A Look at JAL (TSE:9201) Valuation Following Buyback and Dividend Hike for Shareholder Returns

Reviewed by Simply Wall St

Japan Airlines (TSE:9201) just announced plans to buy back up to 8 million shares and raised its second quarter dividend. Both moves are focused on boosting shareholder returns as part of its ongoing capital strategy.

See our latest analysis for Japan Airlines.

It’s been a busy year for Japan Airlines, with today’s fresh buyback announcement following a boost in its interim dividend and a series of capital moves aimed squarely at rewarding shareholders. Over the past 12 months, momentum has clearly been building. While the 1-day share price return sits at 1.3%, the year-to-date share price return has reached 21.2%. Looking at the bigger picture, long-term holders have enjoyed a robust 26.5% total shareholder return over one year, and an impressive 66.1% over five years, reflecting both the impact of these shareholder-friendly policies and improving fundamentals.

If Japan Airlines’ latest buyback has you curious about what else is on the move, now’s the time to broaden your search and discover See the full list for free.

With such solid returns and management's strong focus on rewarding shareholders, the big question now is whether Japan Airlines shares still offer value at current levels, or if the market has already priced in future growth.

Price-to-Earnings of 10.4x: Is it justified?

Japan Airlines currently trades at a price-to-earnings (P/E) ratio of 10.4x, noticeably below the Japanese market average and peer group multiples. This may suggest that the stock is undervalued relative to other companies in the sector.

The P/E ratio measures how much investors are willing to pay for each yen of earnings and is often cited as a quick gauge of value, particularly for profitable businesses like airlines. For Japan Airlines, this low multiple signals that the market might be underpricing its recent earnings strength or is cautious about its growth outlook.

Compared to the JP market P/E of 14.3x and the Asian Airlines industry average of 10.5x, Japan Airlines appears favorable. Even against the estimated Fair Price-to-Earnings Ratio of 16.6x, the current market price seems to offer good value and room for re-rating should fundamentals hold up.

Explore the SWS fair ratio for Japan Airlines

Result: Price-to-Earnings of 10.4x (UNDERVALUED)

However, ongoing concerns around air travel demand and any slowdown in revenue or profit growth could challenge Japan Airlines’ currently attractive valuation.

Find out about the key risks to this Japan Airlines narrative.

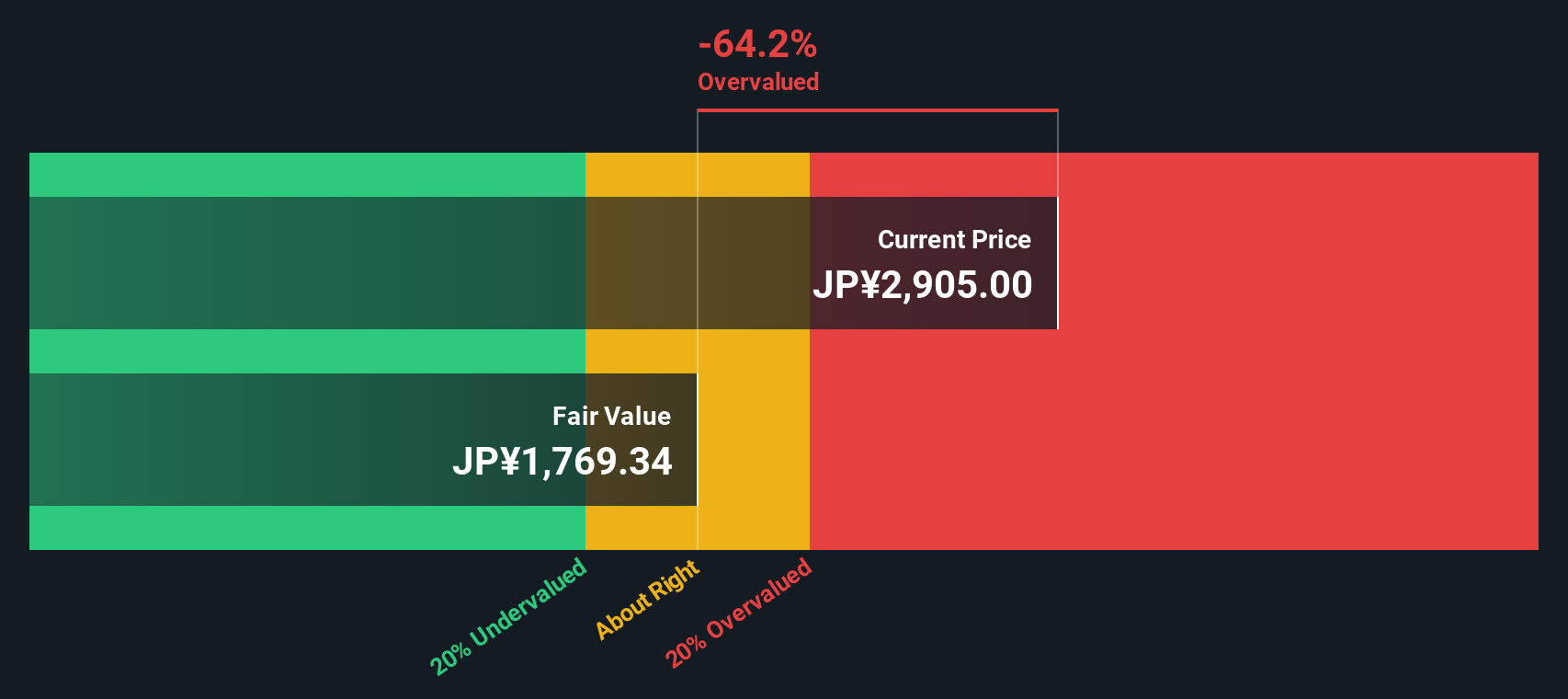

Another View: What Does the SWS DCF Model Say?

While Japan Airlines looks attractively valued against its earnings today, our SWS DCF model offers a more cautious take. According to this approach, the shares are currently trading above their estimated fair value. This suggests that some of the optimism might already be priced in. Does the market see hidden growth ahead, or could returns be more limited from here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Japan Airlines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Japan Airlines Narrative

If you think there’s another angle or want to run your own numbers, you can shape your personal view in just a few minutes. Do it your way

A great starting point for your Japan Airlines research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t stop at Japan Airlines. The market offers many other exciting stocks and themes that could help you pursue your investment goals even faster.

- Boost your income potential and see which companies are offering attractive yields by checking out these 14 dividend stocks with yields > 3%.

- Stay ahead of market trends with these 27 AI penny stocks, which are shaping tomorrow’s industries through innovative artificial intelligence solutions and rapid growth.

- Find undervalued gems that others might miss by starting your search at these 880 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9201

Japan Airlines

Provides scheduled and non-scheduled air transport services in Japan, Asia, Oceania, the Americas, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives