The Bull Case For Japan Airlines (TSE:9201) Could Change Following Share Buyback and Dividend Hike Announcement

Reviewed by Sasha Jovanovic

- Japan Airlines announced a share repurchase program of up to 8 million shares worth ¥20,000 million and a second quarter dividend increase to ¥46 per share, reflecting a continued focus on enhancing shareholder returns.

- This move signals Japan Airlines’ ongoing commitment to balancing capital allocation and shareholder distributions as guided by its medium-term management plan.

- With both a share buyback and dividend lift, we’ll explore how Japan Airlines’ refreshed payout approach shapes its investment narrative today.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Japan Airlines' Investment Narrative?

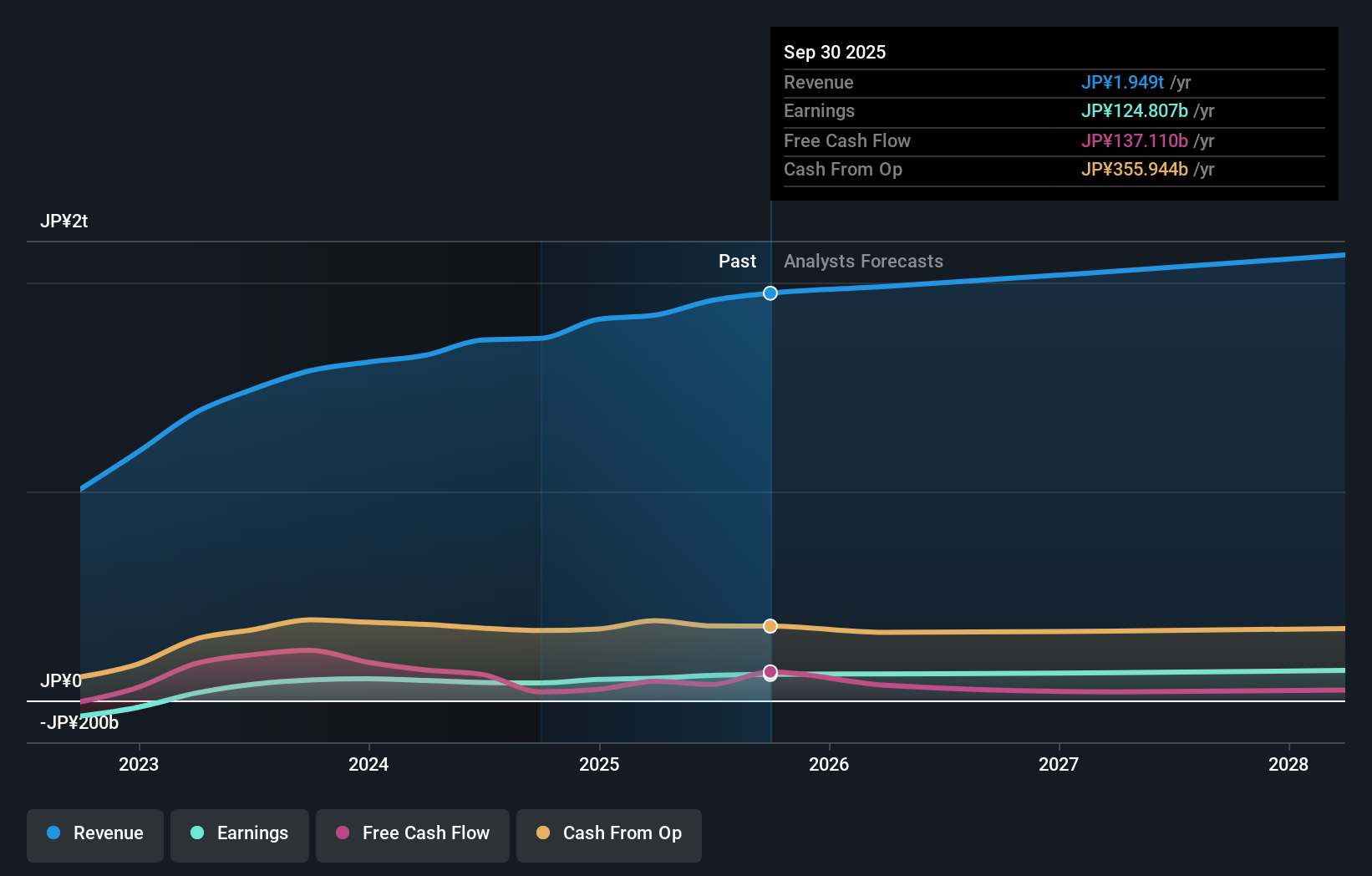

Shareholders in Japan Airlines generally need to believe in the company's ability to sustain gradual earnings and revenue growth while carefully balancing capital allocation, especially as it faces slower forecasted growth compared to broader industry benchmarks. The recent announcement of a share buyback and a higher dividend signals an effort to reward shareholders and possibly build confidence in management’s approach following previous dividend track record fluctuations and board turnover. While these moves show commitment to investor returns, they may not fundamentally change the biggest immediate catalysts or risks for the business, such as relatively slow expected earnings growth, questions around long-term board stability, and the need for consistently strong operational recovery. The buyback could support investor sentiment short term, but it doesn’t erase challenges like an inexperienced board or below-average return on equity. On the upside, any short-term boost is tempered by structural issues that could persist without broader operational improvements.

But, critical board experience issues remain that investors should be aware of. Japan Airlines' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Japan Airlines - why the stock might be worth just ¥3627!

Build Your Own Japan Airlines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Japan Airlines research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Japan Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Japan Airlines' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9201

Japan Airlines

Provides scheduled and non-scheduled air transport services in Japan, Asia, Oceania, the Americas, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives