 59% below estimated fair value suggests potential upside for investors exploring this niche market segment.

- Navigate through the intricacies of Komori with our comprehensive health report here.

Explore historical data to track Komori's performance over time in our Past section.

Matsuya (TSE:8237)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Matsuya Co., Ltd. is a company that operates department stores in Ginza and Asakusa, Japan with a market capitalization of approximately ¥57.72 billion.

Operations: Matsuya generates its revenue primarily from the Department Store Business, accounting for ¥39.30 billion, followed by Comprehensive Building Services and Advertising at ¥5.48 billion, and the Restaurant Business contributing ¥3.27 billion.

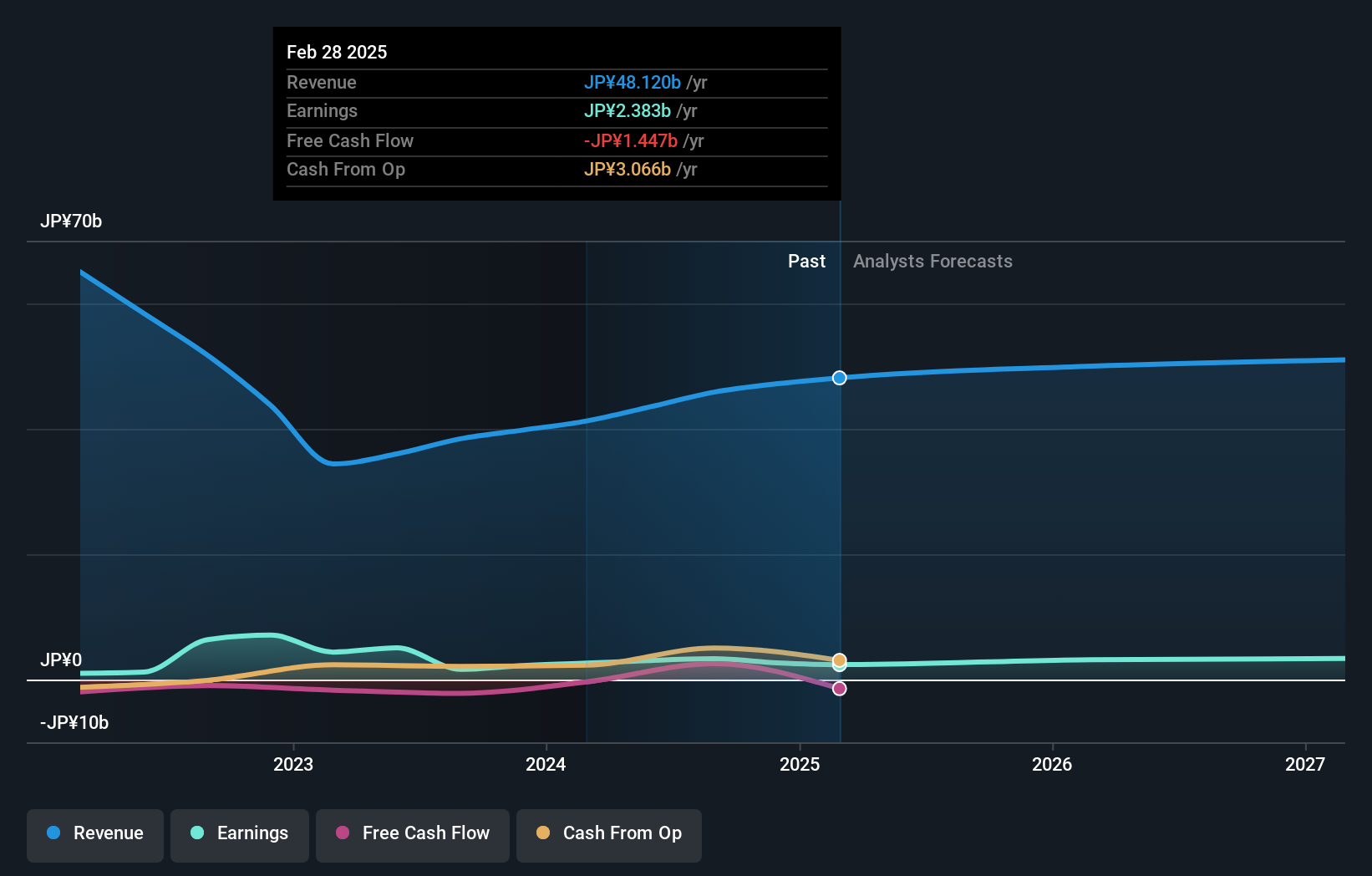

Matsuya, a compact player in the retail sector, has shown promising signs with earnings growth of 19.5% over the past year, outperforming its industry peers. Its debt-to-equity ratio has improved from 100.2% to 67% in five years, though its net debt-to-equity remains high at 51.5%. The company’s interest payments are well covered by EBIT at an impressive 93 times coverage. Recent sales results for November show a notable increase of 18.1% year-on-year, suggesting robust demand and potential for continued growth despite existing leverage challenges.

- Dive into the specifics of Matsuya here with our thorough health report.

Gain insights into Matsuya's historical performance by reviewing our past performance report.

Japan Transcity (TSE:9310)

Simply Wall St Value Rating: ★★★★★☆

Overview: Japan Transcity Corporation operates in the logistics sector both domestically and internationally, with a market capitalization of approximately ¥64.12 billion.

Operations: Japan Transcity Corporation generates revenue primarily from its Comprehensive Logistics Business, which amounts to ¥119.93 billion.

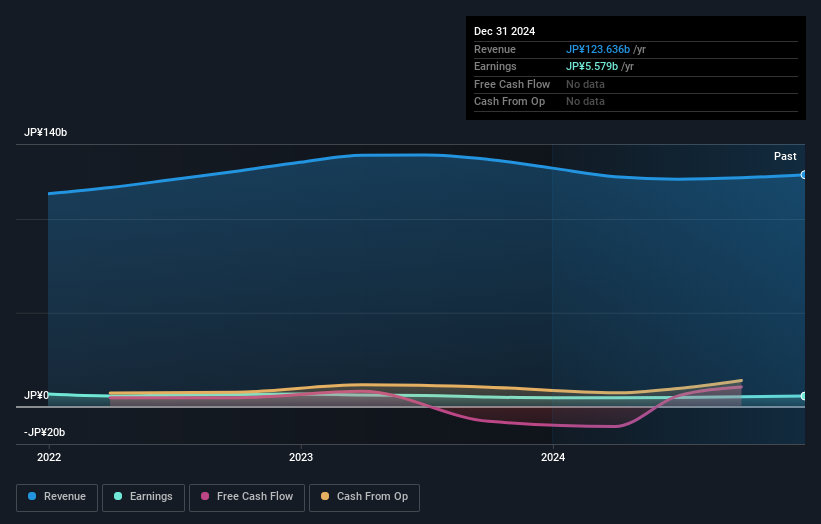

Japan Transcity, a small cap player in the shipping industry, has shown promising financial metrics. Its debt to equity ratio improved from 55.6% to 43.9% over the past five years, indicating stronger financial health. The company trades at nearly 90% below its estimated fair value, suggesting potential undervaluation in the market. Over the last year, earnings grew by 3.3%, surpassing industry growth of just 1%. Recently, it completed a share buyback of approximately ¥795 million and announced increased dividends for fiscal year ending March 2025, reflecting robust shareholder returns and confidence in future performance.

Summing It All Up

- Discover the full array of 4664 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Komori might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6349

Komori

Engages in the manufacture, sale, and repair of printing presses in Japan, North America, Europe, and Greater China.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives