Japan Airlines Shares Surge 19% in 2025 Amid Global Travel Rebound

Reviewed by Bailey Pemberton

If you are wondering what to make of Japan Airlines right now, you are not alone. After some turbulence in the last month, with shares dipping 5.8% over 30 days and 1.1% in the past week, it is only natural to question whether we are seeing a mere pause, a value opportunity, or perhaps the first signs of something bigger. Yet, step back for a moment and the bigger picture looks a lot less gloomy. The stock is up 19.4% since the start of the year, 25.4% over the past year, and a remarkable 53.5% in five years. This kind of long-term climb speaks to resilience, and recent investor optimism seems tied to recovery in global travel demand and broader enthusiasm for reopening themes in Japan’s markets.

Given all this, the real question is how much room there is for more growth, and whether Japan Airlines is still undervalued despite its recent run-up. According to our companies' value scoring system, the airline passes 3 out of 6 main undervaluation checks, landing it with a solid value score of 3. But what do these checks actually mean for your decision-making? In a moment, we will break down the different valuation approaches at play, and toward the end, we will go one step further to share an even smarter way to think about valuation for stocks like Japan Airlines.

Approach 1: Japan Airlines Discounted Cash Flow (DCF) Analysis

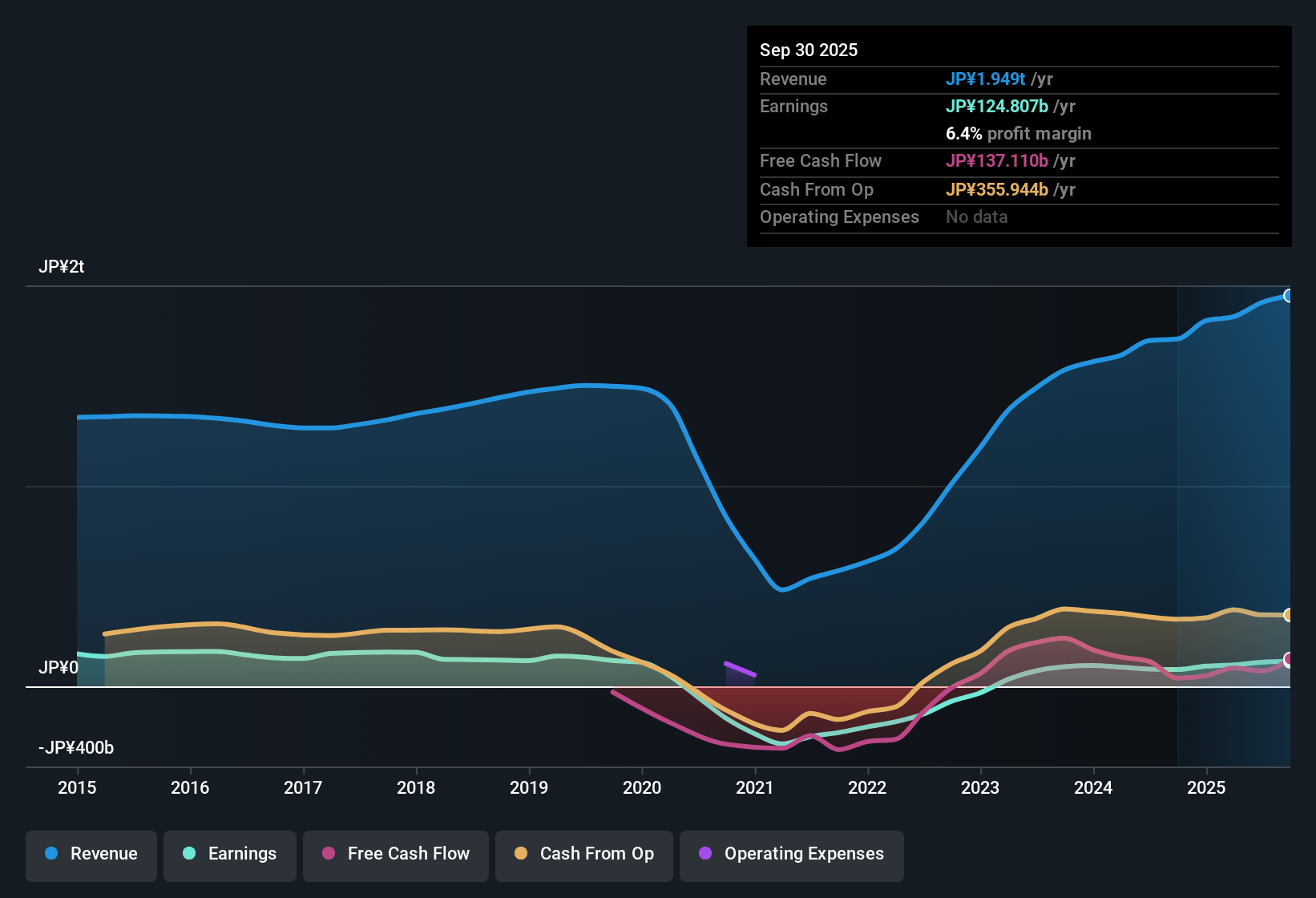

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today's yen value. For Japan Airlines, this involves projecting the cash the business will generate and considering both analyst estimates and extrapolations for future years.

Currently, Japan Airlines generates a Free Cash Flow (FCF) of ¥124.7 billion. Analysts offer five years of forecasts, after which further projections are provided by Simply Wall St. For example, FCF is expected to be around ¥48.8 billion in 2026, decreasing to ¥42.3 billion in 2027 before rebounding to ¥54.2 billion in 2030 as the business matures. In the years beyond, the estimates rely on more modest growth rates reflecting long-term industry trends.

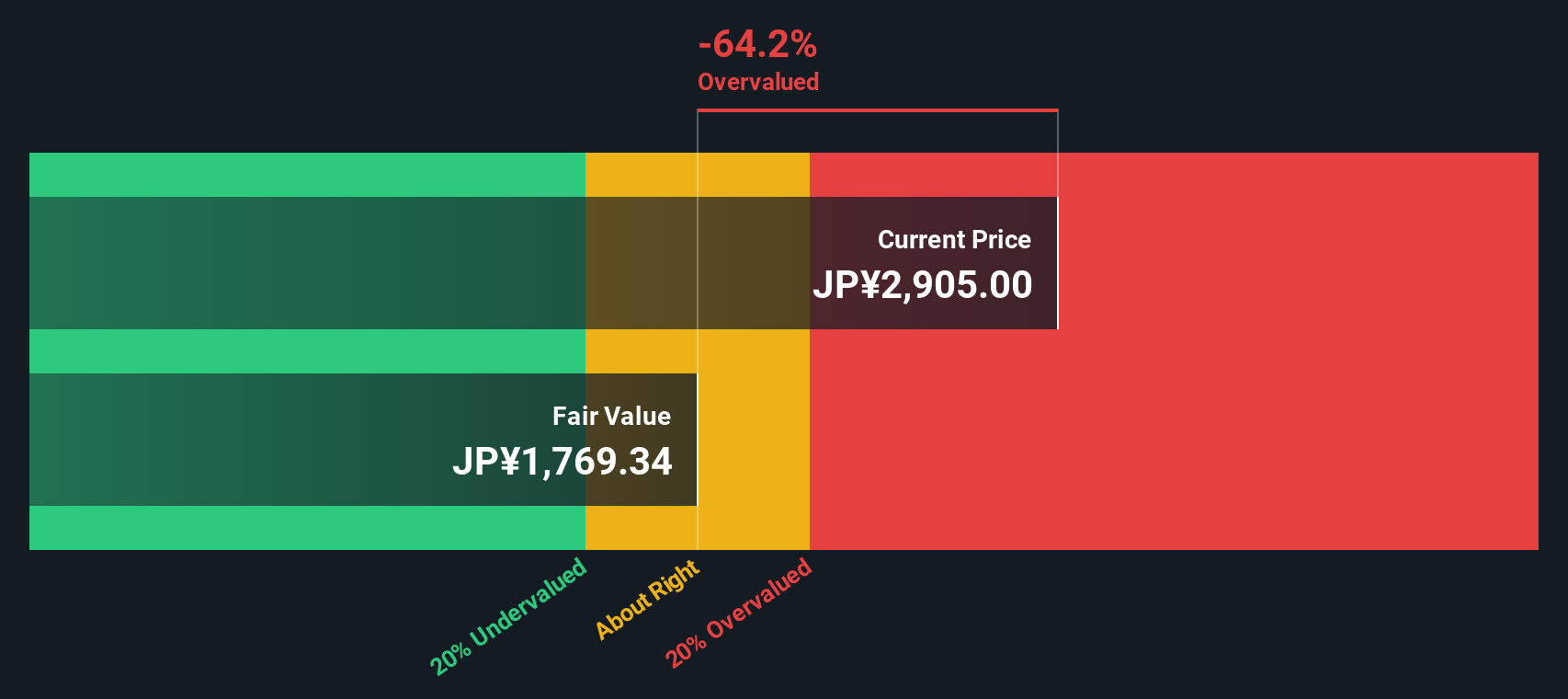

Bringing it all together, the DCF analysis calculates an intrinsic value for Japan Airlines of ¥1,668.59 per share. This is significantly below the current share price and suggests the market has bid the stock roughly 76.8% higher than what fundamentals indicate. In other words, based only on these cash flow assumptions, Japan Airlines appears overvalued at current prices.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Japan Airlines may be overvalued by 76.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Japan Airlines Price vs Earnings

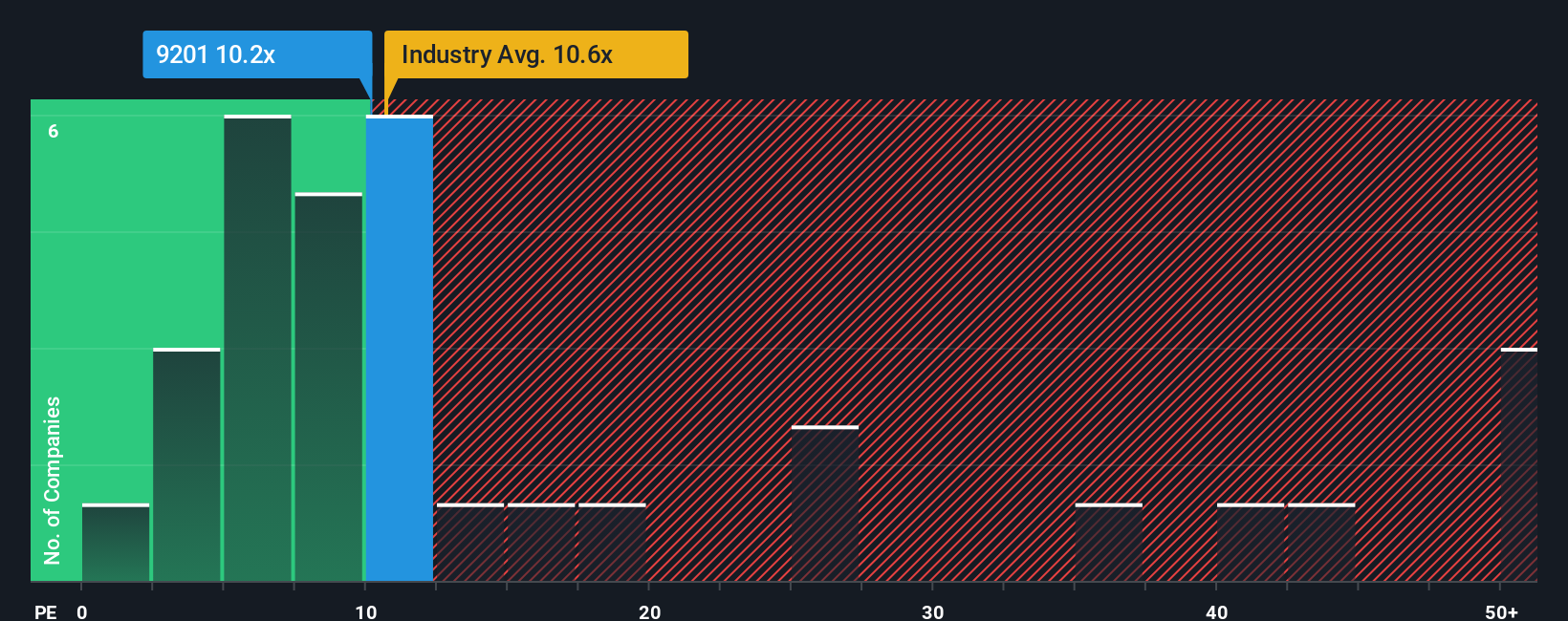

When valuing profitable companies like Japan Airlines, the Price-to-Earnings (PE) ratio is often the go-to metric. The PE ratio tells you how much investors are willing to pay for each yen of earnings and is especially useful because it allows you to quickly compare profitability and market expectations across similar businesses.

Of course, there is no single “correct” PE ratio. What is considered normal or fair depends on how fast a company is growing, how consistent its earnings are, its profit margins, and the unique risks it faces. For example, a fast-growing airline or one with lower risk may warrant a PE above the industry average, while a more mature or volatile business might trade at a discount.

Right now, Japan Airlines is trading at a PE ratio of 10.72x. This sits above the airline industry average of 9.29x, but below the peer group average of 14.90x. At first glance, this might seem reasonable, as the value is neither dramatically cheap nor expensive compared to similar companies.

But Simply Wall St’s proprietary “Fair Ratio” goes a layer deeper. It calculates that a fair PE for Japan Airlines, given its growth prospects, industry positioning, market cap, margins, and risk factors, should be 16.99x. This is higher than both its current PE and the peer averages, suggesting the market may be undervaluing the stock based on its specific fundamentals. Unlike blunt comparisons, the Fair Ratio method gives a more nuanced view and personalizes the benchmark for Japan Airlines’ unique strengths and challenges.

With the current PE of 10.72x sitting meaningfully below the Fair Ratio of 16.99x, Japan Airlines appears attractively undervalued by this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Japan Airlines Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story behind a stock's numbers, where you connect your perspective about a company, your assumptions for future revenue, profit margins, or industry trends, and your own view of what the fair value should be.

Narratives link a company’s real-world story directly to its financial forecast and then to a calculated fair value, making investing more intuitive and actionable. On Simply Wall St’s platform, which is used by millions of investors, you can find Narratives on the Community page. This makes it easy for anyone to build and share their reasoning.

The true power of Narratives comes from seeing how your outlook compares to others and spotting when the current share price is higher or lower than your fair value. This helps you decide when to buy or sell. Narratives update dynamically as key events like earnings reports or news are released, ensuring your perspective is always current.

For example, one investor might create a Narrative with a high fair value for Japan Airlines based on rising travel demand, while another might set a much lower fair value if concerned about industry risks.

Do you think there's more to the story for Japan Airlines? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9201

Japan Airlines

Provides scheduled and non-scheduled air transport services in Japan, Asia, Oceania, the Americas, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives